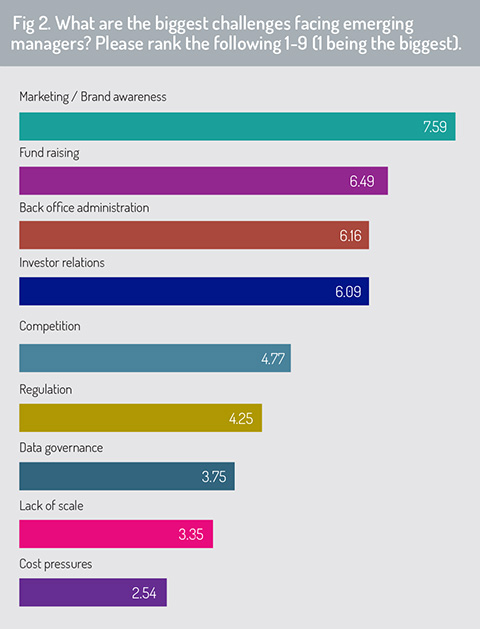

To get a better idea of the factors influencing emerging managers when choosing a fund domicile, it helps to understand the operational challenges they face on a day-to-day basis. Funds Europe asked them what they consider to be the biggest challenges and found they are concerned about a range of issues (Fig 2).

Marketing and brand awareness

There is a wide range of issues facing emerging managers, but the biggest challenge identified by the emerging manager respondents was marketing and brand awareness. It is understandably a huge challenge for emerging managers looking to establish themselves in an increasingly competitive market and raise capital for their strategies.

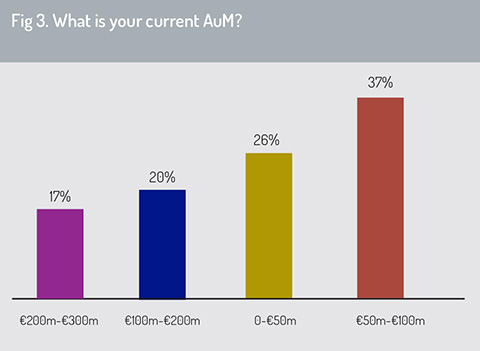

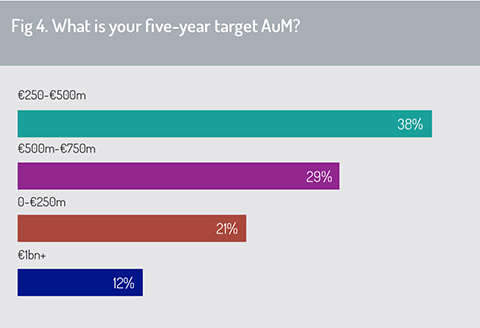

Almost two-thirds, 63%, of respondents have assets under management below €100 million (Fig 3) but have plans to increase capital considerably over the next five years, with 21% of respondents targeting up to €250 million and 38% aiming for €250-500 million (Fig 4). And to support this growth, emerging managers need access to investors and capital.

Almost two-thirds, 63%, of respondents have assets under management below €100 million (Fig 3) but have plans to increase capital considerably over the next five years, with 21% of respondents targeting up to €250 million and 38% aiming for €250-500 million (Fig 4). And to support this growth, emerging managers need access to investors and capital.

Marketing alternative investment strategies can sometimes be a challenge for fund managers looking to fundraise outside of their home market. For instance, while Europe remains a very important source of capital, operating under the Alternative Investment Fund Managers Directive (AIFMD) can entail a heavy regulatory burden and frontload costs for emerging managers at a time when they most need to be lean and agile.

Therefore, solutions such as the national private placement regime (NPPR), which offers a lighter regulatory option for emerging managers seeking to market in Europe, are crucial for the success of fund launches.

However, the effectiveness of the NPPR can depend on how many bilateral relationships the fund domicile has created. Jersey, for example, has strong relationships with all key alternative funds markets such as the Netherlands, Ireland, and the Nordic countries.

Fundraising

The second most significant challenge in the investment outlook highlighted by emerging managers was fundraising.

As central banks and governments have started to remove the monetary and fiscal support that kept economies afloat during the Covid-19 pandemic – and fuelled the bull market since the 2008 Global Financial Crisis – growth has slowed and returns from public markets have stagnated or gone into reverse.

This may be a positive dynamic for emerging managers in the alternative investment space if investors begin to seek strategies – such as hedge funds and private equity – that offer greater diversification and uncorrelated returns to listed equities and mainstream bonds. In addition, demand for alternative sources of income has risen in recent years, as the low rates available from bonds fuelled the popularity of real estate and private credit strategies.

International investors will often favour funds located in strong legal jurisdictions with a high degree of transparency – so choosing an appropriate fund domicile is crucial.

Domiciles such as Jersey with clear, tax-neutral environments enable institutional investors to invest in funds more efficiently. This avoids the need for complex cross-border tax treaties while preventing investors from being taxed twice.

Domiciles such as Jersey with clear, tax-neutral environments enable institutional investors to invest in funds more efficiently. This avoids the need for complex cross-border tax treaties while preventing investors from being taxed twice.

A robust regulatory environment can provide investors with confidence in a domicile. Meanwhile, access to investors in different jurisdictions and key alternative investment markets provides emerging managers with the best opportunity to attract sufficient capital.

Back-office administration

Given the number of operational challenges they face, emerging managers must have faith in their back-office administrators. Unsurprisingly, such concerns featured prominently in the Emerging Manager Survey findings.

The findings were in line with consultancy EY’s 2021 Global Alternative Fund Survey, which found enhancing middle- and back-office processes was a top priority for 30% of fund managers.3 It also revealed a high level of comfort among investors with managers that outsource their back-office processes.

Therefore, locating in a fund domicile with access to high-quality back-office administrators and service providers, with expertise in alternative investment strategies, provides emerging managers with the confidence to outsource and concentrate on their core business.

Investor relations

The investor relations function was another top concern of emerging managers as new reporting regulations have come into force in recent years, and institutional investors have demanded greater insight into how alternative strategies are managed. It is a particular problem for smaller emerging fund managers, as some institutional investors have eschewed new launches due to transparency concerns and chosen to invest with larger established firms with more resources.4

The data revolution of the past decade has completely changed how fund managers operate and opened them up to greater scrutiny from regulators and investors. Managers are now expected to provide more granular detail in several new areas – and investors are unafraid to complain about poor data quality.

The data revolution of the past decade has completely changed how fund managers operate and opened them up to greater scrutiny from regulators and investors. Managers are now expected to provide more granular detail in several new areas – and investors are unafraid to complain about poor data quality.

Another rapidly growing trend in the investment industry is the increasing appetite for sustainable investment strategies, which apply ESG criteria. However, such strategies often require greater disclosure from fund managers to ensure they align with their investors’ expectations, increasing the reporting burden.

While third-party data management and technology platforms provide fund managers with the tools to curate and share insights with their investors, investor relations remains a costly and time-consuming part of the business that many emerging managers are struggling to adequately fulfil.

Read the full report below:

1. Introduction: Shedding light on the emerging manager experience

2. Emerging managers survey 2022

3. The biggest challenges

4. Finding the right solutions

5. Choosing the right domicile

6. Conclusion

© 2022 funds europe