A survey of up-and-coming asset managers, in association with Jersey Finance, finds that the quality of funds services, regulatory standards and costs are the most common drivers behind choosing a domicile.

While the economic outlook has become more challenging since the end of the Covid-19 pandemic – as high inflation, lower growth and greater geopolitical uncertainty have set in – some fund managers are finding investment opportunities. And as demand from institutional investors grows for uncorrelated sources of capital appreciation and income, a new generation of emerging alternatives managers is looking for ways to bring their strategies to market.

Newly launched alternative investment funds in Europe (including the EU, Iceland, Liechtenstein, and Norway) raised €514 billion during 2020, according to the most recent data from the European Securities and Markets Authority (ESMA).1 However, any fund manager looking to launch into the market will likely face considerable operational challenges.

Emerging managers, whether a start-up or spin-out, are encountering a range of issues – from new regulations to low-quality fund services – that could prevent them from hitting their fund launch target and becoming viable over the long term. Even for incumbent fund managers, the evolving fund landscape is difficult to navigate, so choosing the right partners to help overcome operational issues is crucial.

Emerging managers, whether a start-up or spin-out, are encountering a range of issues – from new regulations to low-quality fund services – that could prevent them from hitting their fund launch target and becoming viable over the long term. Even for incumbent fund managers, the evolving fund landscape is difficult to navigate, so choosing the right partners to help overcome operational issues is crucial.

This is why selecting a strong fund domicile – with regulatory certainty, favoured by investors, and a network of high-quality service providers – can play a key role in helping emerging managers to get their business off the ground.

Funds Europe, in collaboration with Jersey Finance, has found today’s emerging managers face a wide range of issues that impact how they choose a fund domicile.

Jersey has considerable experience as a fund domicile and has welcomed many alternative investment funds over the years. The total net asset value of funds serviced in Jersey stood at $737 billion at the end of March this year – that includes assets held in Jersey Private Funds, a vehicle for professional investors, of which there are currently 557.2

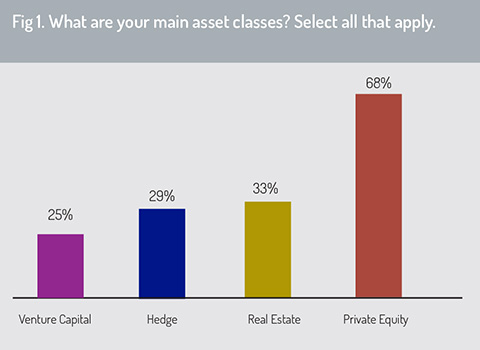

More than 100 emerging manager respondents – defined as those with less than £300 million in assets under administration – from around the world took part in the survey (Fig 1).

Managers specialising in venture capital, hedge funds, real estate and private equity provided detailed insights into the challenges facing this next generation of alternative funds as well as what they want from fund domiciles.

Read the full report below:

1. Introduction: Shedding light on the emerging manager experience

2. Emerging managers survey 2022

3. The biggest challenges

4. Finding the right solutions

5. Choosing the right domicile

6. Conclusion

© 2022 funds europe