In China, digital channels have been central to the growth of the investment funds industry. The survey reveals that this digital expansion is likely to be replicated globally, with digital channels expected to be key in driving asset-gathering in fund markets around the world.

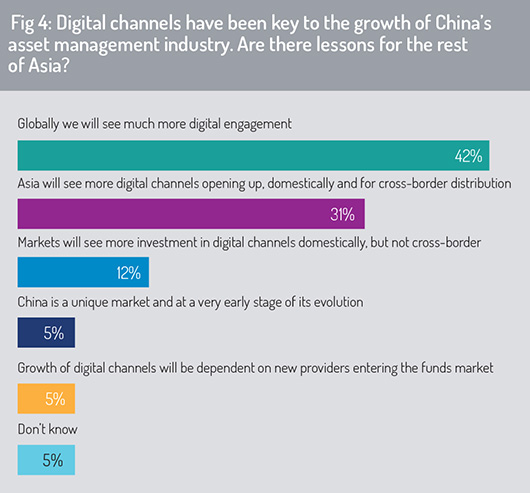

Respondents told us that digital avenues will continue to develop in Asia to support both domestic and cross-border investment flows (fig 4).

Although China has high levels of digital penetration and mobile phone ownership (with 1.58 billion mobile phone subscriptions across a population of 1.44 billion in April 2020), the investment fund market is still at a relatively early stage in its development and a high percentage of retail investment through digital channels has been directed into money market funds and other low-risk products. This money market fund sector (which had assets under management of US$1.14 trillion in February 2020) accounts for more than 50% of total assets invested in mutual funds in China, according to data from the Asset Management Association of China.

This is likely to change as investors recognise value in investing in a more diversified spread of collective investment products and those with a longer time horizon.

To meet this demand, a number of asset management groups are likely to extend their wealth management arms and to enhance their ability to distribute directly to the investor via D2C channels. This may involve partnership between asset management companies and established digital retail and service platforms such as Alibaba.

For example, in 2019 Ant Financial (an affiliate of Alibaba) established a joint venture with California-based fixed income giant Vanguard. This brought together Vanguard’s wealth management expertise and experience as operator of the largest robo-advisory platform in the US with Ant Financial’s massive distribution reach into China’s retail population.

Ant Financial issued a public statement in June 2020 declaring that 128 out of 143 fund management companies in China are now offering products and services on its digital platform. In May 2020, it added what it terms a ‘livestreaming’ feature to its Caifuhao digital platform that will allow fund managers to engage in real-time with their investors and to keep track more effectively of investor preferences and changing client service requirements.

Two months prior to this, Ant Financial revealed a three-year business plan to support digital transformation of 40 million service providers in China. This aims to develop Caifuhao from a financial services platform to an “open, vibrant digital ecosystem that offers a gateway into a comprehensive digital lifestyle”.

Continue reading the report: Technology impact »

© 2020 funds global asia