Our new survey points the way ahead for professionals in all corners of the important – and fast-expanding – alternatives sector.

As an international hub for fund domiciliation, Jersey’s keen interest in the alternatives sector has reaped substantial rewards in recent years.

From private equity to venture capital, real estate, infrastructure and hedge, alternatives are big business here, with the net asset value of funds under administration expanding by 6% in 2019. Private equity and venture capital performed especially strongly, growing by 19% in the course of the year to stand at £136 billion (€150 billion).

Today, the alternatives sector makes up more than 80% of Jersey’s total funds business and is a crucial part of the financial landscape, as Elliot Refson, director of funds at Jersey Finance, is quick to acknowledge.

Leading development, both locally and internationally, is key for a global jurisdictional leader in this space – but the list of what constitutes financially material considerations has grown in recent years to include sustainability and good governance.

International events such as the Covid-19 pandemic, Brexit and the climate crisis have moved good ESG practices from the fringe of the asset management industry to the forefront. This places an onus on international fund hubs such as Jersey, which, to meet investor needs and put global capital effectively to use, must innovate to bring new products and services to fruition.

With assets under management (AuM) expected to exceed US$145 trillion globally by 2025, the proportion allocated to alternatives is also expected to increase.

With assets under management (AuM) expected to exceed US$145 trillion globally by 2025, the proportion allocated to alternatives is also expected to increase.

So, what does this mean for specialist alternative fund domiciles and where do the opportunities to shape the sector lie?

In the following sections, we evaluate the results of a wide-ranging survey conducted by Funds Europe in association with Jersey Finance.

In addition, we dissect the alternatives landscape by considering the appetite for the sector over time, the role of ESG in investment strategies and the driving forces of demand.

A growing appetite

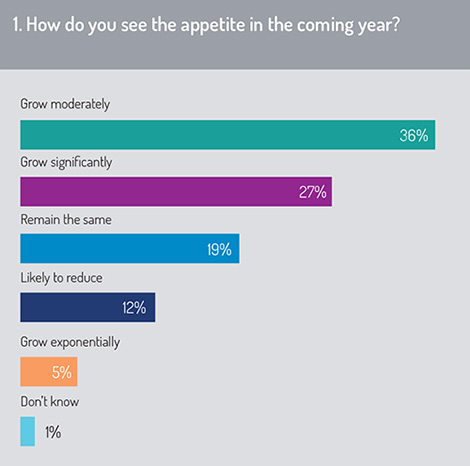

The survey began by asking respondents their expectations for growth in the alternatives sector over the coming year (fig 1). More than a quarter (27%) expected significant growth, while 36% said they anticipated moderate growth and 19% expected it to remain static.

Explaining this growth narrative, Sophie Reguengo, a partner at Ogier said: “As a jurisdiction that specialises in alternative investment funds and wealth planning services for ultra-high-net-worth individuals (UHNIs) and families, Jersey is right to be optimistic, particularly as we are an historic international finance centre with the best regulation and anti-money laundering rules, real people on the ground, and quick to react with new products such as the Jersey Private Fund and, soon, the Limited Liability Company (LLC). Jersey ended 2019 with record figures for total assets under administration, so we are well-placed to support this anticipated trend.”

It’s also important to note that while most respondents expected an upward trajectory for the alternatives sector (5% predicted exponential growth), 12% said they expected appetite to reduce amid global volatility and the severe recession that many economic observers consider likely or inevitable in the wake of the pandemic.

According to the World Economic Forum (WEF), “the Covid-19 recession will be the deepest since 1945-46, and more than twice as deep as the recession associated with the 2007-09 global financial crisis”.

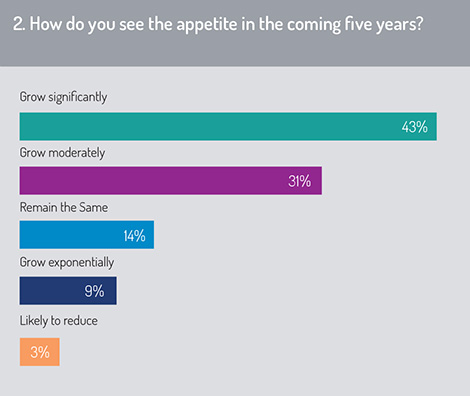

When the survey broadened the time horizon out to five years (fig 2), 43% of respondents said they expected significant growth in the appetite for alternatives, 31% opted for moderate growth and the figure for exponential growth rose to 9%. The proportion who foresaw a reduced appetite dropped to just 3% over a five-year period, compared with 12% over the coming year. In other words, while there is short-term uncertainty, investors remain optimistic over the medium to long-term.

When it comes to property, “the big question is how and when real estate funds will make a return and how the care home, hospitality, leisure, infrastructure and retail sectors will fare once lockdowns are lifted”, said Reguengo.

When it comes to property, “the big question is how and when real estate funds will make a return and how the care home, hospitality, leisure, infrastructure and retail sectors will fare once lockdowns are lifted”, said Reguengo.

“As for the office sector, although office space will need to be adapted to accommodate new social distancing arrangements and maintain high levels of sanitation, market sentiment is that whilst people appreciate the flexibility and the ability to work from home, teams want to physically be together and it is important from a collaboration and mental health perspective.

“We expect change in this sector, but no decline in demand for quality office space in the right location.”

Continue reading the report: Dissecting the data »

© 2020 funds europe