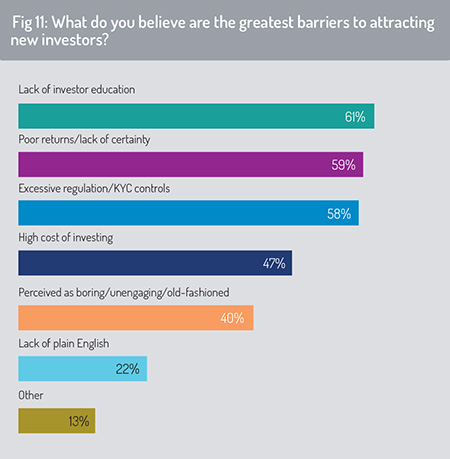

The primary challenge that asset management companies currently face in attracting new investors, respondents tell us, is a lack of investor education. A second is poor product performance and a lack of trust from investors in the products on offer from fund promoters (fig 11).

The dominant constraint, the survey finds, is lack of investor education (61%). Policy makers and financial regulators are recognising the importance of financial education in contributing to a well-functioning market that offers a choice of suitable products within an effective framework of consumer protection and industry regulation.

The Organisation for Economic Cooperation and Development (OECD) states in a policy paper on financial education, for example, that: “Educated investors will be aware of the financial risks they are confronted with and be able to estimate the amount of savings and investments they will need to meet their own needs and those of their family. They will understand the balance of risk and reward relative to saving and investment products and their costs. They will recognise that market fluctuations are normal and, acknowledging their own limitations, they will be in a better position to know who to trust to provide unbiased, objective advice. [As a result] they will be better equipped to recognise and avoid fraud and scams.” (OECD/INFE, ‘Policy Framework for Investor Education’, OECD, 2017, page 9.)

With these principles in mind, policy makers are taking gradual steps in some jurisdictions to raise financial awareness in schools, through the workplace and via social media campaigns. However, a significant part of this educational responsibility will be borne by asset management companies, particularly those with intentions to expand their wealth management capability and to shorten the distribution link to investors by extending their D2C sales options.

The survey also finds that “excessive regulation and know-your-customer controls” are discouraging new investors from purchasing investment fund products. This presents an enduring dilemma for financial supervisors. Tighter regulatory controls imposed to safeguard investor protection, to contain financial malpractice and to foster investor trust are, in respondents’ eyes, having the unintended consequence of discouraging new investors by adding greater complexity to the investment process.

When a respondent selected “other” in replying to the above question, we asked them to provide further detail regarding where they identify barriers to investment. This is some of the additional information that respondents provided:

- There is lack of real clarity around product characteristics. ESG-related products are a good example.

- Investors are overwhelmed by the huge range of investment options available.

- The cost to the investor of investment in collective investment products is still too high. These costs are reduced by direct investments or investing in ETFs.

- Investment products are still not offered via easy-to-use mobile app platforms – the equivalent of an Amazon Prime for investment fund products.

- As innovation cycles become shorter, asset managers need to source talent with a different skill set, as well as adopting new types of technology.

Adapting business models

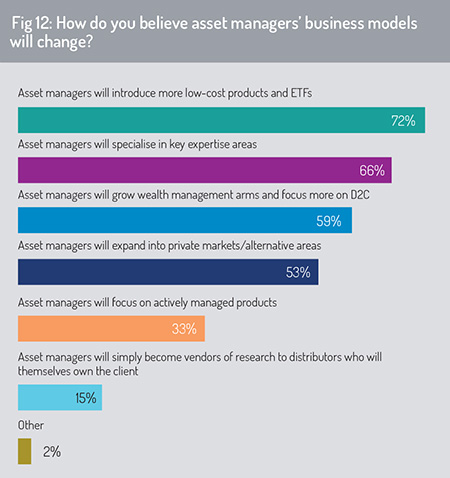

In the last question, 47% of respondents indicated that the high cost of investment represents a significant barrier for asset managers in attracting new investors. In responding to this constraint, 72% of survey constituents anticipate that asset managers will introduce more ETFs and low-cost products (72%).

A second consequence is that this will drive further specialisation from asset management companies, who will narrow their product range and concentrate product innovation in targeted areas of investment expertise (fig 12). One illustration is that some asset management houses will extend their footprint in specialist private market strategies. Others will continue to focus on actively managed products, but will become increasingly selective in supporting fund products only where they identify comparative advantage and strong demand for investment solutions from the customer.

A second consequence is that this will drive further specialisation from asset management companies, who will narrow their product range and concentrate product innovation in targeted areas of investment expertise (fig 12). One illustration is that some asset management houses will extend their footprint in specialist private market strategies. Others will continue to focus on actively managed products, but will become increasingly selective in supporting fund products only where they identify comparative advantage and strong demand for investment solutions from the customer.

More broadly, as we have already noted in this survey, some asset management groups will extend their wealth management arms and will extend their ability to distribute directly to the investor via D2C channels. As one respondent noted, “active management may be need to be repackaged by the asset manager to bring themselves closer to the investor – a form of ‘advisory sales’”.

© 2020 funds europe