The Pacific Alliance countries form the eighth largest economy in the world and are working towards an integrated trading bloc that will also look for investment and links with the wider globe. Funds Europe presents some facts and figures.

It was 2013 that saw the first complete year since the birth of the Pacific Alliance – an economic bloc consisting of Latin America’s largest free-trading countries.

Formed in June 2012, the alliance unites Chile, Colombia, Mexico and Peru in a mission to increase productivity, promote investment between member countries, and foster broader economic integration.

Formed in June 2012, the alliance unites Chile, Colombia, Mexico and Peru in a mission to increase productivity, promote investment between member countries, and foster broader economic integration.

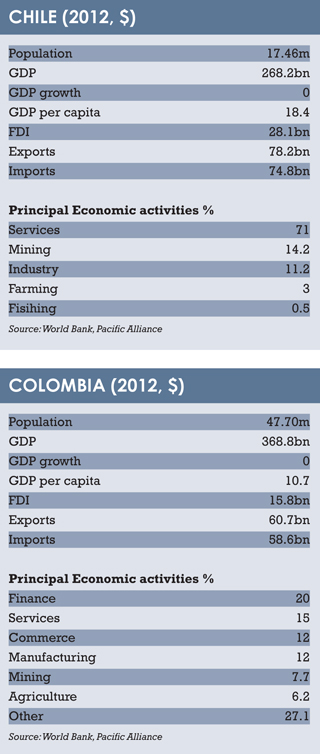

Between them, the countries have a GDP of $1.7 trillion and form the world’s eighth largest economy.

One of the most notable projects of the alliance is Mila, the Intergrated Latin American Stock Market, formed by Chilean, Colombian and Peruvian bourses, and to be joined by Mexico. Mexico is the region’s second largest single stock exchange after Brazil.

Opening shared embassies and removing visa requirements for their citizens are some of the other achievements.

A meeting held earlier this year hosted all the countries’ presidents and was also attended by Canada’s prime minister and Costa Rica’s president.

The bloc is seen in some quarters as a rival to Mercosur, which is made up of Argentina, Brazil, Paraguay, Uruguay, Venezuela and Bolivia. Mercosur has projected a degree of animosity to the Pacific Alliance. Evo Morales, the president of Bolivia, reportedly said the Pacific Alliance was a geopolitical scheme of the US to oppose left-wing governments who belong to Mercosur.

Speaking at a recent a roadshow in Mexico City organised by inPeru, an inward investment body, Magali Silva, Peru’s minister of foreign trade and tourism, said: “I am convinced that the Pacific Alliance is the best thing that could have happened to our countries. This kind of partnership is the best way to compete in a globalised world. As the Pacific Alliance, we have vast possibilities for trade in other markets.”

Speaking at a recent a roadshow in Mexico City organised by inPeru, an inward investment body, Magali Silva, Peru’s minister of foreign trade and tourism, said: “I am convinced that the Pacific Alliance is the best thing that could have happened to our countries. This kind of partnership is the best way to compete in a globalised world. As the Pacific Alliance, we have vast possibilities for trade in other markets.”

Silva added that the four countries of the Pacific Alliance have enjoyed an average growth rate of 5.5% in recent years, compared to the 2.2% growth of the world economy as a whole.

“They are dynamic economies which have made reforms and have achieved sharp reductions in their poverty levels, all of which brings us closer together both as a market and as distinct countries.”

The Pacific Alliance, which in May this year upgraded Costa Rica to a full member state, represents approximately 36% of Latin American GDP. It is set to become the eighth largest economic bloc in the world, with more than 200 million people and representing 55% of Latin America’s total exports – exporting more than Mercosur.

Panama, Guatemala and Paraguay are the latest countries to pursue membership.

©2013 funds global latam