Hedge funds have suffered massive outflows during the financial crisis, which makes Ucits III products look even more attractive, finds Fiona Rintoul…

Investment rules that allow mainstream funds to use leverage, derivatives and short selling were always supposed to open the door for hedge funds to target the much larger client base of mainstream managers. Relatively little of this convergence has happened, but following redemptions during the financial crisis, hedge funds need new investors and may look again to the Ucits III rules for help.

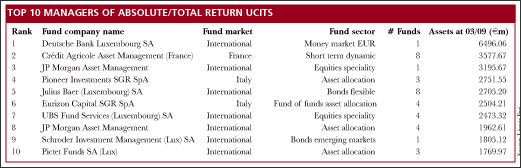

Latest data from Lipper Feri detailing companies that manage Ucits funds with an absolute or total return profile show that all the companies in the top 20 by assets are traditional firms (see table) – as indeed are most of the firms outside the top 20.

The data also show that, in all, there are 644 entities offering 957 absolute/total return Ucits funds with assets under management of €99.5bn. Companies typically have only a couple of funds in this category.

Also, the average portfolio size is just over €100m. Doubtless many of the funds launched by traditional managers will not survive: there are a couple of hundred with less than €10m under management.

Hedge funds have an opportunity, if they can conform to the rules. “Ucits III is a useful market vehicle for hedge funds addressing capital raising challenges and new investment opportunities,” says Ron Tannenbaum, co-founder of GlobeOp Financial Services.

One such manager considering Ucits III is SourceCap, a company that describes itself as a multi-product platform of absolute return strategies.

“We see the Ucits wrapper as potentially quite attractive for investors in hedge funds,” says Andrew Parry, SourceCap’s managing director. “There are definitely opportunities for certain styles of hedge fund to launch as Ucits. Some managers are already moving into this area.”

The primary motivation for alternative managers to launch Ucits III funds is the expanded distribution opportunities that these regulated products offer. John Donohoe, CEO of Carne Global, a consultancy, says: “A large portion of the European hedge fund industry was dependent on aggregators. That has changed. Madoff has affected funds of hedge funds (FOHF). There have been substantial redemptions from that sector and FOHF are not as visible as a source of capital as they were before.”

In the standard hedge fund categories of equity long-short and fixed income, most investors used FOHF for access rather than because they didn’t understand the underlying product, says Donohoe. But hedge funds are now much less precious about access. At the same time fees have come dramatically from the classic 2/20 to something more like 1/10 and hedge funds are often less leveraged than they were before because prime brokers have reduced the leverage they are willing to give large parts of the hedge fund world.

Regular funds

In short, hedge funds – or at least some of them – are becoming more like regular funds. And this means that they can move into a new category as far as asset allocation is concerned. Instead of being just a 3-4% hedge fund allocation, hedge funds can form a 40-50% high-alpha allocation.

Donohoe says: “With the right type of equity long-short or bond fund you can move from being a satellite allocation to being a core allocation. Then the most appealing vehicle is a Ucits III fund. A big factor is the due diligence that investors have to do. It’s much easier to allocate to a Ucits compared to an unregulated fund.”

Donohoe believes the attractions of Ucits III – which include recognition of the Ucits ‘brand’ in South America, the Far East and South Africa – are so compelling that “sooner or later most hedge funds with significant assets under management will adopt Ucits III structures”.

There are, however, cost issues connected with choosing the Ucits III route, such as sub-custodial costs, says Dan Mannix, head of business development at RWC Partners, an institutional asset manager that manages both Ucits and hedge funds. “There is

the ease of dealing with a prime broker, who has vast experience of dealing with long-short hedge funds that may leverage, versus dealing with a traditional long-only administrator.”

Some of these issues will probably be sorted out with time. “You only need to look at the effort Deutsche Bank and Merrill Lynch are putting into Ucits III,” says Mannix.

Richard Pettifer, director of investment management at KPMG, says hedge fund managers need to remember that Ucits is a whole different way of doing business. In the Ucits world managers are competing against 30,000 other funds and there is no prime broker to rely on for capital introductions and administration.

“Succeeding in this crowded marketplace is about understanding the needs of the investors and getting the distribution right,” says Pettifer. “It requires robust risk management and compliance structures and importantly the revenue and cost structure for the manager needs to add up.”

It is important to think about whether Ucits-style distribution is really appropriate.

“We as a business strongly believe products offered to clients need to reflect their level of sophistication,” says RWC Partners’ Mannix. “You need to deliver products through Ucits III that are appropriate for the retail market.”

For Mannix that would not include, for example, funds that use the value-at-risk risk management tool as defined by the Luxembourg authorities. It’s an issue not many people bring up, but one that could hardly be more topical. The implications of introducing quite sophisticated products into a retail distribution environment need to be considered further, suggests Mannix.

Risk assessment

The use of Ucits III by hedge fund managers seems certain to increase. That will undoubtedly contribute to the already ongoing process of convergence between traditional and alternative managers within the industry. But Ucits III is not a one-way ticket to absolute returns for all with no hurdles along the way.

“It would be a massive backward step if portfolio managers were again limited to managing funds on a purely long-only basis,” says Mannix. “But there needs to be an assessment of the real risk in Ucits III down to the amount of leverage or implied leverage, and there needs to be a lot of concentration on how these funds are distributed to retail investors.”

©2009 funds europe