Hong Kong, Australia and Singapore recently introduced new corporate fund structures (the OFC, CCIV and VCC respectively), which are designed to be internationally competitive and entice asset managers to domicile investment funds in the Asia Pacific (APAC) region. This article looks at the background and key features of these vehicles, and assesses the issues that asset managers should consider when deciding whether to utilise them in their fund manufacturing and distribution strategies.

The basics

Asset managers need to consider a number of factors, including regulatory, competitive and investor demands, when considering where to domicile their investment fund offerings.

In APAC, where assets are forecast to double from their 2016 levels to nearly US$30 trillion by 20251, Australia, Singapore and Hong Kong are looking to further build and reinforce their positions as regional asset management hubs. Regional governments and regulators are committed to attracting investment, increasing cross-border trade and regulatory cooperation to create a dynamic and globally competitive funds management industry. The introduction of the new corporate structured fund vehicles in Asia Pacific offers a credible and compelling offering.

The introduction of these new fund structures also comes at a time of increased efforts to develop a single regional market for funds through various cross-border passporting schemes – notably, the ASEAN Collective Investment Scheme (ASEAN CIS)2, the Asia Region Funds Passport (ARFP)3 and various bilateral schemes such as the Hong Kong-China Mutual Recognition of Funds (MRF) scheme4.

More choice, greater flexibility

The new structures introduce some important benefits, such as allowing an umbrella and sub-fund structure, and reduce some compliance requirements. This article assesses some of the advantages and disadvantages of each, as well as the ancillary factors driving fund managers (and investors) to consider them. It outlines the basics behind:

- Hong Kong’s Open-ended Fund Company (OFC), which launched in 20185.

- Singapore’s Variable Capital Company (VCC), which was fully launched in January 20206.

- Australia’s Corporate Collective Investment Vehicle (CCIV), which is expected to launch in 20207.

Hong Kong’s OFC

Hong Kong’s mutual funds have not been able to accommodate diverse needs from fund providers, though its laws have long allowed asset managers to set up investment funds in a unit trust structure. The OFC allows them to set up under a corporate structure.

Unlike a unit trust structure, the OFC does not require a trustee, but acts for and on behalf of itself. Additionally, its enabling law – the Securities and Futures Ordinance – permits it a variable capital structure, which is not the case with companies formed under the Companies Ordinance.

Cost-wise there is little difference between the OFC and the unit trust structures. However, if we compare the cost of selling the funds established in Hong Kong versus outside Hong Kong, there is a cost benefit to set up as an OFC. An OFC is simpler and cheaper because it only requires compliance with Hong Kong legislation.

An OFC can have an umbrella and sub-funds structure, and the law supports cross-investment of sub-funds. It can be public or non-public and must have a board of directors with at least two individual directors. It must appoint a fund manager, an external auditor, and a custodian who has responsibility for all safekeeping of assets.

A key benefit promoted by the authorities is that being domiciled in Hong Kong provides access to mainland China, although whether or not the OFC funds will be distributable under the MRF scheme has not yet been clarified9.

Singapore’s VCC

This specialised corporate structure introduces a fourth fund type to Singapore and is designed to provide fund managers with greater operational flexibility and help them reap economies of scale and monetary savings.

The enabling law (the Variable Capital Companies Act 2018) supports umbrella and sub-funds structures, with sub-funds able to appoint a local board of directors and use the same service provider as the umbrella fund.

A VCC covers both traditional and alternative assets, can be open-ended and closed-ended, and can be used for retail and non-retail strategies10. A retail fund requires three directors; a non-retail fund requires one.

Singapore’s strategic positioning in the region and its role as one of the world’s most competitive nations should further attract interest from asset managers11.

Australia’s CCIV

With the largest fund management industry in the Asia Pacific region, the introduction of the CCIV could prove to be a boon for the country12.

CCIVs have a range of benefits: they have an internationally recognised corporate structure limited by shares; they are designed to integrate with the ARFP cross-border initiative; and they complement the existing regulatory framework, potentially creating cost efficiencies and reducing compliance costs.

In a first for Australia’s fund management market, a CCIV must have one sub-fund (and can have more). Additionally, sub-funds can offer a range of investment strategies delivering increased investor choice, scale and cost savings.

To protect investors, sub-funds’ assets and liabilities must be kept separately, with each CCIV required to have an authorised corporate director, which must be a public company. It is expected that the law will permit both retail and wholesale CCIVs and introduce a depositary requirement for retail CCIVs.

Benefits, drawbacks and challenges to consider

When it comes to fund managers weighing up options around where to domicile, and whether to take advantage of the new Asia Pacific corporate fund structures, there are no ‘right’ answers. In making their decision, fund managers need to factor in a number of variables, not least the demands of the target investor pool and the regulatory obligations for the fund in question.

Additionally, fund managers need to consider the objectives and specifics of each vehicle, including: the establishment and running costs involved; compliance requirements; taxation elements; and how closely their investment strategies will align with each option.

For example, a US-based fund manager who is focused on North American investments would have little reason to domicile their fund in Australia, Hong Kong or Singapore unless they were specifically targeting investors from these or other Asia Pacific locations.

In addition, a fund manager based in Asia Pacific and looking to export an Asian-based investment strategy might consider the advantages of domiciliation in the Asia Pacific region not only to target APAC investors but also to offer a recognised fund structure to other potential markets.

Furthermore, a domicile like Luxembourg has a long history of hosting funds and a strong track record, and is rightly regarded as well-tested and secure. The UCITS framework, which evolved over 30-plus years in Europe, is considered the dominant cross-border brand globally, and in Asia more than 100 fund managers have used UCITS-compliant funds (commonly Luxembourg-domiciled SICAVs) to gather in excess of US$250 billion across more than 1,000 separate funds.

Leveraging the UCITS experience, regional governments and regulators are committed to developing Asia Pacific as an investment management hub, and the evolution of the various passporting schemes and fund structures is, in effect, Asia Pacific’s response to the dominance of the UCITS brand in the region by offering local alternatives.

As such, the costs and benefits of these new corporate fund structures warrant careful consideration by fund managers and investors, to understand how those might better suit their objectives.

Push and pull factors

In considering whether to use these structures, a number of push and pull factors are relevant.

Investors keen for robust regulatory guidelines might find the corporate structures being propounded by Australia, Hong Kong and Singapore of interest.

This links to the ‘pull’ factors in Australia, Hong Kong and Singapore’s favour. They are well-regarded in terms of their legal and regulatory jurisdictions, which reduces risk.

Additionally, each jurisdiction has introduced regulations that have been developed in consultation with the asset management industry and we believe that largely, a fund-friendly approach has been adopted. However, some aspects of the current CCIV drafting create some commercial challenges and further engagement with industry and subsequent refinement would be welcomed.

Another factor is that all are located in a dynamic region that will grow fast in the coming decades. Also, each is based in the same time zone as the investors they are targeting – unlike funds in, say, Europe – and that makes investor interaction easier.

Other key points of attention

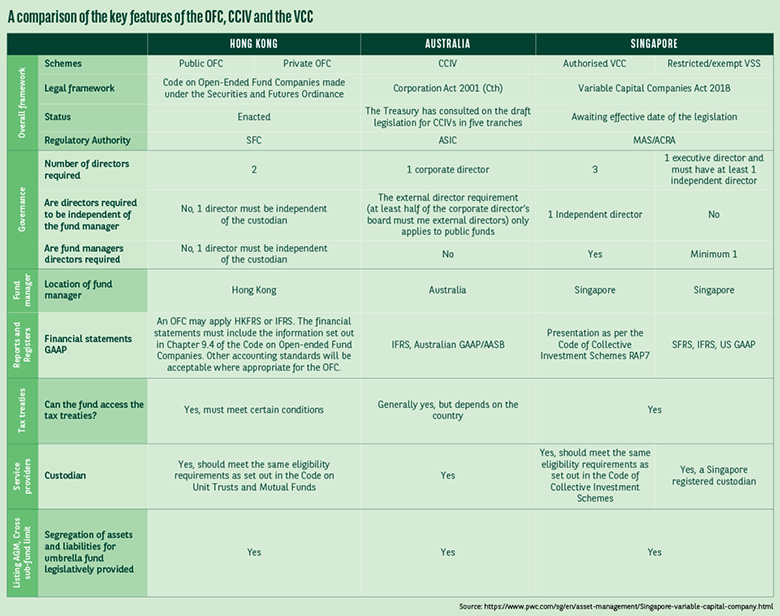

There are a number of differences between Australia’s CCIV, Hong Kong’s OFC and Singapore’s VCC. Some of these differences may drive the appeal of particular jurisdictional structures for regional fund managers. For example, in Australia, the CCIV regime places additional requirements for retail funds versus wholesale funds: notably, there is no depositary requirement for wholesale CCIVs which is mandatory for retail CCIVs.

In addition, the current drafting of the CCIV law for wholesale operators is more onerous than the existing framework for wholesale unit trusts. This could potentially act as a disincentive for fund managers looking to establish a wholesale CCIV13.

Taxation is another important topic. When it comes to OFCs and VCCs, we are awaiting clarity on a number of points14. In Hong Kong, stamp duty implications associated with OFC are subject to limitations; the transfer of shares in OFC is subject to stamp duty; however, stamp duty is not applicable for OFC shares’ allotment and cancellation. Private OFCs in Hong Kong are eligible for tax exemption under certain conditions as defined by the Inland Revenue Department15.

And, in Singapore, a VCC will be treated as a company and a single legal entity for tax purposes – with the sub-funds in umbrella VCCs having their name included on the Certificate of Residence16.

In relation to the Australian CCIVs, the current proposal treats sub-funds as separate entities for tax purposes so that a single CCIV can serve as the umbrella for many different investors and investments. Distributions will have both taxable and non-taxable components, with non-resident taxation only applicable to the taxable components. Withholding tax rates continue to be a focus of industry consultation, which is continuing.

Singapore also says VCCs will benefit from its tax incentive schemes for funds under sections 13R and 13X of the Income Tax Act, while approved fund managers managing an incentivised VCC may be eligible from the 10% concessionary tax rate under the Financial Sector Incentive-Fund Manager (FSI-FM) scheme17.

Key considerations

In summary, fund managers and investors assessing the suitability of these new vehicles must factor in a range of considerations:

- The nature of the fund, its

- assets, and the investor base that is being targeted;

- Push factors in jurisdictions where new rules are coming into force – those could make Asia Pacific offerings more attractive;

- And how the laws underpinning the corporate funds account for wholesale versus retail funds, among other factors.

When deciding where to domicile their funds, managers should therefore ask themselves the following key questions:

- What are your strategic and commercial objectives in Asia Pacific?

- What types of assets and investment strategies do you/are you intending to manage?

- How do you plan to grow your regional footprint and assets under management over the medium to long term?

- What are the key demands of investor pools for specific funds, and are these more closely met by Asia Pacific funds than those domiciled outside of the region?

1 – Asset & Wealth Management Revolution: Embracing Exponential Change, PwC (2017).

See: https://www.pwc.com/gx/en/asset-management/asset-management-insights/assets/awm-revolution-full-report-final.pdf

2 – For more, see: ASEAN Collective Investment Scheme (ASEAN CIS) – regulation memo, BNP Paribas Securities Services (April 24, 2019).

See: https://securities.bnpparibas.com/insights/asean-cis-collective-investment.html

3 – For more, see: Asia Region Funds Passport (ARFP) – regulation memo, BNP Paribas Securities Services (April 29, 2019).

See: https://securities.bnpparibas.com/insights/arfp-asia-region-funds-passport.html

4 – For more, see: Hong Kong Mutual Recognition of Funds (MRF) – regulation memo, BNP Paribas Securities Services (April 29, 2019).

See: https://securities.bnpparibas.com/insights/hong-kong-mutual-recognition.html

5 – SFC implements open-ended fund companies regime, Hong Kong Securities and Futures Commission (July 27, 2018).

See: https://www.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/corporate-news/doc?refNo=18PR90

6 – Explanatory Brief on the Variable Capital Companies (Miscellaneous Amendments) Bill, Monetary Authority of Singapore (August 5, 2019): https://www.mas.gov.sg/news/speeches/2019/explanatory-brief-on-the-variable-capital-companies-miscellaneous-amendments-bill-on-5-august-2019

7 – For more, see: Australia Corporate Collective Investment Vehicle (CCIV) – regulation memo, BNP Paribas Securities Services (March 10, 2019). See:

https://securities.bnpparibas.com/insights/result/cciv-regulatory-memo.html

9 – “Hong Kong, Singapore Gear Up Reform in Asset Management Sector”, Regulation Asia (October 4, 2018).

See: https://www.regulationasia.com/hong-kong-singapore-gear-up-reform-in-asset-management-sector/

10 – For more, see: The Singapore Variable Capital Company – regulation memo, BNP Paribas Securities Services (February 12, 2019). See: https://securities.bnpparibas.com/de/insights/vcc-regulatory-memo.html

11 – The Global Competitiveness Report 2018, World Economic Forum. See: https://www3.weforum.org/docs/GCR2018/05FullReport/TheGlobalCompetitivenessReport2018.pdf

12 – For more, see: Australia Corporate Collective Investment Vehicle (CCIV) – regulation memo, BNP Paribas Securities Services (March 10, 2019). See: https://securities.bnpparibas.com/insights/result/cciv-regulatory-memo.html

13 – https://www.allens.com.au/insights-news/insights/2018/09/unravelled-are-ccivs-the-beginning-of-the-end-for-the-unit/

14 – https://home.kpmg/cn/en/home/insights/2018/06/tax-alert-08-hk-implement-open-ended-fund-companies-regime-july.html

15 – Hong Kong Open-Ended Fund Company (OFC) – regulation memo, BNP Paribas Securities Services, op cit.

16 – The Singapore Variable Capital Company – regulation memo, BNP Paribas Securities Services, op cit.

17 – Ibid.

BNP Paribas Securities Services is working closely with regulators and key strategic stakeholders to provide feedback and address industry questions on the new schemes. And, thanks to our Asia Pacific footprint and global cross-border expertise, we can help clients to identify the impact of the different schemes from a cost of administration or ability to support different investment strategies perspective. We provide support from set-up with trustee, custody and transfer agency services, as well as fund administration. Call our experts for a more in-depth conversation about cross-border fund distribution.

Disclaimer

BNP Paribas Securities Services is incorporated in France as a partnership limited by shares and is authorised and supervised by the ACPR (Autorité de Contrôle Prudentiel et de Résolution) and the AMF (Autorité des Marchés Financiers).

The information contained within this document (‘information’) is believed to be reliable but neither BNP Paribas Securities Services nor any of its related entities warrant its completeness or accuracy nor accept any responsibility to the extent that such information is relied upon by any party BNP Paribas Securities Services shall not be liable for any errors, omissions or opinions contained within this document. Opinions and estimates contained herein constitute BNP Paribas Securities Services’ or its related entities’ judgment at the time of printing and are subject to change without notice. This document is not intended as an offer or solicitation for the purchase or sale of any financial product or service. The information contained in this document does not constitute financial advice, is general in nature and does not take into account your individual objectives, financial situation or needs. You should obtain your own independent professional advice before making any decision in relation to this information. The information contained in this document is not intended for retail investors. Any information contained within this document will not form an agreement between parties. BNP Paribas Securities Services ARBN 149 440 291 (AFSL No: 402467) has been registered in Australia as a foreign company under the Corporations Act 2001(Cth) and is a foreign ADI within the meaning of s 5(1) of the Banking Act 1959. This document is not intended as an offer or solicitation for the purchase or sale of any financial product or service outside of Australia and is intended for ‘wholesale clients’ only (as such term is defined in the Corporations Act 2001 (Cth)).

BNP Paribas Securities Services, acting through its Hong Kong Branch, is regulated by the Hong Kong Monetary Authority and is licensed by the SFC to conduct Type 1 (dealing in securities) regulated activity.

BNP Paribas Securities Services, acting through its Singapore Branch, is regulated by the Monetary Authority of Singapore.

The New Zealand securities services business operates through BNP Paribas Fund Services Australasia Pty Ltd. BNP Paribas Fund Services Australasia Pty Ltd is a wholly owned subsidiary of BNP Paribas Securities Services. BNP Paribas Fund Services Australasia Pty Ltd ABN 71 002 655 674 (‘BPFSA’) is an Australian incorporated company which is registered with the New Zealand Companies Office under registration number 1010736. BPFSA is also registered under the Financial Service Providers (Registration and Dispute Resolution) Act 2008.

© 2020 funds europe