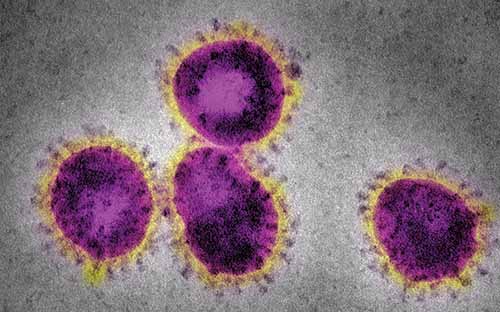

Just as geopolitical risks continued to fade away in Q1 2020, Covid-19 caused markets to unravel again, with investor sentiment declining across the board, writes Monjur Chowdhury.

Following on from Q4 of 2019, interest in UK and European asset classes was expected to continue due to a reduction of near-term political uncertainty. The Conservatives had won in the UK, bringing more certainty to the EU departure timetable.

Fund managers perhaps signalled their reduced anxieties with an uptick in searches for European (including UK Equity) funds, with Allianz Global Investors emerging as the most-searched manager. The asset class rose from 4th most searched in 2019 overall, to 2nd most searched in Q1 2020 for equities. Global Equity held steady as the most-searched asset class in Q1, continuing a trend from 2019.

The positive market outlook for 2020 was, however, short-lived – and we all know why. The start of the year was quickly overshadowed by a virus that seemed – slowly at first, but then quickly – to shift investor sentiment.

Moving through Q1, figures from the fund transaction network Calastone showed that in the first three weeks of February, investors invested plentifully into equity funds, brushing off any concern they might have had about coronavirus.

Due to the possible economic concerns and global business closures brought on by the pandemic and the halting of industrial activity across the world, the ‘Coronavirus Crash’ resulted in record fund outflows in the last five days of February £1.55 billion in the UK during the last week alone – as markets around the world felt the impact.

Due to the possible economic concerns and global business closures brought on by the pandemic and the halting of industrial activity across the world, the ‘Coronavirus Crash’ resulted in record fund outflows in the last five days of February £1.55 billion in the UK during the last week alone – as markets around the world felt the impact.

Global funds were hit the hardest, with UK equity funds seemingly escaping unscathed, until the last day of the month when they eventually succumbed.

The key point of interest moving forward will be to see what Q2 brings. It’s a case of whether major economies such as China continue their recovery, and if due to this we see funds flowing into Asian assets, gradually diversifying as other economies follow suit in terms of recovery and resuming economic activity.

Monjur Chowdhury is investment research associate at CAMRADATA, the owner of Funds Europe. All figures are for three months to March 31, 2020 unless otherwise stated

© 2020 funds europe