We profile some of the most interesting fund launches in recent weeks and examine the performance of a product already on the market.

GLOBAL EQUITIES

GLOBAL EQUITIES

Aviva Investors has launched a global equities fund to be managed by Giles Parkinson, who joined the firm from Artemis Fund Managers in July 2015.

The fund aims to achieve long-term, consistent returns through a high-conviction, low-turnover portfolio of between 20 and 40 global stocks.

As the portfolio has an unconstrained investment approach, businesses will be considered irrespective of their location or sector. A particular area of focus is stocks with global regional reach.

Parkinson will be supported by Richard Saldanha, manager of the firm’s Global Equity Income fund, and Helen Driver, manager of the AIMS multi-strategy Global Equity Income fund.

The portfolio has an annual management charge of 1.5%. In a statement, Parkinson said that given the long-term and enduring nature of the portfolio, he envisaged the fund’s investment horizon to be in excess of five years, although clients could hold the fund indefinitely as a core long-term investment.

Global head of equities at the firm, Chris Murphy, said the launch was part of the continual “evolution” of its equity offering, and the new fund reinforced Aviva Investors’ commitment to outcome-oriented solutions.

ALTERNATIVE EQUITIES

ALTERNATIVE EQUITIES

Aberdeen Asset Management has launched an equity market neutral fund, which blends a number of equity-related alternative strategies and focuses on generating returns through stock selection rather than market exposure.

The liquid, Ucits-compliant fund already holds assets of €200 million and was seeded by a German institutional investor.

The launch follows on from Aberdeen’s Alternative Strategies fund in August last year. There is a minimum investment requirement of €1 million.

The Aberdeen hedge funds team – led by Russell Barlow, head of hedge funds at Aberdeen Asset Management, and managing assets of around €10 billion of assets – has constructed the fund’s portfolio. A select pool of high-quality alternative investment managers are running dedicated mandates within the fund.

Commenting, Barlow said finding ways to generate good returns with limited exposure to broad market movements has become a priority for many investors, and the fund had been able to allocate to a range of managers otherwise unavailable in the alternative Ucits space.

CORPORATE BOND

CORPORATE BOND

Fidelity has launched a short-dated corporate bond fund for managers Sajiv Vaid and Ian Spreadbury, for investors seeking to reduce credit or interest risk in their portfolios, and increase their yield exposure. The fund aims also to achieve both capital growth and income.

Its portfolio will invest primarily in sterling-denominated, investment grade corporate bonds with a maturity of five years or less.

The managers already run the firm’s Moneybuilder Income and Extra Income funds.

Vaid said today’s yield “dilemma” meant investors were wary of extending risk to capture yield, and the fund would seek to cater to this cautious segment of the market.

John Clougherty, head of wholesale at Fidelity International, added that the fund would aim to deliver a consistent level of income, low volatility and equity diversification.

Fidelity is the latest firm to launch such a product, following similar launches from Aberdeen Asset Management, Morgan Stanley and Standard Life Investments.

The fund’s OCF is 0.38%.

MULTI ASSET INCOME

MULTI ASSET INCOME

JP Morgan Asset Management (JPMAM) has launched an alternative version of its Global Income fund, designed to reduce volatility.

The fund will offer broad diversification with the flexibility to source income across geographies and asset classes.

It has the same portfolio team as its Income parent, targets a yield range of 3%-5% and a volatility range of 3%-7%. It has an asset split of 30% equities and 70% fixed income holdings.

Massimo Greco, head of European funds at JPMAM, said that with bond yields remaining near record lows as a result of central bank policy, the need for income is stronger than ever among investors, forming a critical component of overall total returns. “The fund will have the same flexibility to seek strong risk-adjusted returns across income-generating assets globally as the Global Income fund, but is geared towards investors who have a higher degree of sensitivity towards volatile markets,” he said.

Michael Schoenhaut will be lead portfolio manager, supported by co-portfolio managers Eric Bernbaum and Talib Sheikh. Collectively, they have around 50 years’ industry experience.

The managers are based across New York and London.

JP Morgan Asset Management manages multi asset income assets of $35 billion.

ONE YEAR ON

ONE YEAR ON

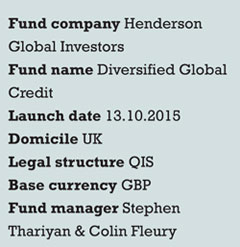

A year ago, Henderson launched a global credit strategy.

The fund aims to provide returns from both income and capital appreciation by exploiting valuation differences in global credit markets.

It invests in a broad range of secured loans, high yield bonds, investment grade bonds, asset backed securities and other fixed income securities, targeting a total return of 3%-5% per annum. It has achieved the top end of this target return parameter since launch, growing 5% over the period ending September 30, 2016.

The firm’s underlying Investment Strategy Group is responsible for the selection and management of securities,

Accommodative central bank policies have produced lower default rates and a strong demand for assets with attractive yields. As a result, both government and corporate bond holdings have contributed positively to the fund’s performance, and sub-investment grade assets (such as secured loans and high-yield bonds) have also been positive performers. However, the fund largely missed out on the rally in US sub-investment grade assets, which started in February 2016.

©2016 funds europe