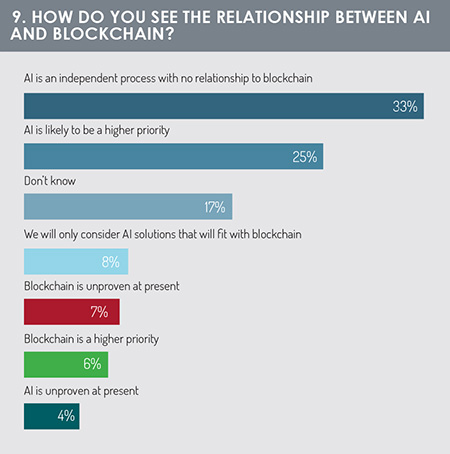

There has been extensive research during the past five years exploring how financial transaction processing and record-keeping can be remodelled using distributed ledger, or blockchain, technology. This does not rely on the use of AI and has emerged as an independent research area with a parallel set of applications – although in some specific contexts, financial services companies may wish to use AI and distributed ledger technology together. This survey asked respondents whether, in their minds, they identified potential linkages between AI and blockchain in their business applications.

Roughly one-third of respondents said that AI is an independent process with no obvious relationship to blockchain technology (fig 9). When asked to identify whether AI or blockchain projects are higher in their list of current development priorities, a quarter of respondents indicated that AI is of higher priority, with 6% indicating that this was the case for distributed ledger. Only 8% of respondents indicated that they will only consider AI solutions that will fit with blockchain.

AI and regulation

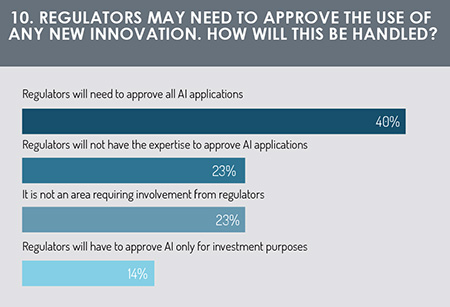

With any new innovation, the application and requirements may need to be approved by regulatory authorities. In the next question, we asked respondents to comment on the level of approvals that would be required for AI projects and how these will be managed by the financial regulators.

The majority view was that financial authorities will take a close interest in how financial services companies apply AI across the investment value chain (fig 10). Some 40% of respondents predicted that regulators will need to approve all applications making use of AI technology; 14% of respondents firms said that regulators will need to approve only AI applications that are applied directly to the investment process.

In contrast, almost a quarter of respondents said that this area does not demand further involvement from the regulators.

In contrast, almost a quarter of respondents said that this area does not demand further involvement from the regulators.

Interestingly, 23% said regulators will not have the expertise to approve AI. This highlights the need for close dialogue between industry associations, AI subject experts (private sector, academic sector) and financial authorities to ensure that any potential knowledge shortfall is promptly addressed.

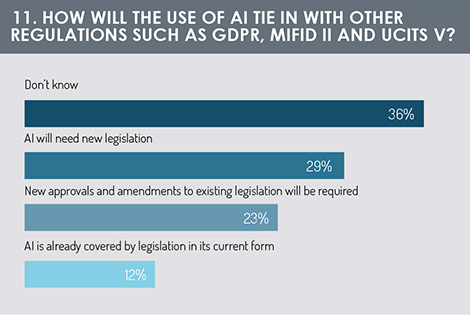

The next question drilled into regulatory and compliance challenges in further detail. Is existing regulation under GDPR, MiFID and Ucits V fit for purpose in providing a regulatory and legal framework that will support use of AI applications?

“Don’t know” was the most common answer (36%). Respondents indicated that there is still considerable uncertainty regarding how existing legislation will need to be adapted to accommodate AI applications (fig 11). For some respondents, this question was likely to be outside of their area of expertise.

A total of 29% said that new legislation will need to be passed to support AI applications. A further 23% indicated that amendments will be necessary to existing legislation.

A total of 29% said that new legislation will need to be passed to support AI applications. A further 23% indicated that amendments will be necessary to existing legislation.

Only 12% believed that AI applications are already covered by existing legislation.

These survey responses suggest that as the industry makes further use of AI in practical applications, it will need to prepare itself for the introduction of new regulation and amendments. Firms will need to take this regulatory overhead into account as they plan and budget for their AI strategies.

AI for the future

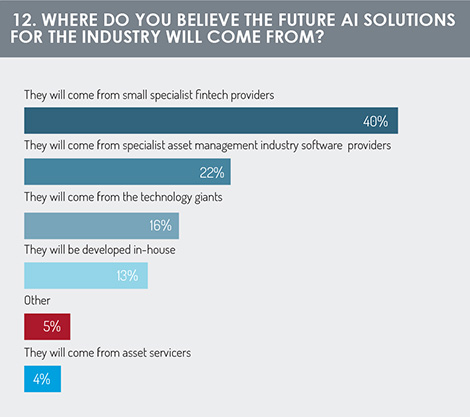

A number of asset management and asset servicing firms are conducting research into potential AI applications. Some are doing this in-house, some through collaborations with fintech companies, and others through public-private initiatives that have government involvement.

We asked survey participants, “Where do you believe the future AI solutions for the industry will come from?”

Respondents indicated that specialist technology vendors will be the major providers of AI solutions for the asset management industry (fig 12). Forty percent said this will come from fintech companies, with a further 22% believing AI solutions will come from asset management software vendors. Technology giants such as Google, Amazon or Facebook may leverage their data science and machine learning research divisions to financial applications (16%).

Respondents indicated that specialist technology vendors will be the major providers of AI solutions for the asset management industry (fig 12). Forty percent said this will come from fintech companies, with a further 22% believing AI solutions will come from asset management software vendors. Technology giants such as Google, Amazon or Facebook may leverage their data science and machine learning research divisions to financial applications (16%).

Given the specialised skill set required for AI development and the major investment cost involved, only 13% of respondents predicted that AI solutions for the industry would be driven by in-house research and development. We should recognise, however, that a number of large asset management and asset servicing firms are major sponsors of technology labs and fintech innovation hubs. So although new developments may not come directly from their own proprietary research, these may be involved in developing AI-based applications through partnership arrangements.

If respondents indicated that new developments would come from other sources, we asked them to specify. We received the following comments:

• Large technology and banking firms are partnering with selected fintech companies, applying both the innovation of the fintech and the necessary capital investment.

• A combination of all of the above.

• A diverse ecosystem.

• Fintech companies as well as tech giants as well as in-house development.

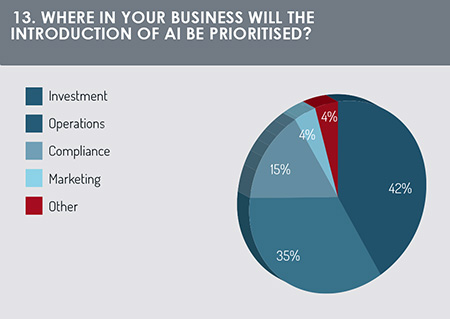

In the next question (fig 13), we asked: “Where in your business do you expect the introduction of AI to be prioritised?”

In the next question (fig 13), we asked: “Where in your business do you expect the introduction of AI to be prioritised?”

More than three-quarters of respondents believe that the introduction of AI will be focused on either investment strategy or operations, with investment receiving a slightly larger share of the vote (42%).

Fifteen percent of respondents indicate that AI will have important implications in the compliance area.

For the next part of the report, click here.

©2019 funds europe