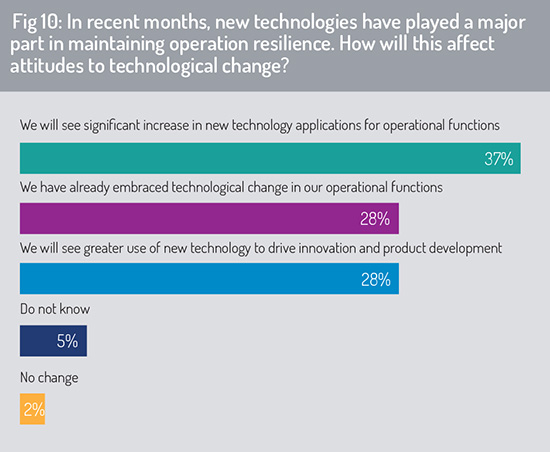

In recent months, new technologies have played an important part in supporting the asset management industry’s move to remote working and to supporting high standards of operational resilience. We asked respondents how this period will affect their attitude to technology adoption (fig 10).

The largest group (37%) said this will result in a “significant increase” in adoption of new technology to manage operational functions and to maintain operational resilience. Almost 30% said they were already investing in technology upgrades to sharpen their operational performance in this area. A similar percentage said that application of new technology will be important to drive innovation and development of new products.

Disruptors and service partners

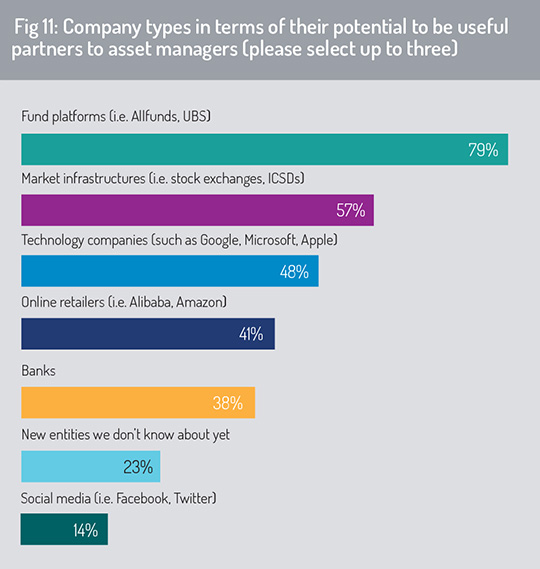

The next section has been included in the survey for the past three years. This evaluates which companies will be the most valuable partners to asset management firms in managing business innovation and which will be the primary sources of disruption. Respondents could select up to three answers (fig 11).

The survey finds that fund platforms are likely to represent the most important partner organisations to fund managers in times ahead (79%), with market infrastructure entities (such as ICSDs and stock exchanges) ranked in second place.

As we have argued elsewhere (see Funds Europe and Calastone, ‘The Changing Face of Fund Distribution’, Europe and UK edition, 2020), wider research by Funds Europe indicates that asset management companies, in Asia and globally, are seeking partnerships with fund platforms that extend well beyond a digital sales function. Alongside a sales component, parties to the investment fund transaction may require support with managing distribution agreements, calculation of distributor compensation (e.g. trailer fees), transmission of data on distributor sales, regulatory compliance reporting, along with portfolio analysis tools and access to product documentation.

With this in mind, market infrastructure providers are expected to play a more important role as partners to asset managers, climbing from third to second in the rankings.

With this in mind, market infrastructure providers are expected to play a more important role as partners to asset managers, climbing from third to second in the rankings.

In Thailand, for example, the Stock of Exchange of Thailand (SET) announced a partnership arrangement with an ICSD and a global asset servicing provider to streamline the infrastructure supporting cross-border investment fund transactions. This collaboration adds order routing, asset servicing and settlement services to the fund trading capability offered by SET’s FundConnext fund platform, thereby encouraging domestic and international inflows into the collective investments marketplace in Thailand.

In Indonesia, the S-Invest funds platform operated by KSEI (the market’s central securities depository) continues to build volume, automating fund communication between asset managers, distributors, broker-dealer and fund custodians while supporting order routing, settlement, client reporting and investor record-keeping in electronic format.

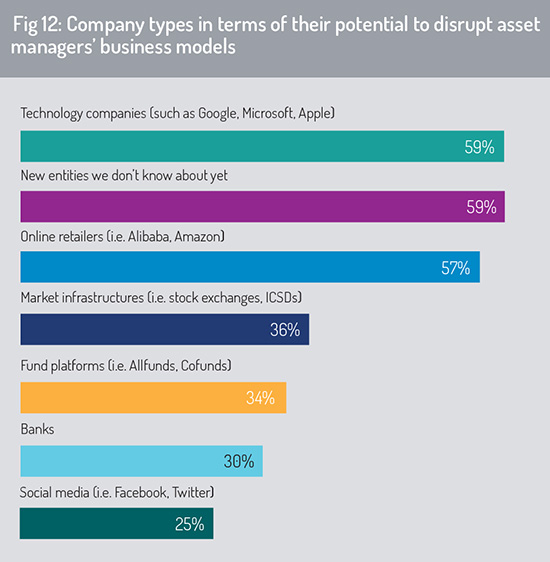

When we asked respondents which types of company are most likely to disrupt asset managers’ business models, the survey places technology companies at the top of the rankings (59%), alongside “new entities that we don’t know about yet” (59%). Online retailers such as Alibaba and Amazon were ranked a short distance behind in third position (fig 12).

In considering the disruption caused by technology companies, two points are particularly relevant. Asset management companies may experience disruption through commercial competition, resulting in loss of sales revenue to competitor organisations.

A second potential threat emanates from the growing centrality of technology companies in providing essential services – particularly cloud-based data management and “as-a-service” delivery options to asset management companies. Through these mechanisms, BigTech firms are gaining a growing systemic importance in financial services – creating what the Financial Stability Board has warned may be a “too-big-to-fail problem” where the failure of one of these firms could endanger the secure functioning of the industry (see further in Funds Europe and Calastone, 2020 Europe and UK survey).

A second potential threat emanates from the growing centrality of technology companies in providing essential services – particularly cloud-based data management and “as-a-service” delivery options to asset management companies. Through these mechanisms, BigTech firms are gaining a growing systemic importance in financial services – creating what the Financial Stability Board has warned may be a “too-big-to-fail problem” where the failure of one of these firms could endanger the secure functioning of the industry (see further in Funds Europe and Calastone, 2020 Europe and UK survey).

Both in Asia and in other global markets, it is likely that a primary source of disruption may come from incumbent players in the investment funds supply chain disrupting themselves. Existing fund manufacturers are seeking opportunities to extend their wealth management coverage and distribution reach through partnership arrangements with large technology platforms in Asia – as characterised by Vanguard’s recent partnership with Ant Financial.

Also, banks and wealth management groups are exploring opportunities to extend their presence up the value chain by enhancing their manufacturing capability and their range of investment solutions. Globally, a number of large distributors take the view that fund promoters will become little more than vendors of research – and they will seek to deliver better investment outcomes to investors at lower cost by meeting a part of the manufacturing requirement in-house (see the comments by Calastone’s Head of Global Markets, Edward Glyn, in Bob Currie’s article ‘Tech will democratise wealth management’, Funds Europe, May 2020). While this trend will be most prominent in the near term for fund markets in Europe and North America, it will also have implications for business strategy for investment fund markets in Asia.

Continue reading the report: Distribution channels »

© 2020 funds global asia