Demand for stress testing has risen as fund managers have sought to protect their portfolios from a eurozone break-up. George Mitton discovers that the techniques are becoming increasingly sophisticated.

Last December, financial technology firm SunGard was approached by State Street Global Advisors, one of its largest clients. State Street’s fund managers were worried about the risk of a eurozone break-up, but were not sure how to quantify the potential damage.

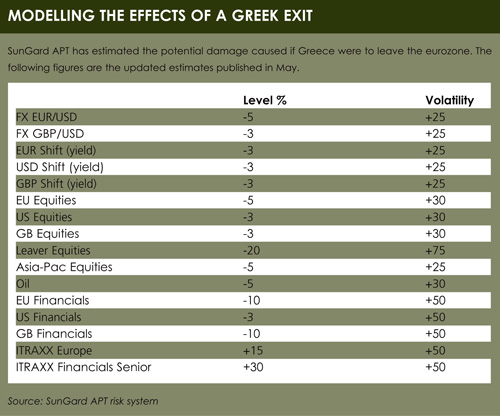

Laurence Wormald, head of research at SunGard APT, began quizzing economists and former colleagues at the European Central Bank about the likely impact of a break-up. His team produced a list of estimates of how asset classes would perform, in terms of price and volatility, in scenarios ranging from Greece leaving on its own to a full break-up of the currency union (see box).

The project proved two things: institutional asset managers have grown understandably nervous about events in Europe, and they are turning to stress tests to inform their strategies.

For Wormald, it was pleasing, finally, to see significant demand for this form of analysis. Armed with his euro break-up scenarios, clients could test what would happen to their portfolios if a crisis hit, and make changes to their holdings that would limit the damage – it was a far cry from merely relying on value at risk (VAR), the risk management measure commonly used prior to the 2008 financial crisis.

“For three years I’ve been saying scenario analysis is the most important part of risk management,” says Wormald. “Forget about calculating your VAR, everybody can do that. Forget about trying to do attribution of risk to factors, because when the shock comes, that attribution is going to be very wrong. The most important thing is to think about future shocks.”

Simple exercise

Risk managers at other firms report a significant rise in demand for stress testing since the eurozone crisis deepened. Techniques that first became visible in the aftermath of the 2008 financial crisis have been adapted to the specifics of the European sovereign debt problem. It has helped that regulators have mandated their own stress tests – to establish the solvency of the banks – as this has legitimised the term and encouraged asset managers and asset owners to apply stress tests of their own.

Stress testing, in essence, is a simple exercise. Rob Stamicar, senior director of risk management at Axioma, a portfolio analysis company, encourages his customers to start with a pen and paper, and write down the scenarios that worry them. In the context of the eurozone, these scenarios could be defined as movements in bond spreads or a default event.

Stress testing, in essence, is a simple exercise. Rob Stamicar, senior director of risk management at Axioma, a portfolio analysis company, encourages his customers to start with a pen and paper, and write down the scenarios that worry them. In the context of the eurozone, these scenarios could be defined as movements in bond spreads or a default event.

The task is then to translate the words on paper into the language of the client’s risk system. The system needs to be fairly sophisticated. To measure exposure to Greece requires more than just listing holdings of Greek bonds; it means looking through composite assets, such as funds, to find the underlying holdings. The risk system must also account for derivatives positions.

The stress test itself can be more or less complex. It is fairly simple to model the effect of a single event, such as European equities dropping 25%, but most real-world crises involve many events that unfold over a period of time. A thorough risk management system allows the user to model a scenario that develops over a period of months.

“In the years before the 2008 crisis, VAR on its own was being over relied on as a risk management tool,” says Stamicar. “Now, clients are asking forward-looking questions. They are asking about scenarios that have not yet happened.”

The eurozone crisis offers a good opportunity to demonstrate stress testing because, as he says, “everybody’s war gaming at the moment”.

Protection

A stress test may reveal interesting things about a portfolio. Many investors have bought insurance on their European bond portfolios in the form of credit default swaps. A stress test can help to establish whether these will offer the protection needed or if, for instance, an accompanying move in exchange rates would be likely to wipe out their value.

A stress test may also encourage an investor to buy options to protect themselves from a steep fall in equity prices, or inspire them to take a position in an asset class which is likely to hedge their exposures. Prices on credit default swaps in Europe are high, and it may be better value to buy an asset class, such as high-yield bonds perhaps, which can work as an effective hedge.

Crash tests

Daniel Satchkov, president of risk management firm Rixtrema, compares stress testing to running crash tests on a car. Crash tests have helped carmakers build protective systems that limit the damage caused by accidents; while part of the chassis may crumple under strain, other parts stay rigid to protect the passengers.

Stress testing may encourage investors to think of their portfolios in a similar way.

“No portfolio is invulnerable, if you want to make any return,” he says. “But it can be constructed so that if it gives away here, it protects somewhere else. If you think of a car that’s really safe, it’s not necessarily a tank, but it could have a system of compensations.”

Of course, stress testing can be applied to a range of scenarios, not just the eurozone crisis. Satchkov encourages clients, which include large pension schemes in the United States, to do stress tests on a stagflation scenario, in which inflation coincides with stagnant economic growth.

In this scenario, there is no crash, but a gradual drop in value across nearly all asset classes, including equities and bonds. The cumulative effect, for a large institutional investor, could be a huge loss.

“I think that’s where we’re heading globally,” he says.

Beyond europe

Meanwhile, Wormald, at SunGard, has been asked by clients to model a number of scenarios beyond Europe. Australian pension funds are concerned about a slowdown in China, South African clients are interested in inflation shocks, and Korean institutional investors want to examine an oil shock potentially triggered by Iran closing the Strait of Hormuz.

But for the meantime, a big source of business is helping companies plan for potential fractures in Europe.

“We’re not trying to predict the really unpredictable; things like political risk,” says Wormald. “Mario Draghi and Angela Merkel could change the nature of the euro crisis in one day.

“On the other hand, the underlying fundamentals are reasonably well understood. There are laws that underlie our economies and markets, even though there’s also randomness and noise.

“In a strange way, I want there to be a euro break-up so I can see whether my predictions come true.”

©2012 funds europe