New investment opportunities in emerging markets (EM) are resulting from the coronavirus pandemic’s impact on consumer behavior. By Patricia Ribiero, Senior Portfolio Manager, and Nathan Chaudoin, Senior Client Portfolio Manager, Emerging Markets Equity, American Century Investments.

COVID-19 has profoundly affected how we live. The need to shop, bank, learn, play and even communicate remotely has hastened the use of digital technologies. The pace of digital adoption should quicken as remote working, online learning and e-commerce penetration continue to rise. These trends are prevalent in emerging economies, where about 75% to 80% of the world’s consumers will soon reside, according to the Brookings Institute. We expect the pattern of faster digitalisation in China, which has continued after the lifting and/or loosening of virus mitigation measures, to develop across emerging markets. This transformation should create investment opportunities in many sectors and industries.

A STRUCTURAL SHIFT IN CONSUMER BEHAVIOR: E-COMMERCE

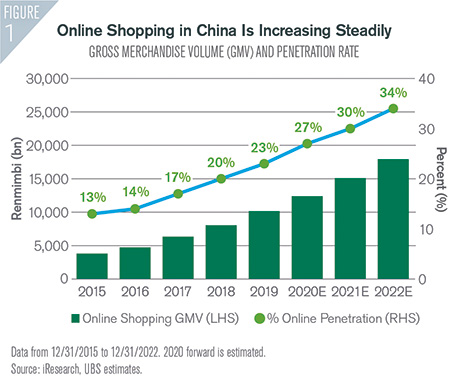

The global health crisis has fuelled the already rapid increase in online economic activity. Before the pandemic, online retail sales (as a percentage of all retail sales) had more than tripled since 2011, according to US Census Bureau statistics. The shelter-in-place environment led consumers to significantly alter their shopping and buying habits. According to July 2020 UBS research, many Chinese consumers – particularly in the 45-plus age group – ordered online for the first time during lockdown periods. They have accepted online shopping as a viable alternative to visiting physical stores. UBS further reported that the addition of this group to the online shopping universe has been a real boost to e-commerce.

The accelerated move toward online shopping has forced many businesses to focus on digital and cloud-based offerings. Many are reorienting away from brick-and-mortar facilities to online operations. We expect underpenetrated areas, such as groceries and food delivery, household items and personal care products (items less frequently bought online before the pandemic) to experience the strongest growth.

The accelerated move toward online shopping has forced many businesses to focus on digital and cloud-based offerings. Many are reorienting away from brick-and-mortar facilities to online operations. We expect underpenetrated areas, such as groceries and food delivery, household items and personal care products (items less frequently bought online before the pandemic) to experience the strongest growth.

The trend toward urbanisation further supports e-commerce expansion. According to United Nations estimates, nearly 700 million people will migrate to cities in emerging markets over the next decade. This should help solidify the shift in EM consumer behavior – to demand premium-quality products in striving for a better quality of life. Better access to the internet in cities should support the transition to more online engagement.

COVID-19 IS CHANGING BEHAVIOR BEYOND E-COMMERCE

The pandemic’s impact on e-commerce is evident, but its effect will reach well beyond online shopping. In fact, consumers’ attitudes on work, transportation, health and hygiene, education and entertainment have shifted, perhaps permanently. The use of online platforms has expanded beyond e-commerce, requiring increased development of sophisticated internet infrastructure, including 5G networks.

Remote Working: Forced to work from home, individuals need better software and more reliable internet access. This new environment has led to an explosion in usage of online collaboration and communications tools. Beneficiaries include companies offering IT services, cloud-based technologies, servers, data storage, networking logic and memory.

Biking Boom: The reluctance to take public transportation during the pandemic has led to surging demand for traditional and electric bicycles (e-bikes). Online searches for bicycles have increased more than 500% since March 2020, according to Google Trends. Demand continues to widely outstrip supply, and many areas have long waiting lists for new inventory. Makers of e-bikes and scooters are also benefiting from the significant increase in demand for food delivery as indoor dining remains unavailable in many cities.

Telehealth: The pandemic has led many consumers to deploy healthcare apps and virtual medical visits for the first time. China has seen strong growth in online consultations, which are expected to grow 40% annually through 2026, according to market research firm Frost & Sullivan. We expect this trend to continue to soar as patients become more comfortable with telehealth and more appreciative of the convenience of online visits for routine care.

Additionally, medical institutions may not be able to meet increasing demand for in-person healthcare visits, a result of scarcity and the uneven distribution of resources across emerging markets.

Additionally, medical institutions may not be able to meet increasing demand for in-person healthcare visits, a result of scarcity and the uneven distribution of resources across emerging markets.

Cleanliness and hygiene have become a top priority, another trend we believe will persist. Use of surgical gloves for personal protection remains low in key areas such as China and India. However, we expect demand for gloves in healthcare facilities and for personal use to continue to increase.

Remote Learning: The pandemic’s long-term impact on education could be profound. Roughly two-thirds of students (or 1.2 billion people) have been affected by pandemic-related shutdowns, according to UNESCO data, so remote learning has escalated. We expect this move to continue.

Media Consumption: How people consume media and entertainment has changed radically. Streaming music and video and online gaming has increased exponentially since the onset of the pandemic. Online advertisers, streaming content providers and online gaming platforms are notable beneficiaries.

THE EFFECTS ON EMERGING MARKETS: CHINA, ASIA AND BEYOND

Internet usage is rising in China, across the ASEAN region and in India as it becomes an integral part of life. Online shopping, digital payments and working-from-home needs support this. Southeast Asia’s internet economy tripled in the previous four years, to US$100 billion in 2019, according to Bloomberg.com. This economy is expected to triple again, to US$300 billion by 2025. As a result, companies in the region are investing to improve their online footprints and expand fulfillment capabilities. Companies are reorienting their businesses as many customers are using online platforms for the first time. Covid-19 has aided this trend, leading to a sharp increase in e-commerce penetration in Asia and India.

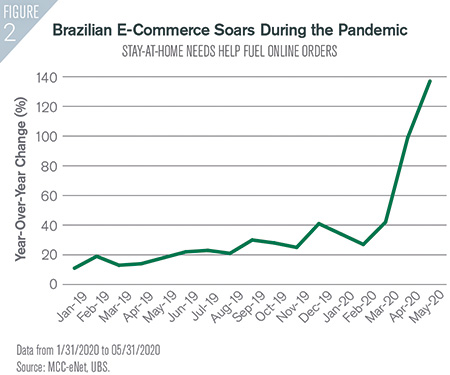

Internet usage is inflecting positively in Russia and Brazil as well. In Russia, e-commerce penetration is accelerating significantly. Trends well underway in developed markets, such as Uber-like models for taxis and food delivery, are growing rapidly. In Brazil, e-commerce is underpenetrated but on the upswing.

STRUCTURAL CHANGES CREATE NEW OPPORTUNITIES

Covid-19 has accelerated the broad shift from offline to online. This move has borne out in e-commerce, especially in categories (e.g. grocery delivery) and demographics (e.g. older consumers) that have historically been underrepresented online. The long-term effects of the pandemic are reaching outside e-commerce. Working, learning, playing and caring for ourselves and our families have been transformed by the stay-at-home environment.

We believe many of these trends represent long-term, structural changes to consumer behavior that will be with us long after the coronavirus. And these changes have created new opportunities in many sectors and industries transformed by the global health crisis.

The opinions expressed are those of the portfolio team and are no guarantee of the future performance of any American Century Investments portfolio. This information is for an educational purpose only and is not intended to serve as investment advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

This information is not intended as a personalized recommendation or fiduciary advice and should not be relied upon for investment, accounting, legal or tax advice. No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.

American Century Investment Management (UK) Limited is authorised and regulated by the Financial Conduct Authority. American Century Investment Management (UK) Limited is registered in England and Wales. Registered number: 06520426. Registered office: 12 Henrietta Street, 4th Floor, London, WC2E 8LH.

American Century Investment Management, Inc. is authorised by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin)).

All rights reserved.

© 2020 funds europe