Cuba is subject to a strict embargo by the US and is not part of international capital markets. Florida-based Thomas J. Herzfeld tells Stefanie Eschenbacher how he invests in the island nation through a variety of legal strategies.

The Havana Stock Exchange closed more than half a century ago during the Cuban revolution, and today the closest thing the country has to a trading floor is the thriving Cuevita black market.

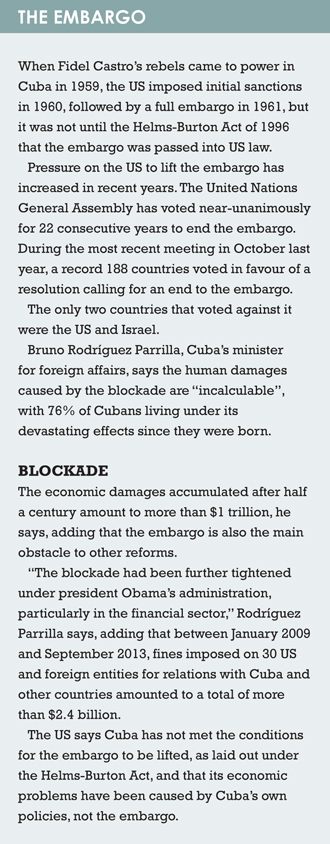

Cuba is subject to a strict US embargo, consisting of economic sanctions, as well as restrictions on travel and commerce for those under US jurisdiction.

Florida-based Thomas J. Herzfeld, the founder of Thomas J. Herzfeld Advisors, invests in Cuba nevertheless, circumventing the US embargo through a variety of legal investment strategies.

His Herzfeld Caribbean Basin Fund holds a small amount of the last outstanding sovereign debt of Cuba, and invests in companies that have claims on land seized during the Cuban revolution.

The investment strategy depends on how relationships between the US and Cuba proceed, but Herzfeld says he is now more confident than ever that the embargo will be lifted.

“The embargo will likely be lifted during president [Barack] Obama’s term in office, he has already said that he would like to see this happen,” Herzfeld says.

CUBAN EXILE

Other triggers could be the death of Fidel Castro, even though he is no longer in government, or the release of imprisoned Alan Gross, a US government contractor, accused of spying.

“The opposition to lifting the embargo comes mainly from the Cuban exile community in south Florida, but the hardliners are ageing and a lot of the emerging leaders of this community are softening their stance.”

“The opposition to lifting the embargo comes mainly from the Cuban exile community in south Florida, but the hardliners are ageing and a lot of the emerging leaders of this community are softening their stance.”

The fund holds several direct investments, including defaulted sovereign debt of Cuba, sometimes referred to as Cuban 77s because of their maturity date of 1977, or Batista bonds.

Herzfeld says he owns a small issue of those bonds, the only sovereign debt that is still outstanding. “We value these bonds at zero, but they have 14 years of coupons attached to them, and if bonds and interests are paid, it will be a gain for our portfolio,” he adds.

Under US law, the embargo against Cuba can be lifted if, among other conditions, it settles with businesses that were seized by the Castro government in 1960.

Herzfeld holds shares of Cuban Electric, a US company that ran the electricity in Cuba until its plants were seized; he bought the shares just before they were suspended trading.

“We bought the investment because of the cash value in the bank, but the company has a claim on confiscated property in Cuba,” he adds. The stock was trading at between $6 and $7 per share before it was suspended, which Herzfeld says is equivalent to the cash the company still has in the bank in the US.

Herzfeld says he bought the investment because of the cash value in the bank, but the company’s claim on confiscated property that is also worth about $77 per share.

Another direct investment is a penny stock, Fuego Enterprises, which publishes a magazine on Cuba that is distributed on charter flights. In addition, it has licences from the Cuban treasury department for business in the country. “It is our most speculative investment,” Herzfeld says, adding that it trades at 30 cents per share.

Herzfeld says when he first raised money for his fund, he knew it was uncertain when trade between the US and Cuba would eventually resume.

The fund, therefore, invests throughout the Caribbean Basin in other companies Herzfeld expects to benefit from Cuba, regardless of whether the US embargo is lifted, such as cruise ships and property businesses.

ECONOMIC CHANGE

“Our strategy was to invest in companies that we thought would do well, even if there was no political and economic change in Cuba,” he says.

“At the same time, we wanted to invest in companies that get an increase in business when trade with Cuba was permitted.”

This approach has changed over time, and Herzfeld focuses on companies that would do well once the US embargo is lifted.

“Once the embargo is lifted, there will be a change in direction and we will take some more illiquid and private investments within the country,” he adds.

Still, the majority of the funds’ holdings are publicly traded companies in the US and other nearby countries – the Cayman Islands, Colombia, Mexico, Panama and Puerto Rico.

The net asset value per share of his Herzfeld Caribbean Basin Fund has risen to $9.70, from $5 when the fund first started trading on the Nasdaq in May 1994, and Herzfeld says the fund has paid out over $5 in distributions.

Herzfeld says he is working closely with Cuban American businesses who he could partner with once investment is legal.

©2014 funds global latam