Searches for China equity funds dropped in Q2 but activity has since picked up, writes CAMRADATA.

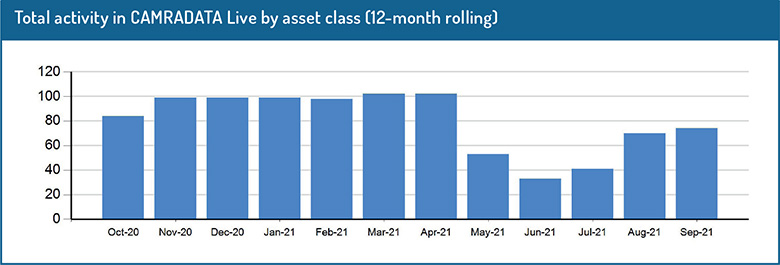

The total activity in CAMRADATA Live by Chinese equity has varied over the 12 months to September 30. There was a decrease in activity from April 2021 to June 2021. The activity has gradually started to increase over time. The Chinese government appears to have done more to control risks compared to other countries, which improves the economy and increases prospects for Chinese equities.

There are 40 Chinese equity vehicles in CAMRADATA Live. The total activity by size was primarily All Cap (61%) and the total activity by style was mostly Growth (65%). The one-year performance returns of these vehicles ranged from 14.78% to 59.85% and the three-year performance returns ranged from 3.75% to 35.51%, highlighting the importance of carrying out detailed research and analysis on asset managers managing this asset class.

For CAMRADATA’s proprietary IQ universe, Chinese Equity (USD), the top-performing asset manager for three years to June 30, 2021 was Allianz Global Investors with its vehicle AllianzGI China A-Shares Equity composite. This achieved an IQ score of 0.92, with the vehicle achieving an excess return of 28.83% over the benchmark whilst taking excess risk of 13.01%. The top-performing asset manager for one year to June 30, 2021 was Barings with its vehicle Barings China A- Share Fund. This achieved an IQ score of 0.76, with the vehicle achieving an excess return of 28.73% over the benchmark whilst taking excess risk of 12.74%.

The recovery of the economy has been supported by the constant global stimulus and vaccine rollouts. Perhaps there is a risk of a market consolidations in the economy. However, there are also longer-term positives for the sustainable businesses.

*All figures are to 12 months to September 30, 2021 unless otherwise stated.

© 2021 funds europe