Dividends are becoming central to equity investment strategies in the low-growth environment. Barney Hatt looks at how the ETF world is responding.

European stocks have had a difficult couple of years as the eurozone sovereign-debt crisis has plagued the region. However, although allocations have understandably diminished, European equities remain a key component of many long-term, buy-and-hold portfolios, offering international exposure as well as adding essential diversification benefits.

For investors seeking to create a tactical tilt in their portfolios or increase European stock exposure, there are European equity dividend exchange-traded funds (ETFs) that offer access to this segment of the market.

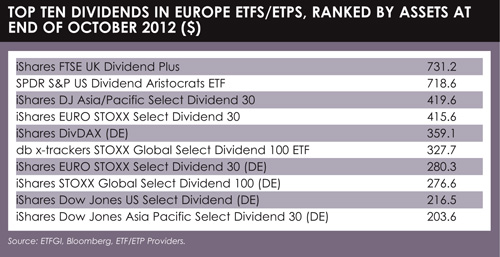

The first ETF dividend was offered in 1990. However, the array of dividend indices has expanded greatly over the last couple of years. Today iShares dominates the European ETF market with eight of the top ten European dividend funds, ranked by assets at the end of October.

Stephen Cohen, BlackRock’s head of iShares Europe, Middle East and Africa investment strategy, says: “We have seen an evolution of dividend funds and a growth of exposures in terms of how many countries and regions can now be accessed through ETF dividend funds. They have definitely been a big growth area from this perspective.”

Among its product range, iShares has select dividend indices that provide an element of screening around which stocks go into the index. This is to try to deliver an element of sustainability of dividends.

GROWTH DRIVERS

For Manooj Mistry, head of db X-trackers at Deutsche Bank, a key growth driver has been the continuing low interest environment with investors keen to embrace new sources of income without having to see deterioration in their capital.

He says a good product will have a reasonable yield and scope for reduction on the negative downside of an investor’s capital.

Mistry says, “A few years ago a high dividend index on the FTSE 100 was very skewed towards financials, and banks made up a very high percentage of the underlying index. Before the crisis banks were paying a reasonable yield but when we had the crisis bank shares dropped dramatically.”

Mistry adds: “What we saw was the capital aspect of the index product was also diminished.”

Like other providers, db-x trackers look to index providers to construct dividend indices.

Mistry says: “We discovered that they will try to take into account forward looking dividends, but also make sure that there is not a very high overweighting to one particular sector or industry so as to ensure the capital returns are not impacted as well.

“It is all about trying to construct a reasonable index. We have some products in this space already and we will probably look to develop more going forward.”

Cohen says there is a growing recognition by investors that dividends play a big part in total return within equities. He cites BlackRock’s own research on this topic, which, he says, shows the amount of return that has come from yield or income from dividends over the last 40 to 50 years has been substantial.

State Street Global Advisors (SSgA) has launched four European equity dividend ETFs under its SPDR ETF brand over the last year. These are based on US, emerging markets, UK and eurozone equities respectively. All are driven by S&P dividend methodologies.

“BORING STOCKS”

The SPDR S&P US Dividend Aristocrats ETF, which was listed in October 2011, was ranked second by assets in the top ten table of dividend ETF/exchange-traded products in Europe, at the end of October 2012 with assets under management of $718.6 million (€549.4 million).

Explaining why the fund has been successful in terms of assets, Scott Ebner, SSgA’s global head of ETF product development, says: “We think it has responded to needs of many customers who are looking for income from equities, especially in low interest rate environments where the incomes from bonds are potentially less attractive than they have been.”

Lyxor has also had success with its SG Quality Income ETF. Listed on October 19 this year, by the end of the month it had already attracted $113.7 million in assets.

Lyxor has also had success with its SG Quality Income ETF. Listed on October 19 this year, by the end of the month it had already attracted $113.7 million in assets.

According to Lyxor chairman Alan Dubois, the fund is based on two ideas. One is that the dividend rate is important for investing. The second is that “boring stocks” are often undervalued, he says.

“By boring stocks I mean companies which have a very good balance sheet, sustainable growth and income. They may not make the news and are therefore often undervalued. We have made this ETF based

on these cross-research assets with a quantitative methodology which provides an ETF that is very successful.”

FUTURE TRENDS

Looking forward at possible future market trends, Deborah Fuhr, partner at ETFGI, a data provider, says: “I think we will see more UK investors embracing the products as we find the retail distribution review is implemented when advisors are no longer paid to sell specific products, and look instead at the whole of the market.”

She adds: “As the less affluent retail investors begin to invest on their own, we will see these types of product – income and more specifically ETFs – become more popular in the UK and Holland.”

She says it is also likely that the European Securities and Markets Authority is still looking at implementing a ban on inducements across Europe under the Markets in Financial Instruments Directive.

Meanwhile Ebner highlights a particular area of future potential growth: emerging markets.

“We are seeing more interest from investors in similar dividend yielding strategies for equities in emerging markets, for example. Whereas the majority of the growth today has been focused in developed market strategies. This is an area of potential growth in the ETF market.”

Cohen predicts continued inflows into dividend funds. “If we look globally we have seen consecutive inflows in dividend funds across all the ETFs – not just iShares – for over two years,” he says.

Cohen predicts continued inflows into dividend funds. “If we look globally we have seen consecutive inflows in dividend funds across all the ETFs – not just iShares – for over two years,” he says.

“We expect to see this trend continue into 2013, because the need for yield is unlikely to go away any time soon. Interest rates are not going to go up any time soon, and this will continue to drive this interest in dividends.”

Cohen says he expects a growing awareness of the role of dividends within equity total returns will also continue to drive interest in dividends-based ETF products.

“When we look regionally, we think Europe offers opportunities in terms of dividend funds because yields in Europe are generally quite good,” he says. “A lot of the companies typically are the larger companies which have a lot of exposure to non-European markets in terms of growth.”

©2012 funds europe