In our regular market review of exchange-traded funds, Funds Europe looks at which areas are waxing or waning and expectations for 2018.

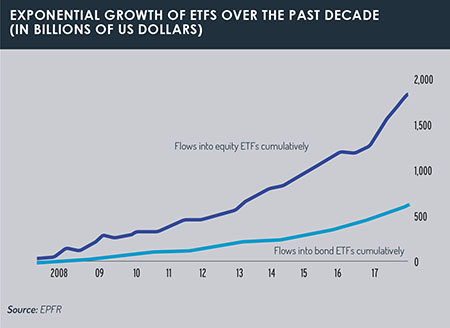

In 2017, exchange-traded funds (ETFs) enjoyed record growth, with global inflows of $460 billion (€374 billion). This year the industry is expected to breach the $5 trillion mark for the first time. But beneath the headline figures, what have been the most recent investment trends?

Chris Mellor, equity product specialist at Invesco PowerShares, says that the key trend in the Emea market over recent months has been strong demand for simple, low-cost market exposure.

This saw more than €60 billion of inflows into Europe-domiciled equity ETFs in 2017, almost half of which was into European and global large-cap funds. That €60 billion was more than triple the level of equity inflows of 2016.

A second key trend of 2017, Mellor says, was growing demand for fixed income ETFs. These ended the year with total assets of €150 billion after inflows of more than €25 billion over the year.

While total assets of equity ETFs are three times larger (€450 billion in Europe at the end of last year), Mellor says that the fixed income sector has been one of the fastest-growing areas of the ETF market.

The burgeoning demand prompted PowerShares to launch three low-cost fixed income products in the final quarter of 2017.

The third key area of activity that Mellor mentions in relation to 2017 was in smart beta ETFs. Helped by rising markets, assets in factor-based and non-market cap weighted ETFs rose by 30% globally and by 45% in Europe-domiciled products.

“The majority of assets in this area are invested in relatively traditional strategies such as dividend, value or growth products,” he says. “However, in the smart beta universe, the biggest gainers in 2017 were ETFs offering exposure to multi-factor strategies and more specialist single-factor approaches like momentum or quality.”

Still searching

Eric Wiegand, Deutsche Asset Management’s ETF strategist, says that the search for yield in bond markets continues to be a dominant theme for most investors in ETFs.

As a result, high-yield indices continue to attract inflows and he expects that trend to continue in 2018 with investors particularly seeking high-yield US dollar corporate bond exposure (or ETFs that provide exposure to higher-yielding corporate bonds while remaining mainly investment grade-focused).

“Currency trends are continuing to play a big part in investor asset allocation decisions, and not just for those taking exposure to bonds outside their domestic market,” he says.

“Emerging market equity indices, which had a solid fourth quarter in 2017, are denominated in US dollars for example, so dollar moves could be a big driver this year, especially as the US is one of the few developed markets actively raising interest rates.”

The continuing steady rise of ETFs compared with other asset classes is the big-picture trend mentioned by James Butterfill, head of research and investment strategy at ETF Securities.

In 2017, ETFs accounted for 19% of total global fund sales business, compared with 13% in 2011. If that growth continues, the expectation is that the ETF sector will account for 35% to 38% of total funds sales by 2027.

While, as a rule of thumb, passives account for 35%-40% of any one portfolio globally, the proportion varies massively from one country to another.

Passives account for less than 20% in the UK, while in Spain the figure is just 2% – so the potential for further substantial growth exists, Butterfill says, hence the extrapolated growth of 35-38% by 2027.

Silver, gold and robots

Aneeka Gupta, an equity and commodities strategist at ETF Securities, says that last year saw a surge of inflows into equities and bonds, but not that much into commodities. 2018 has so far seen “relentless outflows” from crude oil despite rising oil prices, she says.

A pronounced trend so far this year has been a surge of flows into robotics ETFs. Investors are bullish on the sector because of earnings momentum and positive first-quarter earnings expectations. “We are also seeing strong flows into precious metals, specifically gold, and we are seeing outflows from silver,” Gupta adds. “Investors are taking cash out of silver (which underperformed gold last year) but we feel that this is going to reverse.

A pronounced trend so far this year has been a surge of flows into robotics ETFs. Investors are bullish on the sector because of earnings momentum and positive first-quarter earnings expectations. “We are also seeing strong flows into precious metals, specifically gold, and we are seeing outflows from silver,” Gupta adds. “Investors are taking cash out of silver (which underperformed gold last year) but we feel that this is going to reverse.

“I think there will be a catch-up effect as silver is a more industrialised precious metal and is better positioned in terms standing to benefit as the economy picks up. We feel silver has a better chance of gaining investor sentiment.”

Looking ahead to the rest of the year, Gupta expects to see global economies continue to pick up. “We continue to see investors interested in the growth story globally and we remain positive on emerging markets and global equities.”

Lionel Melin, cross-asset strategist at ETF specialist Lyxor Asset Management, says that the market exuberance of 2017 and a series of recent record highs has left the outlook for 2018 looking a bit “toppish”, especially with the prospect of a number of central banks looking to exit quantitative easing programmes.

“Lyxor has seen a positive start to this year, but expect differentiation and divergence to gradually become more apparent across regions as well as asset classes,” Melin says. One of the “grand global themes for 2018”, he suggests, will be a rise in capital expenditure in Europe and the US.

“Even in Asia, recovering capex is a theme, especially in the tech sector, and in Japan given increasingly acute labour shortage issues,” he says.

“The global economy is in its best shape in a decade, while inflation shouldn’t return to negative territory. So yields are likely to rise everywhere from here, although Lyxor is not calling a market implosion.”

©2018 funds europe