From the impact of technology to the future of investment advice, how do the Australian survey’s findings compare with the rest of the world’s?

The remaining questions in this survey highlight insights provided by global respondents to the 2020 Funds Europe (specifically the 2020 Europe and UK survey) and Funds Global Asia surveys (specifically the 2020 Asia survey and 2020 Australia survey), providing a view on the direction of the global asset management industry.

Typically, the commentary also evaluates key findings identified by Australian respondents and how these trends compare with the global respondent group.

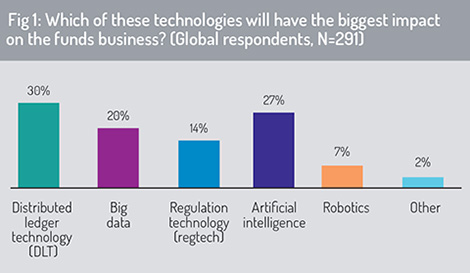

When we asked our global respondents which technologies will have the biggest impact on the funds business (fig 1), they told us (as they did in the 2019 global survey) that distributed ledger technology will be most important (30%). They also indicated that the ability to harness new innovation made possible through artificial intelligence applications (27%) and the ability to manage ‘big data’ will be key to the advance of the asset management industry worldwide.

In Australia, respondents retain a positive outlook about the potential offered by DLT, with 43% of Australia-based respondents indicating that DLT will have greatest impact on the future of the asset management business. This positive sentiment has potentially been reinforced by the visibility of DLT infrastructure in the Australian market, such as Calastone’s global transaction network and ASX’s ongoing project to replace its CHESS settlement and record-keeping system with a DLT-based platform, which is due to go live in 2023. DLT has been on the industry’s radar for almost a decade; the market is becoming more discerning in identifying use cases where DLT is well suited and others where alternative options may be appropriate to meet user requirements.

In Australia, respondents retain a positive outlook about the potential offered by DLT, with 43% of Australia-based respondents indicating that DLT will have greatest impact on the future of the asset management business. This positive sentiment has potentially been reinforced by the visibility of DLT infrastructure in the Australian market, such as Calastone’s global transaction network and ASX’s ongoing project to replace its CHESS settlement and record-keeping system with a DLT-based platform, which is due to go live in 2023. DLT has been on the industry’s radar for almost a decade; the market is becoming more discerning in identifying use cases where DLT is well suited and others where alternative options may be appropriate to meet user requirements.

Australian respondents also indicated that artificial intelligence (AI) applications offer significant potential for delivering innovation to the investment funds industry (24%). AI is finding growing application in the asset management industry, from use in client service applications, investment research analytics, regulatory and compliance software, to computer security and fraud detection.

With this development, the need to handle ‘big data’ and to maintain an efficient data infrastructure goes hand-in-hand (23%).

Technology adoption

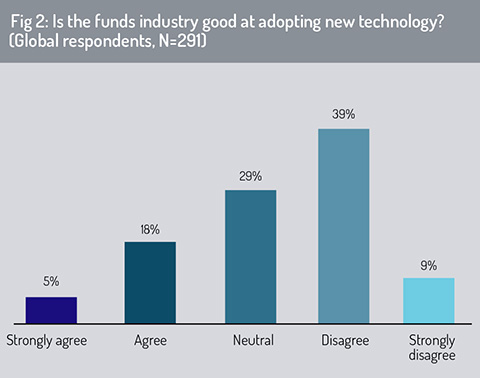

In keeping with previous surveys, we asked whether the asset management industry is good at adopting new technology. The answer, for a fourth consecutive year, is a striking “no” (fig 2).

Across our global survey, almost half our respondent group disagree that the industry is good at technology adoption (9% disagree strongly). In contrast, less than one quarter believe that the industry is good at adopting new technology.

Across our global survey, almost half our respondent group disagree that the industry is good at technology adoption (9% disagree strongly). In contrast, less than one quarter believe that the industry is good at adopting new technology.

This sentiment is particularly strong in our Europe and UK respondent group, which finds that the funds industry is actually getting worse at technology adoption. Just 17% agreed that the industry is good at adopting new technology (down from 25% in 2019). In contrast, 54% of respondents disagreed with this statement (of which 10% disagreed strongly).

There was also a negative assessment from our Australia-based respondents: only 19% said that the industry is good at technology adoption (only 3% agreed strongly), compared with 40% that disagreed with this statement.

For those that disagreed, we asked for further explanation of why this is the case. In the global survey, there was a fairly even split between the lack of a compelling business case for adoption and weak understanding of new technology.

Significantly, less than 10% of global respondents said that they have no need to adopt new technology. The need for technology updates and enhancement to their digital strategies is clearly pressing – and respondents identified a compelling need to sharpen their skills base to fulfil this requirement.

For Australia-based respondents, budgetary constraints and lack of a compelling business case for adoption (65%) were the dominant reasons why they believe the industry is falling short with technology adoption.

Weak understanding of new technology (49%) and a lack of the required technology skills in-house (46%) also present significant obstacles to the industry’s ability to upgrade its legacy technology and to innovate through new technology applications.

Distributed ledger technology

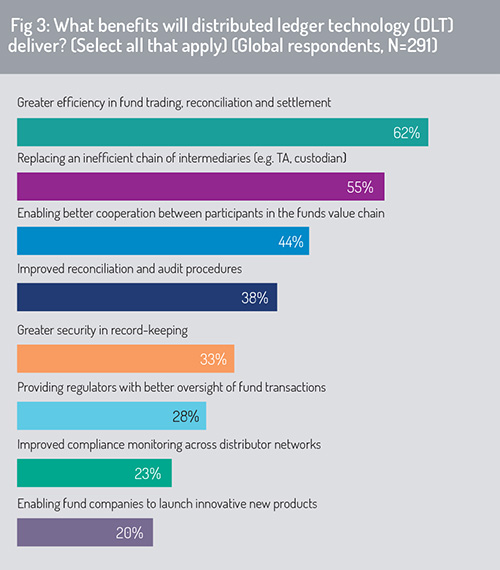

When asked which benefits of DLT will be most important for the asset management industry, global respondents indicated that “greater efficiency in fund trading and settlement” will be the dominant benefit (fig 3, 62%)

Respondents believe that the application of DLT will drive reconfiguration along the investment funds value chain (55%), with financial intermediaries (e.g. transfer agents, fund custodians) potentially being ‘disintermediated’ from the transaction value chain as record-keeping is centralised on distributed ledger.

Respondents believe that the application of DLT will drive reconfiguration along the investment funds value chain (55%), with financial intermediaries (e.g. transfer agents, fund custodians) potentially being ‘disintermediated’ from the transaction value chain as record-keeping is centralised on distributed ledger.

The global survey also finds that adoption of DLT will enable better cooperation between participants in the investment funds transaction lifecycle (44%), enabling participants to share access to a common book of record which can be updated in near-to-real time. This can reduce the cost of reconciliation across multiple data records and enhance the efficiency of regulatory oversight and audit (38%). Respondents also highlight the potential for DLT to deliver greater security in record-keeping (33%).

For Australia-based respondents, greater security in record-keeping is the dominant benefit that application of DLT will deliver to the funds industry (61%). The Australia survey also finds that improved reconciliation and audit procedures (52%) and the ability to deliver greater efficiency in fund trading and settlement (48%) lie uppermost in respondents’ priorities. Some 45% of respondents say that greater adoption of DLT is likely to trigger disintermediation across the investment funds transaction value chain.

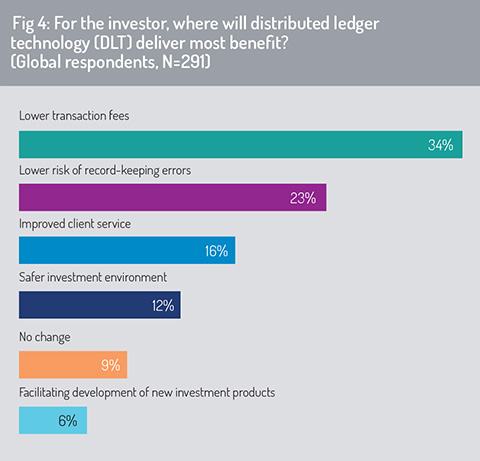

Focusing on where DLT will deliver most benefit to the investor (fig 4), the global survey finds, as it did 12 months ago, that the principal benefits will be delivered through lower transaction fees (34%).

It will also deliver a lower risk of record-keeping errors (23%) and the potential to drive improvements in client service (16%).

It will also deliver a lower risk of record-keeping errors (23%) and the potential to drive improvements in client service (16%).

In keeping with the findings of last year’s global survey, respondents appear to value the cost-efficiency benefits of DLT above the risk-management benefits (through a safer investment environment, lower risk of record-keeping errors) or potential improvements in client service.

However, this is not the case for Australia-based respondents, which attach highest priority to the ability of DLT to deliver a lower risk of record-keeping errors (30%). A further 24% of respondents said that DLT will contribute to a fall in transaction fees charged to investors (24%) and 21% said this will enable improvements in client service.

It is noteworthy that just 5% of global respondents (and 6% in the Australia survey) highlighted the potential for DLT to deliver greater creativity in the development of new investment products. We watch this with interest for the future, given the potential for asset management companies to create fund units through ‘tokenised’ issuance on blockchain. This will allow fund promoters to structure new investment products and, potentially, to offer improved trading liquidity by ‘fractionalising’ illiquid assets into smaller denominations that trade as tokens on blockchain.

© 2020 funds europe