Reviewing the occupational pension framework in various countries, Samuel Sender, of the Edhec-Risk Institute, says there is an urgent need to rethink DC provision.

In recent research conducted with the support of AXA Investment Managers, we take a close look at occupational pension plans in the Netherlands, Germany, the UK, Switzerland, France, the US and Australia (serving as an outside reference).

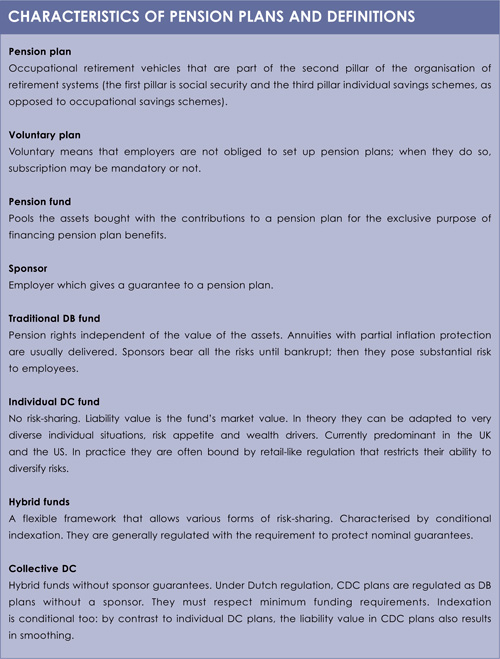

These occupational retirement vehicles form part of the second pillar of retirement systems. The first pillar is social security and the third pillar comprises individual savings schemes.

The general framework for occupational pension plans can be described as intra and inter-generational hybrid pension plans. They have risk-sharing mechanisms between members and with sponsors.

In our research, we define the degree of hybridity of a pension plan as the extent of this risk-sharing with the sponsor. At one end of the spectrum lie traditional defined-benefit (DB) funds, where all the risk is borne by the sponsor for as long as the sponsor can bear it. The pension benefit is independent of plan returns seeing as the sponsor gives a guarantee to the fund in exchange for the possibility that its initial cash contribution is reduced so that the pension fund has an underfunded guarantee value.

Collective defined contribution (CDC) schemes, which are hybrid pension plans with collective risk-sharing and conditional indexation but without a sponsor, and individual defined contribution funds where the risk is entirely borne by individuals. Both lie at the other end of the spectrum.

Within the countries of interest, individual DC plans are the prerogative of the Commonwealth countries, and they have progressively replaced traditional DB funds in the UK and in the US.

Continental European countries, and in particular the most innovative (the Netherlands) have opted for more risk-sharing in the form of hybrid funds – defined as collective pension plans that benefit from some (but varying) risk-sharing between participants and with the sponsor, and usually offer guarantees and conditional indexation.

Individual DC funds, as they are today, are usually deeply sub-optimal, as they are plagued by poor governance, sub-optimal default options, are significantly more expensive than DB funds and, in the US, do not offer annuitised income.

In continental Europe, hybrid pension plans are professionally managed and cost-efficient vehicles. Participation in pension plans is usually mandatory and the vast majority of the population is covered by hybrid pension plans.

However, since they are regulated they must provide the same type of solution for all categories of investors. So an assessment of the type of guarantee they offer is necessary.

Should hybrid pension plans offer nominal guarantees (as is usually done) and if so, to which participants should they offer these guarantees?

Nominal guarantees may be extremely costly as in practice, and given the current yearly investment horizon, such guarantees may result in pension funds being locked into low interest-yielding investments. This is particularly true in situations such as the present one, where quantitative easing may involve accelerating inflation in future years.

In reviewing the necessary improvements in pension plans, a general and flexible framework for pension funds would make different forms of risk-sharing possible, including DB and individual DC forms of collective funds.

It would also allow for a flexible definition and management of guarantees.

In the shift to individual DC funds in the UK and the US, individual DC funds run the risk of becoming inefficient vehicles, benefitting from no risk-sharing at all, being extremely underdiversified, lacking default (annuitisation in the US) and being costly.

So, it is urgent to rethink the DC framework and envisage a DC 2.0 that would try to compare or compete with collective solutions. There should be more involvement of member states in the design of adequate solutions – or, more simply, in setting appropriate governance structures and organisations.

The regulation of individual DC funds should be profoundly modified, and it should definitely be far removed from the inadequate retail fund regulation it is inspired by. Individual DC funds should be able to diversify their exposures and invest in illiquid securities and, in a nutshell, have the same flexibility that DB funds have today because ultimately, they must also provide retirement income.

NOMINAL GUARANTEES

Of course, there is no need to wait for regulatory change to improve practices, which should ideally be driven by a genuine aim to service investors’ needs rather than to blindly adhere to regulations, incentives and usual market practices.

Today, DC funds dispose of significant means enabling them to avoid the pitfalls of short-term retail funds, as they can diversify their assets using international investments, corporate bonds, listed real estate, commodities, and even funds of hedge funds.

In addition, the current technology makes it possible to offer some guarantees in DC funds. Inflation guarantees or target inflation indexation are important for those who rely primarily on the income from DC pension funds, as is often the case now in the UK and the US.

Nominal guarantees can foster confidence in DC arrangements, especially over the short run. However, the cost of financial guarantees must be made clear, for instance by showing by how much the participation to the upside is reduced (and by how much the downside is protected).

Nominal guarantees can foster confidence in DC arrangements, especially over the short run. However, the cost of financial guarantees must be made clear, for instance by showing by how much the participation to the upside is reduced (and by how much the downside is protected).

When it comes to hybrid plans, nominal guarantees on premiums are usually required in continental Europe. Yet for the younger participants, these guarantees can be reduced – as long-term investors they have little need for nominal guarantees if this comes at the expense of real (inflation) indexation. This reduction in nominal guarantees gives way to more flexible and profitable funds and, on the whole, produces more sustainable hybrid plans.

Nominal guarantees can be important for the older participants, because over the short-term nominal guarantees can be considered a proxy for real ones. This also means that, ideally, the system should be flexible enough to accommodate different indexation policies, in line with the life-cycle approach where the risk and reward changes with age.

However, the effort should not be borne by regulators alone – practices need to evolve too, as there is empirical evidence that pension funds behave sub-optimally – that is, they do not fully use their ability to diversify and invest in illiquid assets, and they often have a strong home bias, which is not only contrary to standard academic prescriptions that recommend diversifying assets geographically, but also runs the risk of insufficiently protecting the purchasing power of retirees in maturing economies.

On the whole, even if regulations can be largely improved to ensure a sustainable framework for pension funds and give adequate long-term incentives, improvement in practices, even relative to standard portfolio construction theory. It is not obvious that pension funds have adapted their investment policies to account for demographic changes.

Samuel Sender is applied research manager at Edhec-Risk Institute

©2012 funds europe