One of the most crucial decisions an emerging manager can take is choosing where to domicile its funds. The domicile will have a considerable impact on a manager’s day-to-day operations and its profitability.

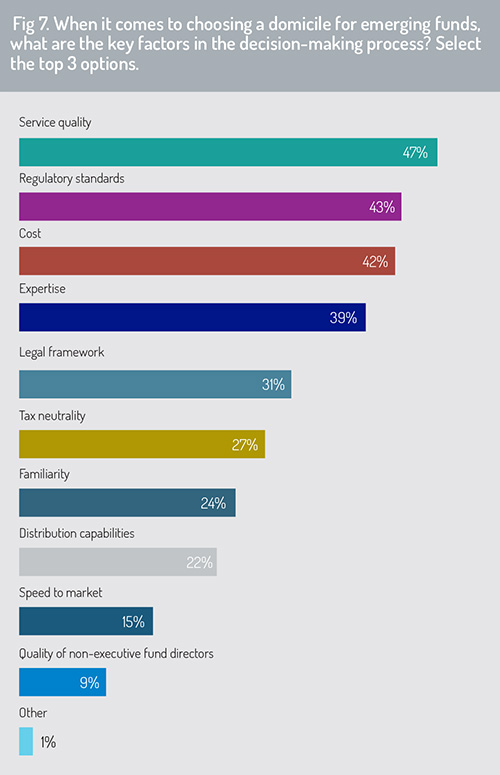

But managers must often consider a variety of issues when searching for the right domicile. Funds Europe asked respondents to select their top-three key factors in the decision-making process, to determine which are the most important in aggregate (Fig 7).

Service quality

For emerging managers, the most important factor when choosing a fund domicile is service quality, selected by 47% of respondents to the survey. This is understandable; the quality of service from a third-party service provider can help managers through many of the early teething problems many start-ups encounter.

Therefore, a potential fund domicile must have a strong ecosystem of service providers and expertise – particularly when it comes to managing alternative investment strategies – that can help them overcome any issues they face.

“Ready access to specialist support and advice is clearly critical for emerging managers, who are tight on resources and time,” says Jersey Finance’s Refson. “For domiciles, that highlights the importance of being able to demonstrate experience in the right areas, and of the need for good social capital.

“Ready access to specialist support and advice is clearly critical for emerging managers, who are tight on resources and time,” says Jersey Finance’s Refson. “For domiciles, that highlights the importance of being able to demonstrate experience in the right areas, and of the need for good social capital.

“The last thing emerging managers want is to find it a struggle to get the information or help they are looking for – whether that’s legal advice, governance and compliance, non-executive directors, administration, ESG expertise, auditing or accounting.”

Regulatory standards

The regulatory standards of potential fund domiciles are also a critical consideration when deciding where to launch a fund, with 43% of respondents stating it is one of their top-three factors.

Investors considering whether to back an emerging manager will often want to know that the fund’s domicile has a robust regulatory framework before investing their money. A recent survey by financial services firm Cowen and the Alternative Investment Management Association found that “concerns regarding operational due diligence, poor administration standards and lack of fund transparency” were the biggest barriers to investment for 80% of institutional investors when considering whether to back an emerging manager.5

Furthermore, managers are likely to prefer a fund domicile with a stable political and regulatory outlook while they are growing their business, to ensure they are not caught out by sudden shifts in the regulatory or legislative framework.

Strong bilateral relationships with key markets are also crucial for emerging managers wishing to market their funds more widely. This is particularly important for UK investors as its future relationship with the EU has been an ongoing significant source of uncertainty.

“It’s no real surprise that emerging managers are looking for assurance and certainty around regulatory compliance,” notes Jersey Finance’s Refson. “It’s an increasingly complex environment, from marketing rules when targeting EU investors, to reporting requirements and substance obligations. From a domicile perspective, that means being able to provide a platform that is robust, clear, and certain in its regulatory outlook, with little potential for any unanticipated shocks or changes.”

Cost

The challenging investment environment for emerging managers is making it more difficult for them to generate profits, and margins are coming under increased pressure. More than half, 54%, of UK investment managers saw profits fall during the first quarter of 2022, and a majority expect them to fall further during the second quarter of the year, according to the CBI/PwC Financial Services Survey.6

Therefore, it is little surprise that costs are one of the most important factors in deciding where to establish a fund, with 42% of emerging managers surveyed selecting it as one of their top factors for determining a fund’s domicile.

In a report published in 2020, consultancy Deloitte reported that costs for European managers had increased at a compound annual growth rate of 8% for the period 2015-2019, outpacing revenue growth which increased by 6.9% over the same period. This saw profit margins on an EBIT (earnings before interest and tax) basis fall by 2.9% over the period.7

Emerging managers are already facing cost pressures across a range of different parts of their business. While fund accounting topped the survey as the area where emerging managers are finding the highest costs, there are also considerable costs for marketing funds.

One way managers can reduce their operational and regulatory burden in the EU is through the NPPR regime, which allows more cost-effective marketing to EU investors by avoiding the burden of AIFMD compliance. Yet, many may not be aware of this cheaper alternative, with just 26% of respondents highlighting it as their main regulatory framework compared with 35% for AIFMD.

“What’s clear is that emerging managers want access to good, reliable, high-quality services – but they are keenly influenced by cost too,” says Jersey Finance’s Refson. “It’s a theme that came out strongly in a recent paper we commissioned on the evolution of international fund jurisdictions. Costs have always been a factor, but the issue now is that those centres that were historically cheaper are now faced by a raft of regulatory and reporting requirements, and that is pushing costs up.

“Managers are feeling that rise and are consequently looking carefully at their options. For Jersey, it has always been a question of balance – of getting that high-quality ecosystem right, and at a price point that is clear and not exposed to those sorts of fluctuations. It’s a proposition that should chime well with emerging managers, given these survey results.”

What else matters?

While the quality of fund services, regulatory standards and costs emerged as the most common drivers for choosing a domicile, there are a range of other factors that also influence where emerging managers decide to launch their fund.

Another important influencing factor is the level of available expertise in a fund domicile, highlighted by 39% of respondents. It is a challenge for emerging managers that runs through the survey – whether they have difficulties in securing services and solutions or lack support in new areas such as ESG. A domicile with a robust ecosystem of fund professionals that are familiar with alternative investing gives managers a greater sense of comfort that they will have the support they need to launch funds and grow their business.

A strong legal framework was highlighted as a key factor by 31% of emerging managers, and 24% highlighted familiarity as an important consideration in the domicile selection process. Finally, being able to bring a strategy to market quickly was highlighted by 15% of emerging managers as a key factor in choosing a domicile.

Read the full report below:

1. Introduction: Shedding light on the emerging manager experience

2. Emerging managers survey 2022

3. The biggest challenges

4. Finding the right solutions

5. Choosing the right domicile

6. Conclusion

© 2022 funds europe