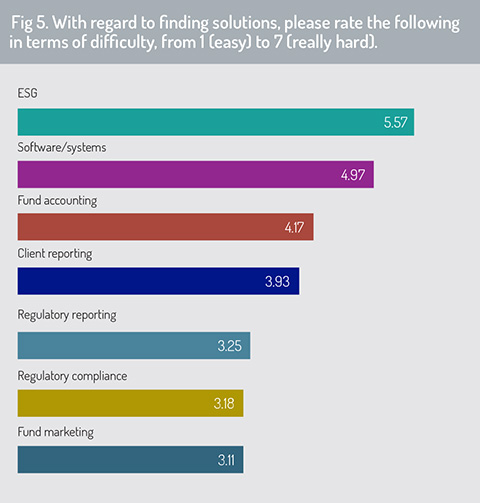

Emerging managers are finding it increasingly difficult to find the solutions they need for a successful launch (Fig 5). A strong fund domicile should be able to react and provide managers with what they need.

ESG strategies

The rising popularity of ESG investing has been well documented in recent years, with huge aggregate allocations to strategies with aims such as mitigating climate change or promoting social diversity and inclusion.

With institutional investors already investing or planning to invest in ESG strategies, often willing to pay the higher fees that socially responsible funds sometimes command, alternatives managers have a greater incentive to launch their own strategies.

With institutional investors already investing or planning to invest in ESG strategies, often willing to pay the higher fees that socially responsible funds sometimes command, alternatives managers have a greater incentive to launch their own strategies.

While ESG strategies have been around for many years, they remain a growing part of the investment industry. A lack of standardisation and skills means some managers are struggling to find the right solutions.

“ESG continues to shape the funds landscape, and emerging managers are not immune to that trend. In fact, in some cases they are fundamental to innovation in ESG,” says Elliot Refson, head of funds at Jersey Finance.

“Domiciles need to be able to show they are serious about providing an ecosystem that can cater to the evolving ESG space, backed up by a robust regulatory framework and access to relevant skills. It is why Jersey Finance launched its sustainable finance strategy in 2021, to formalise our approach and demonstrate our commitments in this area.”

Software and systems

Another significant challenge for the emerging manager respondents was finding the right software and systems for their strategies. Advances in modern portfolio management and trading mean that creating systems and processes from the ground up is likely to be prohibitively expensive and require considerable expertise.

Therefore, whether requiring reporting systems or portfolio management software, emerging managers are increasingly relying on a range of third-party technology partners to help them with their day-to-day operations.

A domicile with a culture of technological innovation and expertise in alternative investment offers emerging managers an ideal environment in which to compete and thrive in the digital era.

A domicile with a culture of technological innovation and expertise in alternative investment offers emerging managers an ideal environment in which to compete and thrive in the digital era.

“The links between cost and technology are clear, and the indications are that emerging managers are alive to the potential for technology to play a part in their model,” explains Jersey Finance’s Refson. “That’s why it is so important for domiciles to provide an environment that is tech-ready and understanding of the need for fintech solutions to form an integral part of the funds landscape – from back-office servicing and accounting, to reporting, data management and investor relations.”

Fund accounting

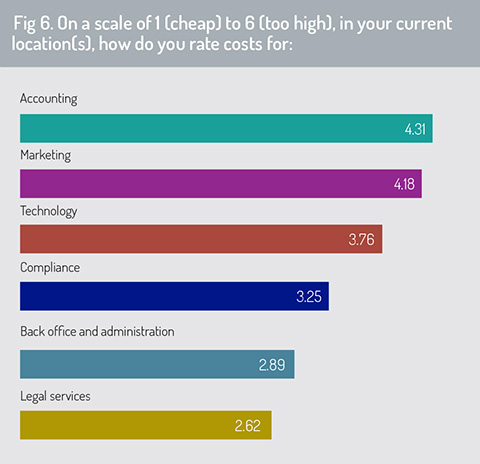

ESG will likely play a key role in the future of many emerging managers’ launch plans and how they manage, while software and systems will help them achieve their business and investment outcomes. But fund accounting is a business-critical function for which many emerging fund managers find it difficult to find good solutions (Fig 6). This is particularly worrying as the relationship between an investment manager and its fund accountant can be one of its most important.

It is not just the difficulty in finding fund accounting solutions; many also consider the cost of their solution to be too high, the survey found.

Read the full report below:

1. Introduction: Shedding light on the emerging manager experience

2. Emerging managers survey 2022

3. The biggest challenges

4. Finding the right solutions

5. Choosing the right domicile

6. Conclusion

© 2022 funds europe