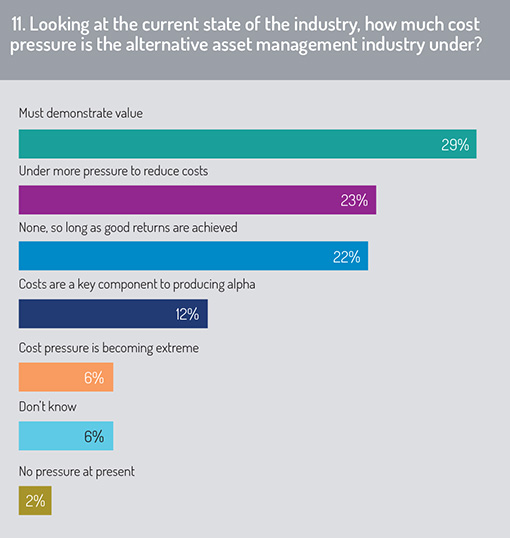

The survey asked participants to consider the impact of cost pressures on the alternative asset management industry (fig 11). The overarching message is that the industry faces a range of pressures to demonstrate value for money.

Respondents said the key cost pressures are the need to demonstrate value (29%) and reduce costs (23%). Six percent said the pressure is becoming extreme.

However, an interesting mixture of views emerged. For example, 22% said there is no cost pressure as long as good returns are achieved, while 12% said costs are a key component when it comes to producing alpha. Just 2% said there is no cost pressure at the moment.

Jersey’s position is to offer a straightforward route to the market. According to figures from the Jersey Finances Services Commission (JFSC) as of December 31, 2019, the number of registered managers who chose to market into the EU via the national private placement regime (NPPR) rose by 9% year-on-year.

Jersey’s position is to offer a straightforward route to the market. According to figures from the Jersey Finances Services Commission (JFSC) as of December 31, 2019, the number of registered managers who chose to market into the EU via the national private placement regime (NPPR) rose by 9% year-on-year.

This demonstrates Jersey’s effectiveness in being able to market to various regions, as well as highlighting the draw of the private placement route for non-EU managers seeking access to EU investor capital. A clear sense of certainty underpins the whole process.

Tangible talent

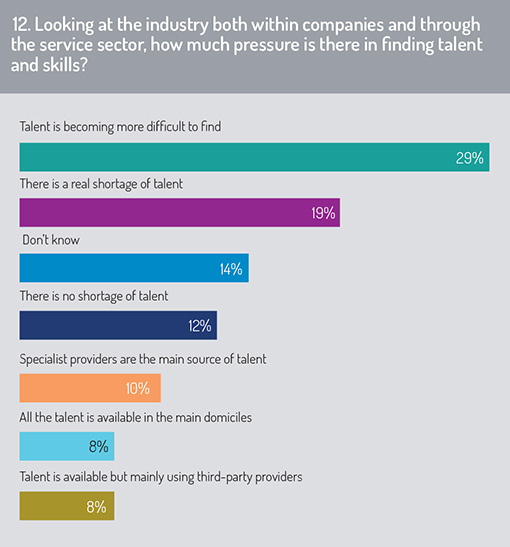

Having an array of talent is at the heart of any successful business and industry, which also reflects good corporate culture and solid governance structures. Respondents were asked to evaluate the pressure of sourcing talent and skills both at a company level and in the service sector (fig 12).

Many agreed that talent is becoming increasingly hard to find (29%). Interestingly, there was a narrow but noticeable margin between those who said there is a real shortage of talent (19%) and those who said the opposite (12%).

“The increased complexity of business, as well as overall growth in demand for alternative investments, has created an increase in aggregate demand for talent, as well as demand for higher levels of sophistication and expertise,” said Paul.

“The right expertise and experience does not develop quickly or easily, which in turn creates short-term competition for talent. There is a need for training – internal and external – of personnel. In addition, the importance of retaining talent cannot be understated, which leads to a need to seek feedback, evaluate and improve the overall employee experience.”

“The right expertise and experience does not develop quickly or easily, which in turn creates short-term competition for talent. There is a need for training – internal and external – of personnel. In addition, the importance of retaining talent cannot be understated, which leads to a need to seek feedback, evaluate and improve the overall employee experience.”

A tenth of the survey’s respondents said specialist providers are the main source of talent, while 8% said all the talent is available in the main domiciles. Likewise, 8% said it is available, but mainly via third-party providers.

Concluding thoughts

The survey concluded by asking respondents to identify a single element that they would change about the industry. There were a range of responses, including:

- Giving ESG a high priority;

- Improved transparency and quality institutional data;

- Improved gender equality now, not in a long-term target plan;

- Innovation and sustainable thinking;

- Building long-term trust with clients and service providers;

- Genuine ESG engagement;

- More standardisation across jurisdictions;

- Creating global standards;

- A reduction of overall fees;

- Industry cooperation to agree standards/ways for participants to work together, which will pave the way for greater automation for data flows and cost-efficiency; and

- General awareness of its function in society.

In many ways, the open-ended responses are consistent with the findings of the survey. In particular, the importance of ESG is not to be underestimated. It is no longer rising, but has risen, and those who incorporate it at the heart of all their investment strategies are primed to withstand future global volatility – and, most importantly, fulfil part of ESG’s societal function by delivering sustainable returns.

Continue to the final section of the report: Survey methodology »

© 2020 funds europe