In a major change of fortune, UK equity was the most searched-for asset class among equities last month on CAMRADATA Live, writes Amy Richardson.

With vaccination campaigns coming into play in December 2020, there is an expectation of approximately 5% growth in GDP in 2021. There was a boost to global equities in November, reflecting the vaccine announcements from Pfizer-BioNTech and Moderna resulting in a 12% gain since the beginning of the year.

The key to maintaining this momentum is rolling out these vaccines as quickly as possible, which would increase investor confidence. Although the exact timelines are unknown at present, investors continue to use CAMRADATA Live to assign mandates, create buy lists, monitor managers and research asset classes.

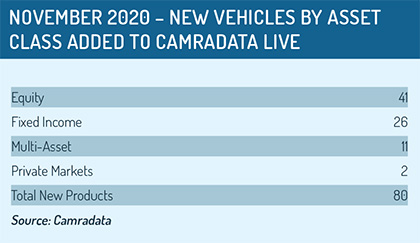

Asset managers added 80 new products to the CAMRADATA platform this month, just over 50% of which were equity products. In relation to equities, the most searched asset class amongst institutional investors was UK equities, with Columbia Threadneedle Investments having the most researched strategy in this field.

Asset managers added 80 new products to the CAMRADATA platform this month, just over 50% of which were equity products. In relation to equities, the most searched asset class amongst institutional investors was UK equities, with Columbia Threadneedle Investments having the most researched strategy in this field.

This interest in the UK from investors is a huge shift from 2019 and can also be seen across private markets – where UK property is the most searched asset class.

In relation to fixed income, global broad bond continues to be the most searched asset class, with Insight Investment being the most researched manager. In multi-asset, global diversified growth remains the most searched asset class, with Aberdeen Standard at the top.

In relation to fixed income, global broad bond continues to be the most searched asset class, with Insight Investment being the most researched manager. In multi-asset, global diversified growth remains the most searched asset class, with Aberdeen Standard at the top.

One area of interest we can be certain of in 2021 is sociably responsible investing. More than a third of the searches run by CAMRADATA for institutional investors across Europe were for ESG strategies, and with the impending change of president and the refocus on climate change in the US, we predict this will open up further opportunities in this space.

In addition, we see a focus on enhanced reporting across diversity and inclusion from asset owners that will drive changes across the asset management industry.

Amy Richardson is a senior director of CAMRADATA, the owner of Funds Europe. All figures are for one month to November 30, 2020, unless otherwise stated.

© 2020 funds europe