The funds industry recognises that outsourcing front-to-back office operations proved incredibly resilient to Covid-19, says Leonard Ollier, Head of Business Development for Asset Managers at Societe Generale Securities Services.

Covid-19 has totally transformed asset management operations and remote working arrangements or split operations are expected to remain in place for a prolonged period.

Yet inconsistent broadband connectivity and network capacity are among the operational challenges that Covid-19 has exposed for front and middle office teams. Some investment firms had difficulties [OLS1] to interact seamlessly with their providers, leading to delays around exchanges of information that have consequences for settlements and position-keeping.

Cyber-security is a big concern. Fund managers are privy to exceptionally sensitive market and client data – yet home broadband provides less secure connectivity than in the office.

Also, a number of tier two and tier three investment managers acknowledged they encountered difficulties when attempting to access online tools, such as portfolio management systems and shared data files. This led to delays in client reporting and meant managers were themselves deprived of real-time market information.

All this has prompted more asset managers to outsource front and middle office activities to third parties, sS), because investment banks and other providers of securities services have weathered Covid-19 reasonably well from an operations perspective, largely due to their well-oiled business continuity plans. SGSS was no different.

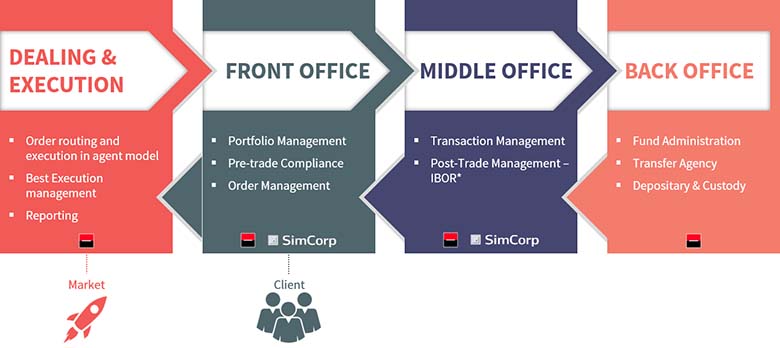

CrossWise – our front, middle and back office outsourcing solution – as well as I-DEAL – our outsourced dealing desk – were robust and able to support clients during the crisis without any decrease to service levels or added costs.

Our Portfolio Management System is still able to provide live information to perform powerful analysis and take sound investment decisions. Even with a considerable increase of operations [OLS2] since the beginning of the crisis, our teams have been able to monitor operations, manage discrepancies and maintain the quality of report to our clients.

Remote access to our tools is secured and fully maintained for all our clients and thanks to the 100% availability of our I-DEAL platform we are also able to guarantee the best access to liquidity, which is crucial in times of volatility. The number of received bond orders increased fivefold, with a similar trend for equity. Our FOREX and ETD activity has more than doubled.

Outsourcing set to accelerate

Outsourcing was already a source of reflection for fund managers before the crisis. Firms realised that, for example, outsourced dealing desks offered advantages such as a reduced number of broker relationships to manage, better market access, more reliable exposures to counterparties and enhanced liquidity. Each of these reduces running and market access costs for clients.

In addition, more managers now recognise that an outsourced middle office solution makes it easier to monitor ongoing operations during crisis situations and can be instrumental in mitigating operational risk. This partly explains why, in the medium term, outsourcing across the front and middle office – and leveraging solutions like CrossWise – is likely to see a further spike.

Among the benefits of outsourcing are that outsourcing fees are variable, meaning managers can generate efficiencies and performance benefits. CrossWise utilises SGSS’ outsourcing and operations management experience, and leverages market-leading SimCorp Dimension technology, which increases buy-side automation and creates net positive results in terms of managing costs and operational risk.

Once the realm of boutique asset managers, front to back office outsourcing is now being adopted across a wider spectrum. The funds industry has recognised that the outsourced model offered by providers such as SGSS has proven to be incredibly resilient to Covid-19.

© 2020 funds europe