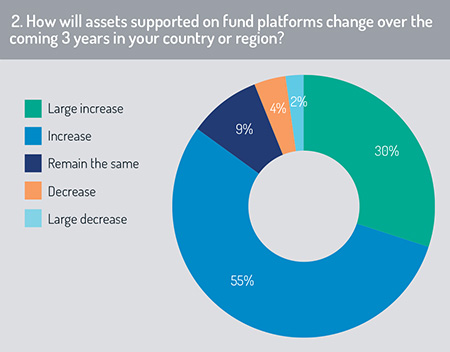

Respondents anticipate that assets under administration on fund platforms are likely to rise over the coming three years in their country or region. More than four-fifths of survey constituents said that fund platforms will experience asset growth over this timeframe, with 30% indicating this is likely to be a strong increase (fig 2).

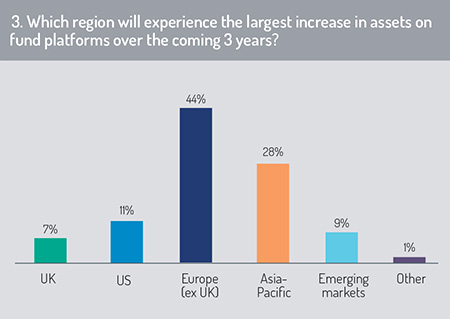

From a geographical standpoint, this growth in assets supported on fund platforms is likely to be most pronounced in Europe (excluding the UK) over the coming three years (44%), with the Asia-Pacific region also expected to see significant rise in AUA on fund platforms (28%). Growth in these regions is expected to substantially outpace growth in platform assets for US- or UK-based platform operators over this time period (fig 3).

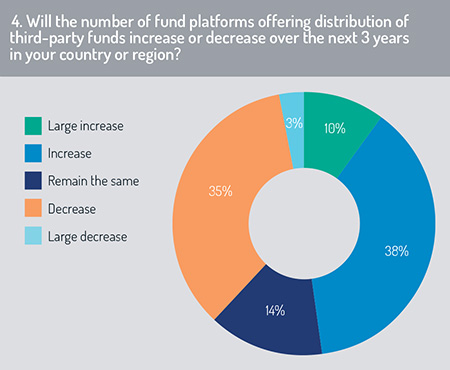

There is a division of opinion within the respondent community regarding whether the number of fund platforms offering distribution of third-party funds will increase or decrease during the coming three years (fig 4). Almost half of respondents indicate there will be an increase in fund platforms offering third-party distribution, with new entrants entering the market in response to sales and service opportunities that are not met currently. In contrast, 35% of respondents suggest that the number of fund platforms offering third-party distribution will decline.

This polarisation of opinion reflects the competitive dynamics prevailing in the fund platform marketplace. Some respondents identify the market reaching a transition point where consolidation is likely in certain locations. Scale is important in the fund distribution platform space, alongside the ability to offer a broad product choice and geographical coverage. There have been a number of recent examples in Europe of platform operators using consolidation opportunities to build economies of scale and to extend market and product coverage. In June 2019, for example, Credit Suisse and Allfunds announced a deal to merge the Credit Suisse Investlab, its open architecture B2B investment platform, with Allfunds to create a wealth platform with more than US$500 billion assets under administration. The combined entity aims to distribute more than 78,000 investment fund and ETF products to more than 700 distributors across 45 countries.

This polarisation of opinion reflects the competitive dynamics prevailing in the fund platform marketplace. Some respondents identify the market reaching a transition point where consolidation is likely in certain locations. Scale is important in the fund distribution platform space, alongside the ability to offer a broad product choice and geographical coverage. There have been a number of recent examples in Europe of platform operators using consolidation opportunities to build economies of scale and to extend market and product coverage. In June 2019, for example, Credit Suisse and Allfunds announced a deal to merge the Credit Suisse Investlab, its open architecture B2B investment platform, with Allfunds to create a wealth platform with more than US$500 billion assets under administration. The combined entity aims to distribute more than 78,000 investment fund and ETF products to more than 700 distributors across 45 countries.

MFEX, which is majority owned by Nordic private equity firm Nordic Capital, completed acquisition of RBC I&TS’s Global Fund Platform (GFS) in April 2019 in a deal through which it will supply fund distribution services to RBC as part of an ongoing partnership. During 2018, MFEX completed the purchase of two other European fund platforms, the French-based Axeltis platform, which it acquired from Natixis Investment Managers, and Ahorro Best Funds in the Spanish market.

Market infrastructure entities that offer fund platform services are also targeting acquisition opportunities as a means to build scale and to widen service coverage. In January 2020, Clearstream and UBS agreed on a long-term partnership in the fund distribution segment in which Clearstream has acquired a majority stake in UBS’ fund platform Fondcenter AG. The combination of Fondcenter with Clearstream’s Fund Desk business, with more than US$230bn in assets under administration (AUA), will become a leading fund servicing provider with significant benefits for UBS and Clearstream clients as a result of greater scale, increased scope and global network coverage.

Over the past two years, Clearstream has already grown its service portfolio in the fund distribution business through the acquisition of Swisscanto Funds Centre Ltd and the subsequent creation of Clearstream Fund Desk, and it has broadened its international network by entering the domestic Australian fund market, as illustrated by the acquisition of Sydney-based managed funds custodian services division from National Australia Bank in July 2019. The future set-up of Ausmaq within Clearstream’s Investment Fund Services business will directly serve Australian customers within the same region and time zone. Later this year, Clearstream will also connect international and Australian market participants via its fully automated fund processing platform Vestima. By integrating the Vestima offering and Ausmaq’s services, Clearstream will be able to extend its established suite of cross-border services to Australian custodian banks, wrap platforms and wealth managers.

Over the past two years, Clearstream has already grown its service portfolio in the fund distribution business through the acquisition of Swisscanto Funds Centre Ltd and the subsequent creation of Clearstream Fund Desk, and it has broadened its international network by entering the domestic Australian fund market, as illustrated by the acquisition of Sydney-based managed funds custodian services division from National Australia Bank in July 2019. The future set-up of Ausmaq within Clearstream’s Investment Fund Services business will directly serve Australian customers within the same region and time zone. Later this year, Clearstream will also connect international and Australian market participants via its fully automated fund processing platform Vestima. By integrating the Vestima offering and Ausmaq’s services, Clearstream will be able to extend its established suite of cross-border services to Australian custodian banks, wrap platforms and wealth managers.

While scale is important to drive cost efficiency – and to maintain visibility before existing and prospective asset management, distributor or (for D2C) investor clients – there may also be opportunities for new platform operators to step into the market. In some jurisdictions, regulatory drivers may force existing distribution parties (e.g. banks, insurers, IFAs…) to rethink their business models, operating at lower margins and potentially triggering a review of existing commission arrangements.

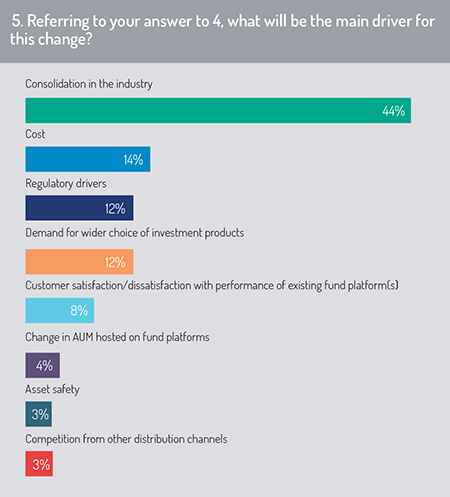

Looking more closely at these drivers for change, the survey confirms respondents’ expectations that there is likely to be consolidation in the third-party fund distribution platform market (fig 5). As cost pressures increase on platform operators, this may force exit from those that cannot establish the scale and product/market coverage required to attract asset managers and distribution partners – and to operate on contractual terms that are attractive to each of these parties.

However, there may also be opportunities for new platform operators to break into the market. In Europe, MiFID II is driving greater cost transparency across the fund transaction lifecycle and is forcing the industry to review its charging structures and procedures for cost disclosure. In the UK, the Retail Distribution Review (RDR) has triggered movement to a fee-based advisory model where financial advisers are no longer permitted to benefit from commissions from fund companies in return for recommending or selling their investment products. Instead, investors now have to agree fees with the adviser upfront. This has prompted a tighter focus on the costs of investment and a review of how investment products and investment advice are provided to, and paid for, by retail customers – including an advance in the market for clean share classes.

However, there may also be opportunities for new platform operators to break into the market. In Europe, MiFID II is driving greater cost transparency across the fund transaction lifecycle and is forcing the industry to review its charging structures and procedures for cost disclosure. In the UK, the Retail Distribution Review (RDR) has triggered movement to a fee-based advisory model where financial advisers are no longer permitted to benefit from commissions from fund companies in return for recommending or selling their investment products. Instead, investors now have to agree fees with the adviser upfront. This has prompted a tighter focus on the costs of investment and a review of how investment products and investment advice are provided to, and paid for, by retail customers – including an advance in the market for clean share classes.

Looking explicitly at survey feedback from UK-based respondents, 47% said that the number of fund platforms operating in the UK market will increase over the coming three years (of which 13% said this will be a large increase), with 42% indicating the number will decrease.

For survey respondents based in mainland Europe (ex UK), platform consolidation is likely to be stronger trend, with 36% indicating that the number of fund platforms will increase over the coming three years and 45% saying this will decrease.

In other locations, regulatory changes and cost dynamics are creating space for platform operators to extend their penetration of the market. In Australia, The Australian Royal Commission on Misconduct in the Banking, Superannuation and Financial Services industry was launched in 2017 to investigate poor standards and misconduct in the banking, superannuation and financial services industry. Publishing its final report in February 2019, the Commission provided recommendations designed to address “cultural failures” in the banking and wealth management sectors.

One implication of this review is that a number of Australia’s largest banks are reducing their involvement in Australia’s wealth management sector, with several already taking the decision to sell off their wealth management arms. Australia’s financial regulators are also looking closely at costs and charges associated with sales of investment fund products. This, in turn, may extend opportunities for fund platforms and new distribution intermediaries to extend their presence in a distribution supply chain forced to operate at tighter margins, to bear higher regulatory and compliance costs (particularly in responding to the recommendations of the Royal Commission), and to operate with a higher level of transparency around its commission structures and remuneration arrangements.

In the Asia-Pacific region, third-party fund distribution in the key Asian markets for UCITS products (i.e. Hong Kong, Singapore and Taiwan), is currently dominated by banks. With these large banks operating their own wealth management platforms – which provide access to UCITS and other investment products (mutual funds, ETFs) that are authorised for distribution in the local markets – consolidation is unlikely in the short-to-medium term. There is relatively low probability of these universal banking entities combining their wealth management platforms with their competitors (see the comment by Citi’s Stewart Aldcroft on page 25 of this report). This conclusion is reflected in the survey results, where more than 80% of Asia-based respondents tell us that the number of fund platforms in the region will rise in the coming three years – and fewer than 10% said this will fall.

In the Asia-Pacific region, third-party fund distribution in the key Asian markets for UCITS products (i.e. Hong Kong, Singapore and Taiwan), is currently dominated by banks. With these large banks operating their own wealth management platforms – which provide access to UCITS and other investment products (mutual funds, ETFs) that are authorised for distribution in the local markets – consolidation is unlikely in the short-to-medium term. There is relatively low probability of these universal banking entities combining their wealth management platforms with their competitors (see the comment by Citi’s Stewart Aldcroft on page 25 of this report). This conclusion is reflected in the survey results, where more than 80% of Asia-based respondents tell us that the number of fund platforms in the region will rise in the coming three years – and fewer than 10% said this will fall.

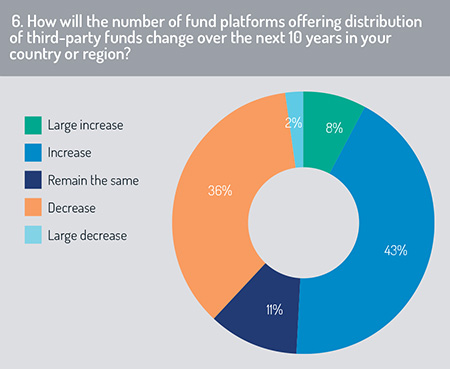

We have noted that, over a three-year timeframe, respondents have divided opinion regarding whether we are likely to see consolidation of fund platforms, or the entry of a wave of new platform operators to the market. Over a ten-year timeframe, survey respondents predict a broadly similar outlook for the fund platform marketplace (fig 6): 51% predict that the number of platforms offering third-party fund sales will increase (compared with 48% for the three-year timeframe). In contrast, 38% expect that this population of platform operators will contract as current providers exit the market (exactly replicating the 38% of respondents that predicted this for the three-year time horizon).

© 2020 funds europe