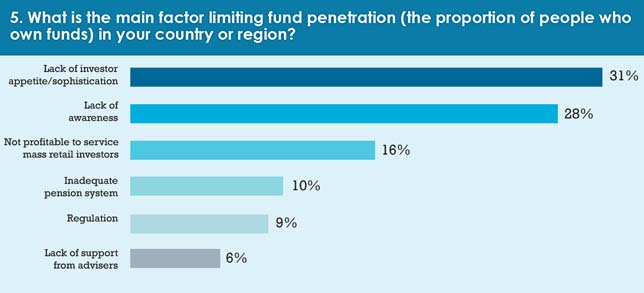

Robo-advisers and exchange-traded funds are not the only challenges faced by fund companies. We asked respondents to pick from a list of factors that are often said to limit fund penetration. The most popular choice was, “lack of investor appetite/sophistication”, which was chosen by 31% of respondents, closely followed by “lack of awareness”, accounting for 28%. These factors far exceeded options such as “inadequate pension system” and “regulation”.

These results help explain the responses to the following question, in which respondents were asked to pick from a list of the main things asset managers should do to increase mutual fund penetration. The top result, with 34% of responses, was “grassroots education of the public”. Clearly, our respondents believe the potential customers of the funds industry are lacking in awareness, and they want that changed.

Interestingly, the second-most popular result was, “develop low-cost direct-to-consumer models”. It seems that, although fee pressure is often seen as a challenge for asset management business models, many of our respondents recognise that a low-cost offering can be an effective way to attract customers.

Interestingly, the second-most popular result was, “develop low-cost direct-to-consumer models”. It seems that, although fee pressure is often seen as a challenge for asset management business models, many of our respondents recognise that a low-cost offering can be an effective way to attract customers.

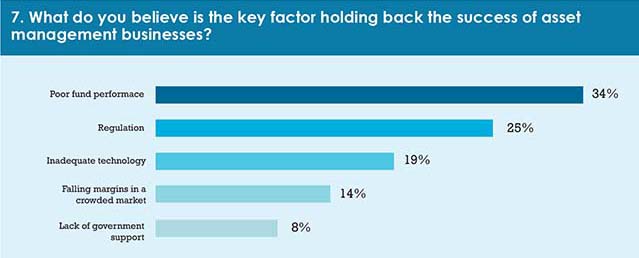

The next question revealed a more pressing challenge, however. When asked what was the main factor holding back the success of asset management businesses, more than a third (34%) of our respondents said “poor fund performance”. The second-most popular answer was regulation, which accounted for a quarter of the responses.

The second-most popular answer was regulation, which accounted for a quarter of the responses.

Karine Hirn, partner at East Capital, agrees that poor fund performance is a major challenge for the asset management industry (see box). Active fund managers exist because they believe they can beat the market, yet numerous studies show that the majority of active managers fail to beat their benchmarks. In this environment, it is hard to justify the fees charged by active managers. Indeed, she says, their very reason for being – their raison d’être – may be in doubt.

For the next part of the report, click here.

©2017 funds europe