The asset management industry is being transformed by a combination of regulatory and cost pressures, technical innovation and changing investor preferences. These factors are prompting asset management companies to redesign their business models and to rethink their approaches to technology investment. Although this adaptation presents cost and risk for the companies concerned, it also presents business opportunities for those that can manage their transformation strategies effectively.

From a technology standpoint, it is important for asset managers to have a well-designed technology strategy to compete at the leading edge of the funds industry. Technology can degrade quickly in financial services and it is important for companies to be using secure, well-tested systems that are up to date and maintained. This is important to capture new business opportunities created through innovation. It is also essential to security and risk management – for example, to minimise vulnerability to cyber attacks that may exploit ageing technology and outdated security protocols.

UK and Europe

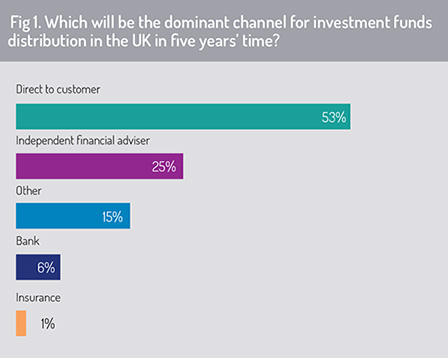

Survey results indicate that respondents expect to see significant growth in direct-to-customer (D2C) sales by asset management companies during the forthcoming five years (fig 1). More than half of respondents said that D2C platforms will provide the dominant channel for UK fund sales within this timeframe. Independent financial advisers (IFAs) will remain an important distribution avenue, but their role within this market will be eroded by D2C channels.

It is striking that a majority of respondents believe that D2C sales will be the dominant channel for fund distribution in the UK within half a decade. Although the Retail Distribution Review (RDR) in the UK prompted a review of the advised fund sales segment, financial advisers currently perform an important role in retail distribution sales in the UK – and retail investors will continue to require advice around pensions decumulation (where pensions holdings are translated into retirement income), inheritance planning, tax guidance and in a range of other areas.

If, as respondents anticipate, D2C channels become the dominant distribution channel for UK investors, financial regulators and asset managers will need to be vigilant to ensure that investors have the skills and financial education to make judicious decisions regarding fund selection.

In continental Europe, distribution in the retail investment fund market is served primarily by retail banks and their networks of tied agents, along with a small number of D2C platforms and some digital solutions (including robo-advisory services) emerging from established incumbents and new technology start-ups. While provision of independent advice from financial advisers is well established in the UK and in the Netherlands (where there is also a ban on inducements), financial advice offered to retail investors in other EU markets is typically provided by non-independent advisers – often those based at bank or insurance companies and selling tied products.

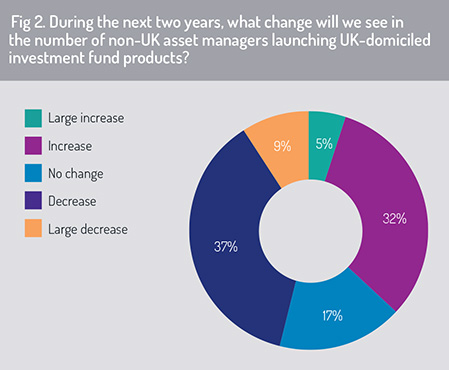

In monitoring the potential implications of Brexit on the asset management industry in the UK and Europe, the survey asked what changes we will see in the number of non-UK asset managers launching UK-domiciled investment fund products. If the UK does leave the EU, asset managers with a manufacturing capability in another EU member state will no longer be able to apply passporting rules under Ucits and AIFMD to distribute those fund products to UK investors. To manage this consideration, the survey asked whether non-UK asset managers will increase their range of UK-domiciled investment funds products to meet UK investors’ demands.

Opinions were divided on how the UK’s potential exit from the EU would shape the plans of asset managers (fig 2). Exactly 37% of respondents said that there will be an increase in the launch of UK-domiciled funds, with 5% of these believing there will be a large increase. However, 46% said that launches of UK-domiciled funds by non-UK managers will decline, 9% of whom suggested the decrease would be large. Slightly less than 20% of respondents believe there will be no change.

This breakdown confirms that asset management firms are managing their Brexit contingency plans, and their future strategies for distributing fund products across the UK and internationally, in substantially different ways – there is no single template that is guiding asset managers’ manufacturing and distribution strategies for the two years ahead. Some asset managers already maintain UK-domiciled funds, even when EU passporting facilities have been available, to meet the specific requirements of the UK market and preferences of UK investors. However, with 46% of respondents indicating that launch of UK-domiciled funds will fall, this provides an indication that some fund managers are reorienting their manufacturing capability away from the UK and choosing to hub their Europe-based fund activities out of other European locations, for example Luxembourg or Dublin.

This breakdown confirms that asset management firms are managing their Brexit contingency plans, and their future strategies for distributing fund products across the UK and internationally, in substantially different ways – there is no single template that is guiding asset managers’ manufacturing and distribution strategies for the two years ahead. Some asset managers already maintain UK-domiciled funds, even when EU passporting facilities have been available, to meet the specific requirements of the UK market and preferences of UK investors. However, with 46% of respondents indicating that launch of UK-domiciled funds will fall, this provides an indication that some fund managers are reorienting their manufacturing capability away from the UK and choosing to hub their Europe-based fund activities out of other European locations, for example Luxembourg or Dublin.

©2019 funds europe