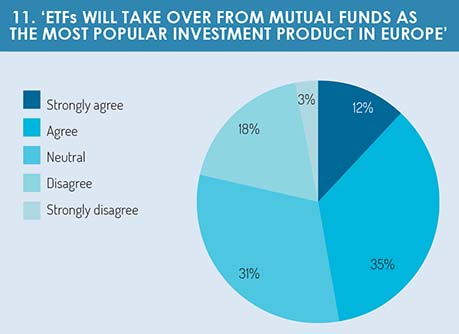

We have established that ETFs are growing in favour. But how popular will they get? Could they, perhaps, take over from traditional mutual funds as the most popular investment product in Europe? There was a lack of consensus on this question, with 31% of respondents withholding judgement (see figure 11). But more agreed (47%, including those who strongly agreed) than disagreed, suggesting there is a widespread view that ETFs could seize the position as the top investment product.

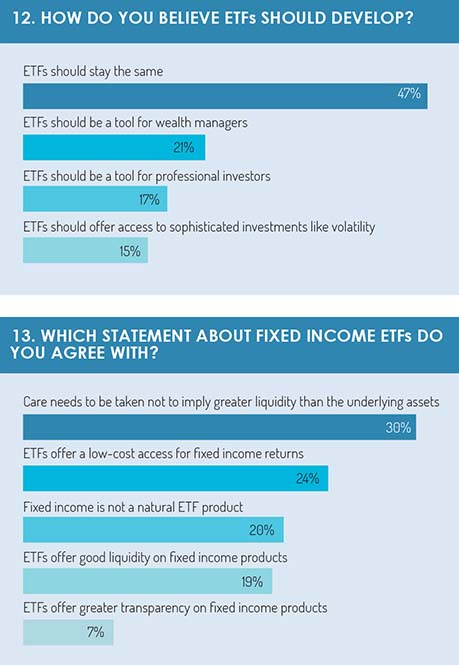

As they develop, what must ETFs do to improve? We wanted to know if ETFs should develop more as a tool for wealth managers or professional investors, or whether they should focus on offering access to sophisticated investments such as volatility. Our respondents gave a strong vote for the status quo, with 47% stating that ETFs should stay the same (see figure 12). In this changing world, perhaps it is only natural to desire some consistency.

That said, ETF providers cannot be accused of complacency. Many new asset classes are being launched within the ETF format. One area of development is fixed income ETFs. How do our respondents view these kinds of products? The findings indicate some scepticism here, with a fifth of respondents stating that fixed income ‘is not a natural ETF product’ (see figure 13). The most popular response, with a 30% score, displayed a similar ambivalence in its statement that ‘care needs to be taken not to imply greater liquidity than the underlying assets’. However, 24% of responses said that ETFs can offer low-cost access to fixed income returns.

That said, ETF providers cannot be accused of complacency. Many new asset classes are being launched within the ETF format. One area of development is fixed income ETFs. How do our respondents view these kinds of products? The findings indicate some scepticism here, with a fifth of respondents stating that fixed income ‘is not a natural ETF product’ (see figure 13). The most popular response, with a 30% score, displayed a similar ambivalence in its statement that ‘care needs to be taken not to imply greater liquidity than the underlying assets’. However, 24% of responses said that ETFs can offer low-cost access to fixed income returns.

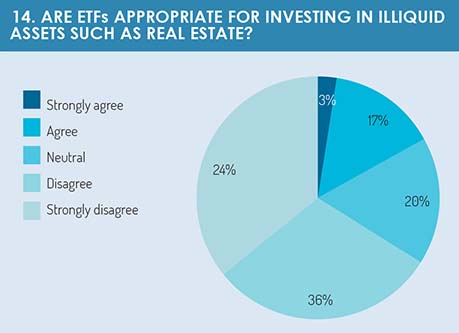

An even more controversial question is how illiquid assets, such as real estate, should be handled within the ETF structure. Our respondents gave a fairly clear response here. The majority (60%) said ETFs are not appropriate for investing in illiquid assets – with 24% expressing their opinion strongly (see figure 14). Only a fifth of respondents said ETFs were appropriate for illiquid asset investment. This result seems to suggest a limit to ETF growth. Some of the most attractive areas for development in asset management today are in alternatives, yet many alternative assets are illiquid. Apparently, this puts them outside the proper scope of ETFs.

This finding indicates one of the central features of ETFs. Although they have many benefits and are tipped for strong growth in the years ahead, there are still doubts about their applicability to a wide range of asset classes.

This finding indicates one of the central features of ETFs. Although they have many benefits and are tipped for strong growth in the years ahead, there are still doubts about their applicability to a wide range of asset classes.

Funds Europe plans further surveys to examine these and other issues facing the funds industry, in the hope of discovering what the future holds for the world of funds.

For the final part of the report, click here.

©2017 funds europe