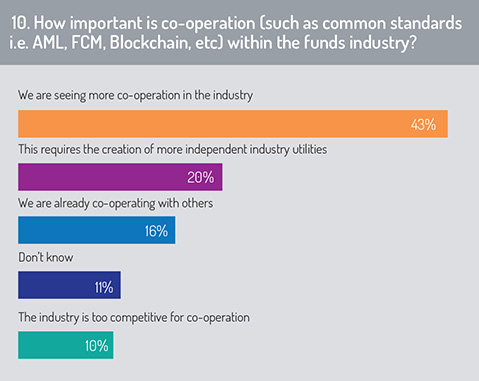

Although the asset management industry remains highly competitive, it is important that firms cooperate with each other across the value chain to ensure consistent use of standards (messaging standards, trade matching standards, standards around corporate actions processing, collateral management and many other areas) to encourage process harmonisation and minimise ad hoc ways of working.

Figure 10 explores how levels of co-operation between industry participants – including application of common industry standards and use of collaborative technology such as blockchain – is changing across the investment funds industry. Survey results provided a positive outlook on levels of collaboration between industry participants, with a majority of respondents indicating that they are seeing levels of collaboration rising within the industry or that they are currently involved in collaborative ventures with other firms. This illustrates the importance of flexible technology infrastructure – often API-based and built around a microservices architecture – that can adapt as standards evolve.

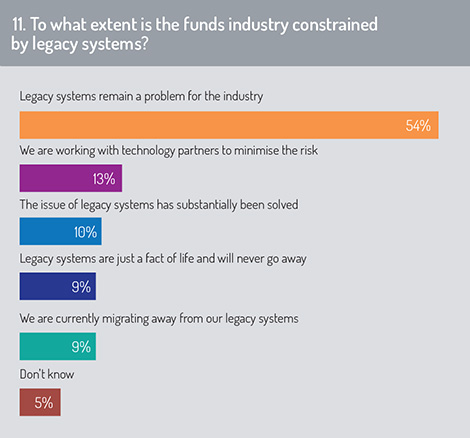

However, the asset management industry continues to be constrained by legacy technology and both asset management and asset servicing companies need to consider how they drive digital transformation while addressing any ongoing legacy issues.

Legacy systems and change management

Legacy systems and change management

Technology employed by asset servicing and asset management firms can degrade quickly and it is important for firms to invest if they are to perform at the leading edge of the industry. A well-designed technology strategy is not just about committing resources – it is also about foresight and about forward planning. When a firm buys a new technology system, it is important to be thinking about its upgrade strategy at each point in the development cycle and to do so right from the start of each new technology contract.

When we asked our survey constituents how far the funds industry is constrained by legacy technology (fig 11), they told us unequivocally that legacy issues remain a major problem. A majority said that legacy technology is still a major constraint (54% of respondents across the global survey and 60% of respondents in the US market) or that “legacy systems are a fact of life and will never go away”.

It is noteworthy, and perhaps a little alarming, that just 9% of respondents said that they are currently managing a migration programme away from their existing legacy systems. This illustrates the migration challenges that asset management and asset servicing firms encounter in upgrading to new technology systems, while needing to minimise disruption to customers and to their ongoing business processes as technology is being migrated.

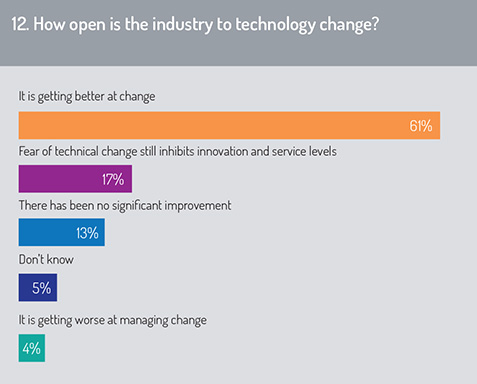

This point is confirmed in figure 12, where almost one-fifth of respondents said that fear of technical change continues to inhibit innovation and efforts to improve service levels.

This point is confirmed in figure 12, where almost one-fifth of respondents said that fear of technical change continues to inhibit innovation and efforts to improve service levels.

On a positive note, there was a strong belief among our survey constituents that the industry is getting better at managing technology change. As the industry makes greater use of agile implementation methodology, microservices-based architecture, cloud-based data services and API-driven client-server interfaces, these tools are making asset servicing companies better equipped to deliver high-quality services through digital channels.

Driving transformation in fund distribution

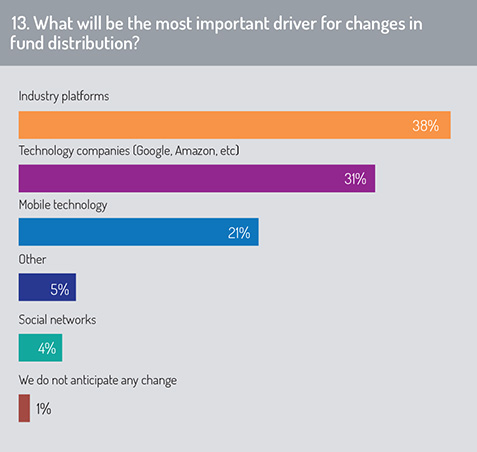

Turning our attention to change management with the fund distribution layer (fig 13), the survey asked: “What will be the most important driver for changes in fund distribution?”

The largest group of respondents, representing 38% of answers received, said that the growth of distribution through industry fund platforms will be the most important driver for changes in distribution and marketing strategies. Over two decades, we have seen the rise of fund platforms, such as Allfunds, FundsNetwork, Charles Schwab Global or Cofunds, establishing an extensive fund distribution network and extending access to a wide universe of investment funds and ETFs.

Technology companies – potentially including ‘Big Tech’ such as Google and Amazon – will be a major promoter of change in this sector. A number of global technology firms have been establishing strategic relationships with firms in the financial sector, deepening their understanding of the financial ecosystem and how its technology requirements are evolving. Given the huge network that Big Tech online retailers have established for merchandise distribution, as well as the expertise that they can offer in distribution supply chain management, financial payments and platform technology, these retailers are now realising the opportunity to extend their service coverage into the funds distribution sector. For example, Ant Financial Services Group, an affiliate of the of the Chinese Alibaba Group. announced in August 2018 that 14 newly approved target-date retirement funds operated by Chinese asset management firms, including China AMC, Bosera Funds, GF Fund Management and ICBC Credit Suisse Asset Management, will be made available on the company’s wealth management platform, Ant Fortune.

Technology companies – potentially including ‘Big Tech’ such as Google and Amazon – will be a major promoter of change in this sector. A number of global technology firms have been establishing strategic relationships with firms in the financial sector, deepening their understanding of the financial ecosystem and how its technology requirements are evolving. Given the huge network that Big Tech online retailers have established for merchandise distribution, as well as the expertise that they can offer in distribution supply chain management, financial payments and platform technology, these retailers are now realising the opportunity to extend their service coverage into the funds distribution sector. For example, Ant Financial Services Group, an affiliate of the of the Chinese Alibaba Group. announced in August 2018 that 14 newly approved target-date retirement funds operated by Chinese asset management firms, including China AMC, Bosera Funds, GF Fund Management and ICBC Credit Suisse Asset Management, will be made available on the company’s wealth management platform, Ant Fortune.

Mobile technology will be key to digital transformation in fund distribution, enabling investors to trade on their mobile applications, and to manage their global investments through app-based services extended by their asset manager or distribution intermediary.

©2019 funds europe