Margin compression continues to place pressure across the asset management industry, with fund manufacturers, distributors, asset servicing specialists and infrastructure entities all forced to review their business models in the face of margin contraction.

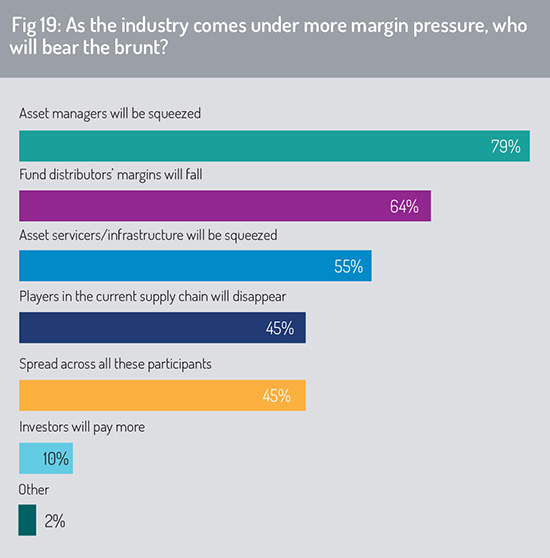

Respondents to this 2020 Asia survey reveal that these pressures will be experienced across the investment fund value chain, with the impact most acute on asset management companies (79%), but with fund distributors (64%) and asset servicing or infrastructure companies (55%) also carrying a heavy burden (fig 19).

An important implication of these cost pressures, respondents tell us, is that this is likely to result in consolidation within these sectors, with participants in the current supply chain being acquired by competitors or, in some cases, exiting specific business lines.

A prominent message to emerge from the Asia survey is that little of this cost pressure will be passed through to the end investor: only 10% of respondents believe that investors will pay more. Respondents expect, inter alia, that asset managers will introduce a wider range of ETFs and other low-cost products, and take additional steps to reduce operating and service costs, in efforts to prevent cost pressures feeding through into higher fees for the end investor.

Attracting new investors

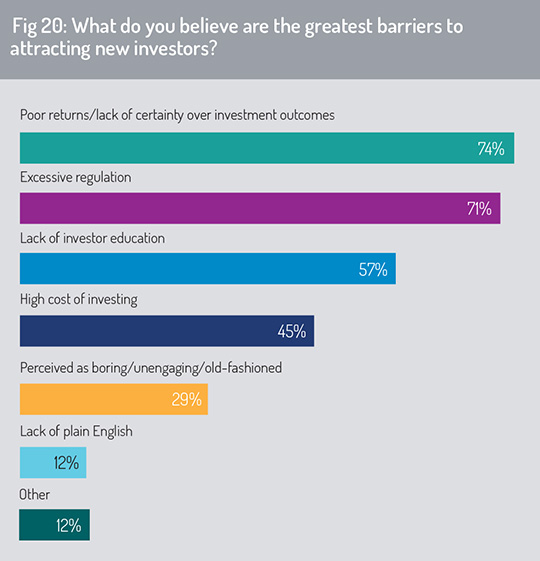

The most significant challenge asset management companies face in attracting new investors derives from concerns about how investment fund products will perform in the current economic environment. Alongside this, investors are held back by concerns around excessive regulation and a lack of suitable investor education.

In the face of current volatility in global investment markets, respondents believe lack of certainty around investment returns is the primary barrier to new investment, flagged up by 74% of respondents. As one respondent said: “The coronavirus encourages people to be cautious and to build cash for a rainy day.”

In several Asian markets, for example China and India, respondents indicated that ongoing steps to lower regulatory obstacles will have a positive effect in encouraging new investment. Thailand has also taken steps to open its doors to cross-border fund distribution, thereby extending the range of investment fund products available to Thai retail investors beyond its current concentration in domestic funds.

In several Asian markets, for example China and India, respondents indicated that ongoing steps to lower regulatory obstacles will have a positive effect in encouraging new investment. Thailand has also taken steps to open its doors to cross-border fund distribution, thereby extending the range of investment fund products available to Thai retail investors beyond its current concentration in domestic funds.

Beyond these factors, lack of investor education provides a barrier to the growth of investment flows across a diversified range of investment fund products. As noted earlier in this report, investors in a range of Asian markets (e.g. China, India) have a high level of digital awareness but sometimes lack a solid understanding of how to construct a diversified portfolio that meets their investment objectives. In India, the Securities and Exchange Board of India (SEBI, the financial regulator) has introduced a programme alongside the Reserve Bank of India and the Ministry of Commerce to improve investors’ education and to promote understanding of their rights. This initiative is at an early stage, but is a step in the right direction to promote collective investments as a vehicle for Indian citizens to meet their wealth management goals.

Access to investment advice

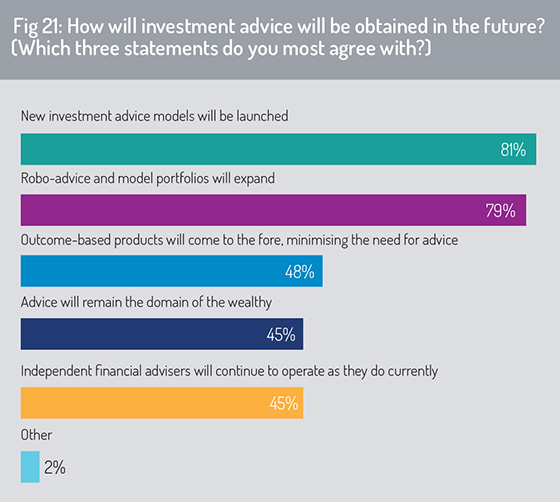

In line with this assessment, more than four-fifths of respondents to this Asia survey said that they expect new models of investment advice to be launched. Close to 80% believe that robo-advisory models will play a key role in Asian markets – typically drawing on an online questionnaire to evaluate an investors’ investment objectives, risk profile and wealth management goals and then using computer-based optimisation to match these investment preferences to a suitable model portfolio.

Two additional statements stand out from respondents’ answers to this question. Some 45% of Asian respondents believe that investment advice will remain the preserve of the wealthy, a noteworthy conclusion given the high levels of income and asset inequality that remain in a number of Asian markets. In this environment, it is important to extend access to investment fund products and advice at affordable costs.

Two additional statements stand out from respondents’ answers to this question. Some 45% of Asian respondents believe that investment advice will remain the preserve of the wealthy, a noteworthy conclusion given the high levels of income and asset inequality that remain in a number of Asian markets. In this environment, it is important to extend access to investment fund products and advice at affordable costs.

In some Asian countries, the investment funds infrastructure is playing a key role in supporting welfare initiatives for lower-income households. In Indonesia, for example, the S-Invest funds platform, hosted by KSEI (the Indonesia Central Securities Depository), is used to process investment flows into the Tapera scheme, a government-backed initiative to promote saving for affordable homes. This programme is funded through work-based employee contributions, supplemented by a mandatory contribution from the employer.

Continue reading the report: Concluding thoughts »

© 2020 funds global asia