Fund-related information given by asset managers to their distributors and investors is only one type of fund industry data. Another type is the information gathered by distributors about end investors. Historically, this information has not necessarily been shared with fund managers. As far as the retail market is concerned, fund managers have generally been happy not to know who their end investors are, so long as the money keeps coming in.

But technology may help to change this situation. We asked respondents if they agreed that “The growth of ‘big data’ will transform fund distribution by showing fund companies precisely who buys their products.” In all, 63% agreed with the statement (of which 21% strongly agreed: see figure 6 on page 8).

The argument in favour of greater data exchange between distributor and fund manager is that this information can be useful to the sales departments of asset management companies. However, there may be a cost attached to owning this customer-level data, especially if it pertains to individual retail investors rather than, say, an institution. The costs that exist occur usually because of requirements imposed by regulators.

To test our thesis, we asked respondents if they agreed that “Fund companies should be careful about how much customer-level data they receive because each piece of data incurs regulatory responsibilities.” A majority, 72%, agreed with this statement (of which 17% strongly agreed: see figure 7 on page 8). This finding reveals a concern among our respondents that acquiring the wrong type of customer data, or too much of it, may be counter-productive. In other words, data may sometimes be more trouble than it’s worth.

The reason asset managers have been able to survive and prosper without necessarily knowing who their end investors are is that distributors have generally handled the administration of end user accounts. This has been a fairly convenient model for asset managers as it relieves them of a great deal of administrative work. But some industry commentators have predicted the model will have to change.

The reason asset managers have been able to survive and prosper without necessarily knowing who their end investors are is that distributors have generally handled the administration of end user accounts. This has been a fairly convenient model for asset managers as it relieves them of a great deal of administrative work. But some industry commentators have predicted the model will have to change.

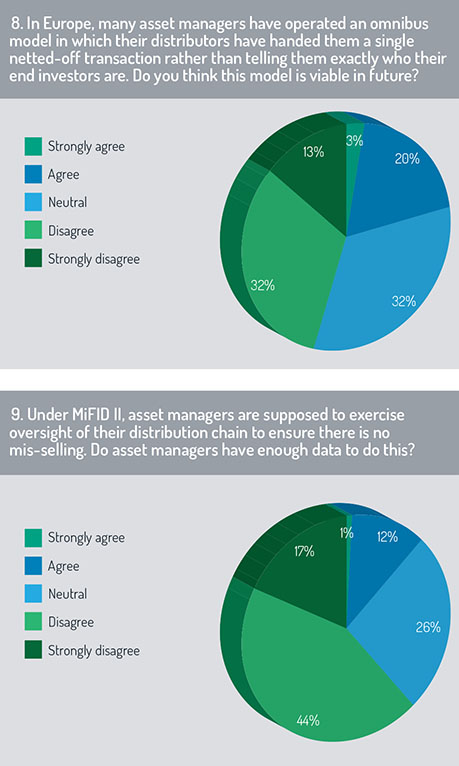

We asked, “In Europe, many asset managers have operated an omnibus model in which their distributors have handed them a single netted-off transaction rather than telling them exactly who their end investors are. Do you think this model is viable in future?” Respondents seemed to have doubts about the omnibus model; they were about half as likely to agree that it was viable than disagree (see figure 8 on page 9). However, there was not a majority either for or against.

An irony of the funds industry is that regulation, which for years has deterred asset managers from holding data on their end investors, may in future lead asset managers to gather more information about their customers. Specifically, the second version of the Markets in Financial Instruments Directive (MiFID II), with its emphasis on transparency and fairness, puts some onus on fund manufacturers to ensure that their funds are not being sold to the wrong people.

We asked, “Under MiFID II, asset managers are supposed to exercise oversight of their distribution chain to ensure there is no mis-selling. Do asset managers have enough data to do this?” Only 13% of respondents thought asset managers had enough data (of which only 1% held the view strongly: see figure 9 on page 9). The majority, a total of 61%, thought asset managers were deficient in this regard. This finding suggests a concern that some asset managers will struggle to meet their responsibilities under MiFID II.

We asked, “Under MiFID II, asset managers are supposed to exercise oversight of their distribution chain to ensure there is no mis-selling. Do asset managers have enough data to do this?” Only 13% of respondents thought asset managers had enough data (of which only 1% held the view strongly: see figure 9 on page 9). The majority, a total of 61%, thought asset managers were deficient in this regard. This finding suggests a concern that some asset managers will struggle to meet their responsibilities under MiFID II.

Given the widespread expectation that data will become a greater focus of fund managers in the years ahead, it is logical to ask if the managers themselves will be able to handle this workload, or if they will rely on service providers to assist them.

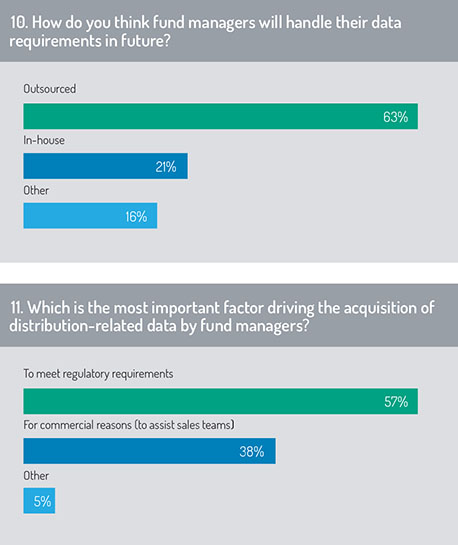

Our respondents tend toward the view that third parties will be needed. When asked how fund managers would handle their data requirements in future, 63% of respondents said these functions would be outsourced (see figure 10 on page 10) compared with 21% who said the functions would be handled in-house.

Our respondents tend toward the view that third parties will be needed. When asked how fund managers would handle their data requirements in future, 63% of respondents said these functions would be outsourced (see figure 10 on page 10) compared with 21% who said the functions would be handled in-house.

The 16% of respondents who chose “other” were asked to say what they had in mind. Several of them predicted fund managers would adopt a hybrid model including some outsourced data functions and some in-house. One respondent suggested that large companies would do it in-house and small companies would outsource. Another said, “in theory it should be insourced but in all likelihood it is extremely difficult to sell data challenges to senior executives within a fund management company, therefore it is highly likely it will be outsourced”.

For the final part of the report, click here.

©2018 funds europe