The next few years will see rising physical losses from climate-related events, higher taxes to combat intergenerational inequality and tougher conditions for over-levered corporates. By Schroders’ Jessica Ground.

Usually sustainability experts avoid having to pen market outlook pieces; it’s all about the long term after all… But our thesis at Schroders is that environmental and social change is accelerating, generating an ever-stronger headwind for companies to navigate.

2018 has provided ample evidence of this, with populism continuing to rise alongside global temperatures. Increasingly, there is nowhere to hide for companies who don’t operate in a sustainable way: technology companies, which in the past seemed almost untouchable, have seen more taxation, regulation and a number of uncomfortable moments in front of Congress. Against this backdrop, environmental, social and governance (ESG) analysis and forecasting has never been more important for investors.

Environmental: the physical risk of climate change

Surely climate change is the ultimate long-term issue, most of you will be thinking. So much of the analysis in this area is about far-off risks and talk about action that needs to take place by 2030; a lifetime for markets.

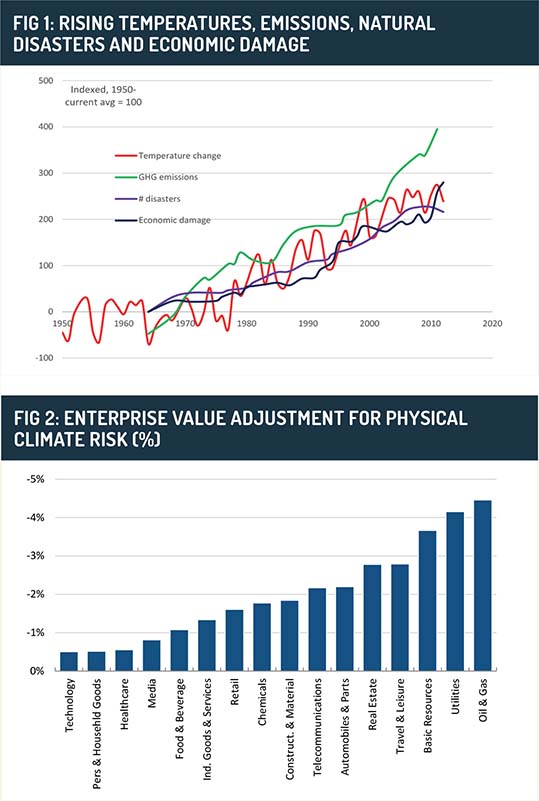

However, one aspect of climate change is here and now: as temperatures climb, so the physical losses from extreme weather events are expected to do so too. This could be especially pertinent in 2019, given that experts expect an El Niño weather pattern to develop, causing warmer temperatures and increasing the possibility of severe weather around the world.

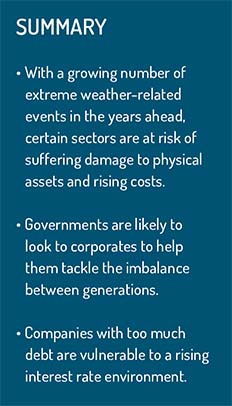

Investors often neglect to thoroughly understand just how vulnerable a company’s physical assets and infrastructure are to severe disruption and damage as a direct result of drastic weather patterns. Recognising this, we created a physical risk framework which we applied to over 10,000 companies globally. It calculates the amount of insurance businesses would have to pay to protect their physical assets against weather-related hazards.

We identified oil & gas, utilities and basic resources as the sectors most exposed to the physical impact of climate change. The potential cost of insuring their physical assets equates to more than 3% of their market values. The sectors least at risk are technology, personal & household goods and healthcare.

There is growing evidence that climate change is exacerbating natural weather systems and that going forward we are likely to see harsh weather materialise more frequently. This doesn’t just apply to 2019 and its possible El Niño event, but to future years as well. This may have important investment implications.

Social: Corporates to bear the brunt of the youth challenge

Many think that the “S” of ESG is the most difficult part of the acronym to analyse. Yet it is the area in which we have had the most success: we forecasted the growth of living wages in 2014, the advent of sugar taxes in 2015, and the impacts of rising protectionism on global supply chains in 2016. So we would like to think our track record on social predictions is pretty compelling, which makes the bar high.

One major challenge we see looming is intergenerational inequality. Developed world populations are getting older, and this is becoming expensive. Related costs like healthcare and pensions are rising almost exponentially. Asset price inflation and low rates have created “generation rent” (so called because of the difficulties many young people face in becoming homeowners). However, given that younger generations have historically largely abstained from voting, policymakers haven’t always grappled with these issues. Recent elections have pointed to a reverse in this trend and as a result, we expect to see increasing pressure on governments to act.

Given the current state of many governments’ finances, providing solutions for younger voters will be a challenge. We can expect companies to have to shoulder more of the burden, which will likely mean higher pension contributions, more support of housing for younger workers, and greater training demands.

We continue to think that companies and consumers face rising taxes on many fronts. For example, carbon taxes continue to increase, although not at the rate we believe is effective enough to really combat climate change. It doesn’t feel as if the world is quite going to be ready for meat taxes in 2019, but given the benefits for health and the environment, we wouldn’t rule it out over the medium term.

Governance: Debt could come back to haunt us

We were somewhat surprised this year when we looked at debt data to find that the share prices of companies with relatively high levels of debt hadn’t been penalised. The current credit and economic cycle has been running for quite some time.

This means few of the current cohort of managers and boards can remember what a bind high levels of borrowing can be when the interest rate or operating environment changes.

This means few of the current cohort of managers and boards can remember what a bind high levels of borrowing can be when the interest rate or operating environment changes.

Research from Bernstein (24 October 2018), paints a rosy picture of companies’ debt positions. It shows that fewer and fewer companies are struggling to service their debt because their operating income comfortably covers their interest expenses. However, the next three years will see 25-45% of this debt rolling over (i.e. when existing borrowing arrangements mature and need to be renewed). Against a backdrop of rising interest rates, this could be a challenge.

Yes, more debt is long-term than ever before, but for some companies, rates don’t have to rise much, nor operations decline a great deal, for things to become markedly tougher.

Conclusion

While many of the issues we’ve raised here are long-term in nature, a number of them pose a more immediate threat to companies than most investors appreciate. Rapid and large-scale environmental and social change is likely to see companies across the board come under increasing pressure from a variety of sources, whether environmental-, social- or governance-related. In light of this, we think ESG analysis and forecasting will continue to rise in importance for investors the world over.

Jessica Ground is Global Head of Stewardship – ESG at Schroders

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue, they should not be construe as advice or recommendation. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

©2018 funds europe