The survey also affirms the position of Stock Connect and (more gradually) Bond Connect as access channels of choice for many international asset managers and institutional investors, offering simple registration and fast entry for those who previously found it challenging to execute their investment ambitions in China through the QFII or RQFII schemes (known as QFI after November 1, 2020).

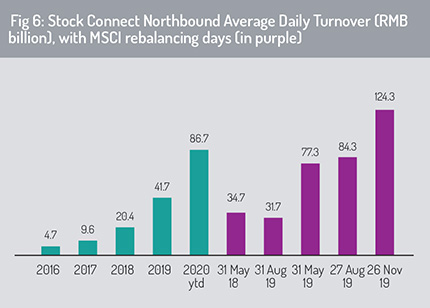

With the part inclusion of China A-shares in the MSCI Emerging Markets Equities Index from May 2018, this has driven a surge of investment into China through Stock Connect, the equities trading link between China’s mainland markets and the Hong Kong Stock Exchange.

Despite economic disruption created by the coronavirus pandemic, the Stock Connect access channel generated record revenue of HKD743 million (approximately US$95 million) during the first half of 2020, a 46% rise on 1H 2019, according to data from the Hong Kong Exchanges and Clearing Limited1.

Despite economic disruption created by the coronavirus pandemic, the Stock Connect access channel generated record revenue of HKD743 million (approximately US$95 million) during the first half of 2020, a 46% rise on 1H 2019, according to data from the Hong Kong Exchanges and Clearing Limited1.

Northbound trade through Stock Connect reached a new high, with average daily trading volume of RMB191.2 billion (approximately US$28 billion) on July 7, 2020. Stock Connect has also driven rising Southbound investment into equities listed on the Stock Exchange of Hong Kong Limited (SEHK), with average daily trade volume reaching a new record HKD60.2 billion (US$7.8 billion) on July 7.

Index inclusion has also encouraged northbound investment flows into local currency government bonds and policy bank bonds via Bond Connect, following the phased introduction of these bond securities in the Bloomberg Barclays Global Aggregate and the JPMorgan Emerging Market Bond indices which began in 2019.

Average daily trading activity through Bond Connect has grown to RMB19.9 billion in 1H 2020. Foreign participation in the CIBM has grown by 217% since the launch of Bond Connect in July 2017, according to Bond Connect Company Limited data (HKEX, 2020, op.cit.), with more than 2,000 participants active in Bond Connect as of July 2020. However, with less than 3% of total CIBM assets in foreign ownership, there is significant opportunity for this to grow further.

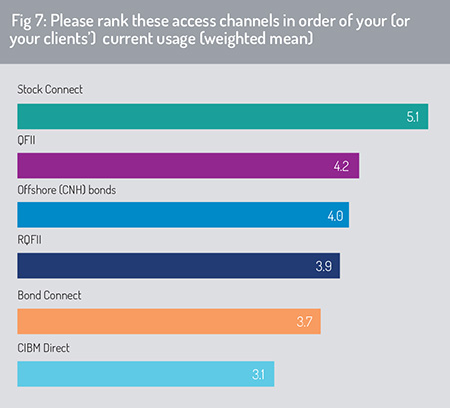

To assess the relative importance of these access channels to international investors, respondents were asked to rank each one in order of importance from 6 (most important) to 1 (least important). These were then ranked in order on the basis of their weighted-mean calculated from respondent scores (fig 7).

To assess the relative importance of these access channels to international investors, respondents were asked to rank each one in order of importance from 6 (most important) to 1 (least important). These were then ranked in order on the basis of their weighted-mean calculated from respondent scores (fig 7).

While the Connects have attracted strong growth in investment flows, QFII and RQFII (known as Qualified Foreign Investors, QFI, after November 1, 2020) remain important to foreign institutional investors, particularly with the recent removal of quota restrictions and ongoing efforts by the Chinese authorities to streamline QFII/RQFII access (known as Qualified Foreign Investors, QFI, after November 1, 2020). However, FIIs are still required to obtain a QFI licence before they can invest and Standard Chartered has not seen a sharp increase in recent applications.

Alongside these channels, foreign institutional investors continue to tap fixed income yield through investing in RMB-denominated bonds issued offshore, particularly in Hong Kong. This complements offshore and onshore access to China’s bond markets respectively through Bond Connect and CIBM Direct.

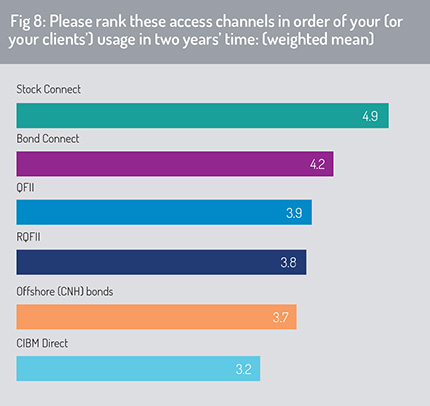

In two years’ time, respondents indicate that overseas investors will continue to favour this multi-channel approach (fig 8). Stock Connect will remain the dominant channel for investing in equities, with northbound investment flow through Bond Connect also continuing its strong growth.

In two years’ time, respondents indicate that overseas investors will continue to favour this multi-channel approach (fig 8). Stock Connect will remain the dominant channel for investing in equities, with northbound investment flow through Bond Connect also continuing its strong growth.

However, investors will also continue to invest through QFI channels, and to invest in RMB-denominated bonds issued in offshore financial centres. CIBM Direct retains its value – particularly for central banks, pension funds and other prominent foreign investors which value the yield opportunities and risk management tools offered through this investment channel. Interest rate derivatives (swaps and forward rate agreements, FRAs) may be used in CIBM Direct for hedging purposes, along with FX derivatives (including forwards and swaps) to manage FX exposures.

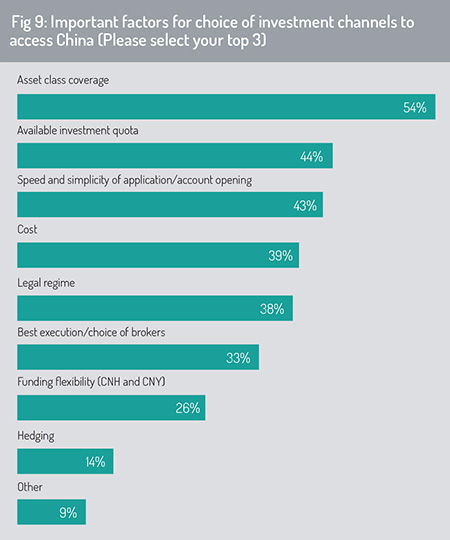

When selecting an access channel, the survey finds that asset class coverage is the factor that respondents value most highly (54%, fig 9). Additionally, investors prioritise the availability of investment quota (44%) and the speed and simplicity of application and account opening (43%).

Speed has remained important given the strength of demand for China investment highlighted earlier in this survey. With inclusion in global indices – the MSCI Emerging Market, JPMorgan Emerging Market Bond or Bloomberg Barclays Global Aggregate bond indices – this has generated a rise in demand for new accounts and a corresponding requirement that these can be processed quickly. A number of asset management respondents told this survey that an extended application procedure could block their ability to exploit new investment opportunities.

Responding to this point, Standard Chartered’s Simon Kellaway indicates that three key factors, namely transparency, certainty and speed, remain fundamental for overseas institutional investors. Investors require transparency around which assets they can invest in and the rules governing those access channels. The Chinese market has become more transparent in terms of providing reliable financial reporting and accounting standards, but investing in smaller companies and in private markets still can boil down to caveat emptor. Second, investors expect high standards of asset protection and certainty that they can access their assets in line with the international standards that they expect in all cross-border investment markets. And, thirdly, they require speed of access in terms of registration and account opening.

Responding to this point, Standard Chartered’s Simon Kellaway indicates that three key factors, namely transparency, certainty and speed, remain fundamental for overseas institutional investors. Investors require transparency around which assets they can invest in and the rules governing those access channels. The Chinese market has become more transparent in terms of providing reliable financial reporting and accounting standards, but investing in smaller companies and in private markets still can boil down to caveat emptor. Second, investors expect high standards of asset protection and certainty that they can access their assets in line with the international standards that they expect in all cross-border investment markets. And, thirdly, they require speed of access in terms of registration and account opening.

The inability of individual channels to meet all of these criteria – and provide efficient FX hedging, funding flexibility, and at acceptable transaction cost – has encouraged market participants to continue with a multiple access channel approach. For example, Bond Connect, despite its strengths in terms of liquidity, convenience and affordability, does not allow investors to hedge their exposures using onshore renminbi (CNY). However, this functionality is available via CIBM Direct.

In turn, Stock Connect does not offer access to a full range of stocks listed on the Shanghai and Shenzhen Stock Exchanges – although its level of coverage is progressively extending. At the time of writing, Stock Connect provides coverage of 80% of stocks listed on SSE and 81% of SZSE by market capitalisation, according to SEHK data. In July 2019, SSE, SZSE and SEHK agreed to allow companies with A-shares listed on the SSE STAR Market to be eligible for Northbound trading via Stock Connect (after relevant business and technical preparations have been completed). During the China International Financial Annual Forum 2020, held in September 2020, the CSRC Vice Chairman also revealed the CSRC’s plans to expand the scope of investments available to foreign investors, for example by allowing overseas investors to trade commodity futures under Stock Connect.

One asset management respondent noted that, while Stock Connect has reduced the friction involved in investing in China, there can still be advantages for investors to trade in A-shares directly utilising local licences (for example via QFI), given that the investment universe through this avenue is wider than that available through Stock Connect.

One asset management respondent noted that, while Stock Connect has reduced the friction involved in investing in China, there can still be advantages for investors to trade in A-shares directly utilising local licences (for example via QFI), given that the investment universe through this avenue is wider than that available through Stock Connect.

Index inclusion

MSCI has included China large cap A-shares in its MSCI Emerging Markets equity index since May 31, 2018. The 5% weight granted to A-shares at their initial inclusion was increased to 20% by November 2019. However, in the event of full inclusion, Chinese A-shares will account for more than 40% of the market capitalisation of the MSCI EM Index, according to MSCI.

China A-shares have also been included in the FTSE Global Equities and FTSE Emerging Market Equities indices since 2019. The first phase of the inclusion of China A-shares in the FTSE Global Equity Index Series (GEIS) was completed in June 2020, with a 25% inclusion factor.

FTSE Russell research predicts that China’s listed equities – A-shares and ex A-shares (B, H, N, P, Red and S Chips) – may, in time, potentially form half of all stocks in the FTSE Emerging Markets index2.

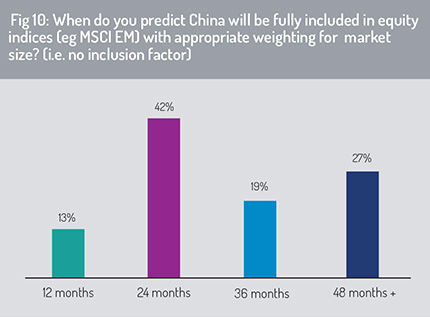

Asked when they expect China to be fully included in the MSCI EM Index with 100% weighting based on market capitalisation, 42% of respondents anticipate this transition is likely within 24 months. However, just over a quarter of respondents believe this will take 48 months or longer. Only 13% believe this is imminent within a year (fig 10).

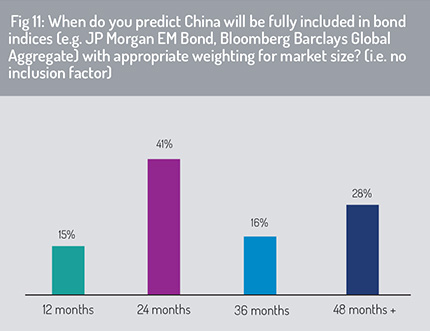

This breakdown is almost replicated for bond index inclusion, where 41% of respondents predict that China will be included in bond indices (such as JPMorgan EM Bond or Bloomberg Barclays Global Aggregate) within 24 months (Fig 11). However, 28% say this will take 48 months or longer. On September 24, 2020, FTSE Russell announced the inclusion of Chinese Government Bonds (CGBs) in the FTSE World Government Bond Index (WGBI). This is scheduled to start from October 2021 – subject to final affirmation, in March 2021, which will depend on the efficacy of new reforms in the following areas: (a) the account opening process (including the ability to register at legal entity level); (b) the ability to transact FX with third parties (for both CIBM Direct and Bond Connect); and (c) changes to the settlement process to allow settlement beyond T+3.

This breakdown is almost replicated for bond index inclusion, where 41% of respondents predict that China will be included in bond indices (such as JPMorgan EM Bond or Bloomberg Barclays Global Aggregate) within 24 months (Fig 11). However, 28% say this will take 48 months or longer. On September 24, 2020, FTSE Russell announced the inclusion of Chinese Government Bonds (CGBs) in the FTSE World Government Bond Index (WGBI). This is scheduled to start from October 2021 – subject to final affirmation, in March 2021, which will depend on the efficacy of new reforms in the following areas: (a) the account opening process (including the ability to register at legal entity level); (b) the ability to transact FX with third parties (for both CIBM Direct and Bond Connect); and (c) changes to the settlement process to allow settlement beyond T+3.

Index inclusion has resulted in high trade volumes through Stock Connect. Taking 2019 as an example, the daily turnover on Stock Connect peaked at RMB124.3 billion (US$18 billion) on November 26, 2019 (fig 6). On June 19, 2020, when FTSE Russell concluded Phase 1 of the inclusion of China A-shares, total northbound daily turnover on Stock Connect reached RMB113.5 billion, the second-highest daily turnover recorded until July 7, 2020, when Northbound turnover hit another record at RMB191.16 billion. This has also been an important driver for regulatory reforms within the Chinese market – for example, DvP settlement and block trading were introduced to the bond market to meet the inclusion criteria prior to accepting government bonds and policy bonds into the Bloomberg Barclays Global Aggregate index.

1 – HKEX Investor Presentation, Aug 2020, https://www.hkexgroup.com/-/media/HKEX-Group-Site/Ir/IR-Pack/2020-Interim/202008_IR-Pack-VF,-d-,w.pdf

2 – https://www.ftserussell.com/blogs/china-shares-inclusion-end-beginning-not-beginning-end

© 2020 funds europe