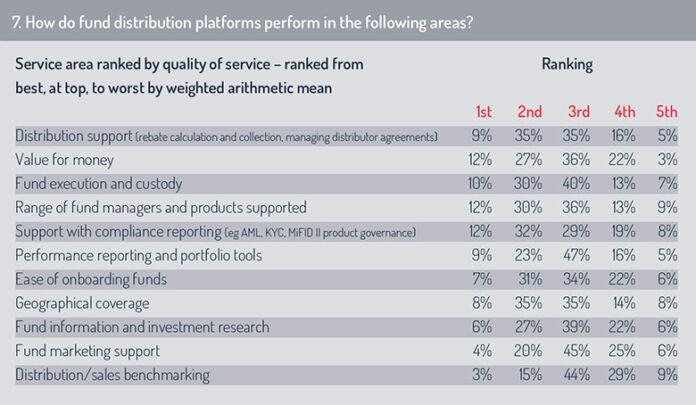

Which services do fund platform operators deliver well? And where can fund platform operators improve to meet the service expectations of their users? The survey asked respondents to assess platform operators’ performance according to 11 service categories, classifying the service from 1 (“very good”) to 5 (“very poor”). These service categories were then ranked in order of service quality on the basis of weighted-arithmetic mean (fig 7).

Ranking at the top of the list of services that fund distribution platforms perform well, respondents highlighted high quality of distribution support – for example in managing distributor agreements, managing rebate calculation and collection – and providing value for money. Platform operators also rated well in delivery of fund execution services and for standards of custody provision and asset safety.

Turning to areas where there is most room for improvement, respondents pointed to a need for improved information flows on distribution sales. Asset managers are seeking improved data flows across the distribution supply chain, for example to facilitate evaluation of sales team performance and to benchmark performance of distributors across an asset manager’s global distribution network.

Respondents also highlighted opportunities for platform operators to enhance the quality of fund research and product information that they offer through their online platforms. Distributors are seeking access to fund documentation and product sheets across a broad range of manufacturers and investment products, available through a single point of access. Some fund platform operators are exploring the potential to apply data science to assist searches and document access, applying algorithmic models to understand their customer base more effectively and to match customer investment preferences and wealth management goals with a suite of suitable products available on the platform.

Improving service to asset managers

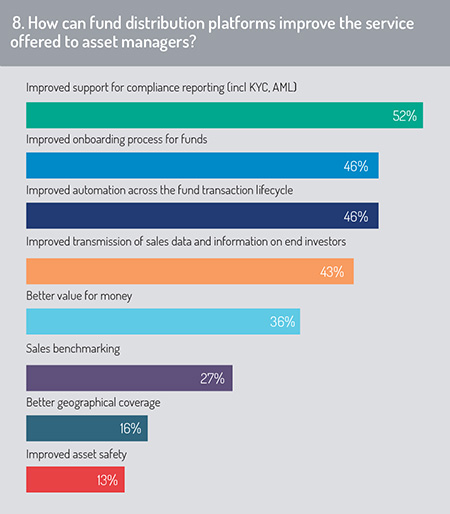

The primary area where fund platform operators can deliver better value to asset management companies, according to survey respondents, is by improving access to the data that asset managers require to meet their compliance reporting obligations – particularly with regard to product governance obligations under MiFID II and anti-money laundering (AML) and countering the financing of terrorism (CFT) responsibilities outlined by the Financial Action Task Force.

Under the second Markets in Financial Instruments Directive (MiFID II), a management company must, under its product approval process, specify a “target market” of end clients for every financial instrument that it sells. It must then take reasonable measures to ensure that the financial product is distributed only to this identified target market and that all risks associated with these product sales are monitored on an ongoing basis.

Under the second Markets in Financial Instruments Directive (MiFID II), a management company must, under its product approval process, specify a “target market” of end clients for every financial instrument that it sells. It must then take reasonable measures to ensure that the financial product is distributed only to this identified target market and that all risks associated with these product sales are monitored on an ongoing basis.

In addition to key data on end investors and lower-tier distribution intermediaries that asset managers require to meet their compliance reporting obligations (52%), asset managers are also seeking a detailed breakdown of sales data for commercial purposes – enabling them to evaluate the performance of their own sales teams and/or to benchmark distributor performance across their global transaction networks (fig 8). This requirement also features prominently in the list of areas where respondents tell us that fund platforms can improve service delivery to asset management companies (43%).

Beyond demand for improved sales data and investor information, asset management clients are seeking automated process flows across the transaction lifecycle, optimising STP rates, removing manual touch points and stripping out corresponding operational risk from their sales and distribution support requirements (46%). They also require an efficient onboarding process for fund products, moving beyond manual, document-centric onboarding procedures to an accelerated, streamlined, digital process (46%).

Improving service to distribution intermediaries

For fund platforms offering B2B services to wealth managers and other distribution intermediaries, survey respondents indicated that the most significant improvements these can deliver to their distributor clients will again be through enhancing their management of compliance information across the distribution supply chain (fig 9).

European regulations do recommend that asset managers take appropriate measures to verify the identity of end investors purchasing their fund products through a lower-tier distribution intermediary (e.g. Joint Guidelines under Articles 17 and 18(4) of Directive (EU) 2015/849 relating to AML and CFT due diligence). However, this makes allowances, if the sale is “low-risk” and national law permits, that the asset manager may entrust this responsibility to the distribution intermediary to verify the investor’s identity and to conduct required due diligence checks (see further in the Funds Europe and Clearstream joint report, Clear Enough: Finding the Best Level of Transparency, July 2019, op. cit.).

European regulations do recommend that asset managers take appropriate measures to verify the identity of end investors purchasing their fund products through a lower-tier distribution intermediary (e.g. Joint Guidelines under Articles 17 and 18(4) of Directive (EU) 2015/849 relating to AML and CFT due diligence). However, this makes allowances, if the sale is “low-risk” and national law permits, that the asset manager may entrust this responsibility to the distribution intermediary to verify the investor’s identity and to conduct required due diligence checks (see further in the Funds Europe and Clearstream joint report, Clear Enough: Finding the Best Level of Transparency, July 2019, op. cit.).

With this point in mind, the need for fund platform operators to offer efficient data transmission across the distribution supply chain is important for asset managers and for distribution partners that may use the platform. The survey identifies this requirement at the very top of respondents’ current priorities (58%). The need for fund platform operators to extend automation across the fund transaction lifecycle also featured near the top of priorities when serving distributor clients (just as it did for asset management clients, see previous section).

Beyond this, distribution parties continue to push for greater choice of investment products supported on fund platforms that they employ – and for these service enhancements to be delivered against more attractive cost structures. The appetite of financial service companies to receive a wider and better range of investment services at a more competitive price is one that has changed little over many decades – and this drive is clearly illustrated in these survey responses.

Looking at areas of service strength, fund platforms received positive feedback for their ability to deliver streamlined registration and account management – and their ability to provide ease of access to fund documentation and product data.

For market infrastructure entities offering fund platform services, such as Clearstream, there is evidence of investment and partnership designed to strengthen their capability in a number of the above areas. Under its Fund Desk Distribution Support solution, Clearstream has extended access to an independent fund research provider, fundinfo, which offers a wide library of fund information to investors and financial intermediaries. Fund Desk also provides a data exchange that manages transfers of data from fund manufacturer to distributor, and vice versa, thereby supporting data flows for compliance reporting and commercial sales benchmarking.

Improving services to end investors

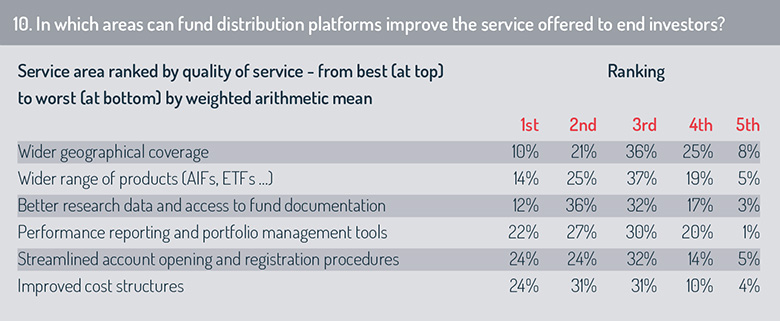

When it comes to improving the services that fund distribution platforms offer to the end investor, survey respondents returned to a familiar set of priorities – demand for a wider choice of investment fund products supported on platforms (particularly including the extension of alternative investment products and ETF ranges) and wider geographical coverage (fig 10).

Investors will also benefit from improvements to the range of fund documentation and research data supported on fund platforms – and through further investment in performance measurement and portfolio management tools that these offer.

With third-party performance analytics providers extending their tools through a wide range of delivery mechanisms (including API, and cloud-based software- or platform-as-a-service solutions), this is extending the options available to platform operators without requiring that these are hosted on an on-premises server.

Whereas the survey highlighted the need for fund platform operators to improve cost efficiencies in delivering a better service to B2B distribution intermediaries, this featured near the bottom of the priority list for enhancing service delivery to the end investor. Platform operators were also rated strongly for the quality of registration and account opening services offered to distributor clients and to end investors, with this service requirement appearing close to the bottom of both ranking tables (fig 9, fig 10) in terms of priorities for improvement.

© 2020 funds europe