It is now ten years since the global financial crisis of 2008. Of its many legacies, perhaps the most relevant, for those working in the funds business, is the vast quantity of financial services regulation that has since been implemented.

In those fraught months following the crisis, legislators naturally sought to impose order on the financial sector. As well as aiming to placate angry voters, policy-makers acted from a genuine concern that the sector had become too large, too unwieldy and too systemically important to go unchecked.

Today, few would argue the financial services sector is too lightly regulated. That is a good thing. Regulation is important to create a transparent industry that is fit for purpose and better prepared to deal with unforeseen risks. But the benefits have come at a cost. The vast quantity of employee time spent on, for instance, the second Markets in Financial Instruments Directive (MiFID II) is a resource that could have been employed on productive work elsewhere.

For this survey, Funds Europe and Calastone wanted to establish the funds industry’s view about the scale and challenge of regulation. Are the costs manageable? Who, ultimately, will foot the bill? And is there a way to deal with the regulatory burden more effectively, perhaps using emerging technologies such as blockchain?

For this survey, Funds Europe and Calastone wanted to establish the funds industry’s view about the scale and challenge of regulation. Are the costs manageable? Who, ultimately, will foot the bill? And is there a way to deal with the regulatory burden more effectively, perhaps using emerging technologies such as blockchain?

On the rise

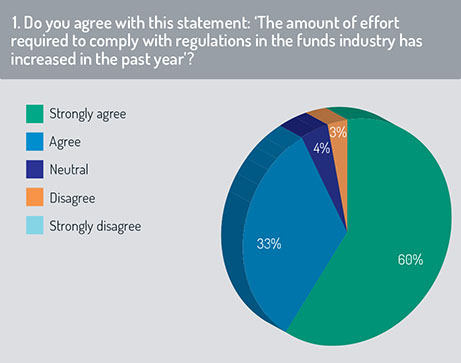

The first question in our survey sought to establish whether our respondents felt the regulatory burden was rising. The result was clear, with a total of 93% agreeing that “the amount of effort required to comply with regulations in the funds industry has increased in the past year” (of this proportion, 60% strongly agreed: see figure 1).

This was a powerful indication of the industry’s sentiment regarding regulation. The effort required to meet regulatory requirements is felt to be increasing, with implications for budgeting, planning and resource allocation.

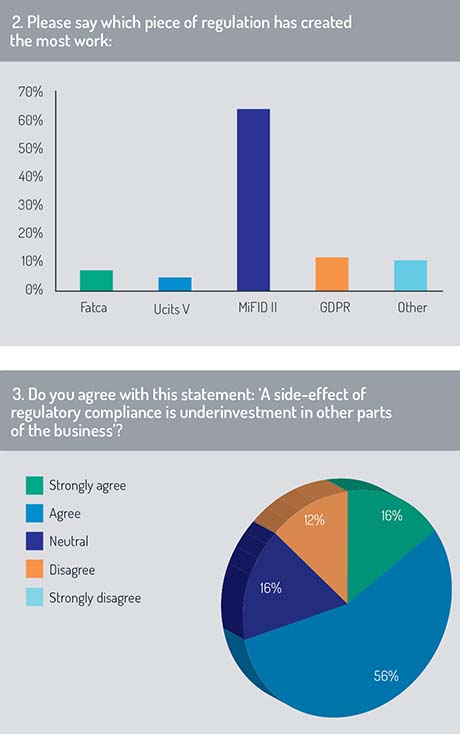

The second question asked which of four pieces of notable regulation had created the most work. Again, there was a clear result. MiFID II was chosen by 64% (see figure 2), far more than opted for the General Data Protection Regulation (GDPR), the Foreign Account Tax Compliance Act (Fatca) or the fifth iteration of the Undertakings for Collective Investment in Transferable Securities (Ucits V).

The second question asked which of four pieces of notable regulation had created the most work. Again, there was a clear result. MiFID II was chosen by 64% (see figure 2), far more than opted for the General Data Protection Regulation (GDPR), the Foreign Account Tax Compliance Act (Fatca) or the fifth iteration of the Undertakings for Collective Investment in Transferable Securities (Ucits V).

A minority (11%) selected “other” and, when asked to specify, gave a range of answers, including the Packaged Retail and Insurance-based Investment Products (Priips) regulation, the Common Reporting Standard (CRS) and the Alternative Investment Fund Managers Directive (AIFMD). One exhausted respondent simply wrote that “all of them were or are still a lot of work”.

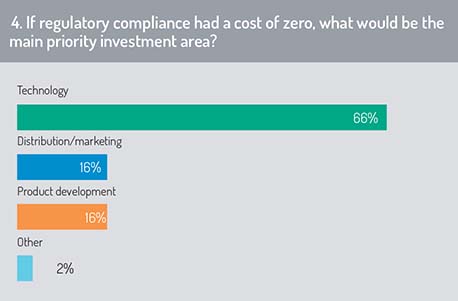

A concern often raised by industry analysts is that regulation has a negative effect on the opportunity/cost ratio. To put it another way, time spent on regulatory matters is time that could have been spent on other work.

We tested this assumption by asking respondents if they agreed that “a side-effect of regulatory compliance is underinvestment in other parts of the business”. A total of 72% agreed with the statement (of which 16% strongly agreed: see figure 3). Our respondents seem to recognise that regulation doesn’t come free.

We then asked respondents to imagine a fantasy world in which regulation was free. In other words, they were asked to suppose that the amount of time and money currently spent on compliance was suddenly available for other purposes. What should it be spent on?

Two-thirds said technology would be the main investment area (see figure 4). In contrast, 16% said product development and the same proportion opted for distribution or marketing.

Two-thirds said technology would be the main investment area (see figure 4). In contrast, 16% said product development and the same proportion opted for distribution or marketing.

If our respondents are right, regulation appears to be in tension with technology. There is a pent-up appetite for technology investment that companies are not acting upon because regulatory demands are swallowing their resources. This situation does not seem optimal.

A fruitful area of research in future would be to establish which types of technology are seen to be a priority – and what asset managers would hope to achieve with that technology investment.

For part two of the report, click here.

©2018 funds europe