Emmanuel Bourdeix, co-CIO of Natixis AM and head of Seeyond, says it makes more sense to adapt to the new investment landscape than to wait for modern portfolio theory to make sense again.

There is little point waiting for a return to ‘normal’ in the midst of a paradigm shift.

It has become popular to note that the Chinese character for ‘crisis’ comprises the symbols for danger and opportunity. In other words, grounds for optimism always exist, however deep the problem. So they do. If optimism is directed towards opportunity.

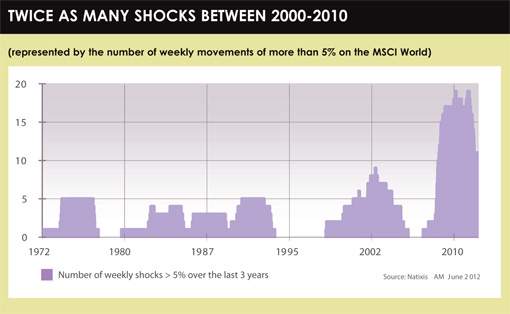

The bad news for traditional, long-only investors is there is no imminent return to ‘normal’ equity returns. Investors have generally been poorly compensated for the risk they have taken for the past twenty years. The uncertainty gauge runs ever higher: it will take time to work through the huge global macro-economic imbalances, and the markets themselves have derived from their primary function of financing the economy to reflect speculative objectives. The cross-correlation matrix shows diversification is even harder to source than when Lehman collapsed. Market fluctuations are of greater magnitude and greater frequency. The new ‘normal’ is choppy, trend-exhausted markets interspersed with significant reversals.

The bad news for traditional, long-only investors is there is no imminent return to ‘normal’ equity returns. Investors have generally been poorly compensated for the risk they have taken for the past twenty years. The uncertainty gauge runs ever higher: it will take time to work through the huge global macro-economic imbalances, and the markets themselves have derived from their primary function of financing the economy to reflect speculative objectives. The cross-correlation matrix shows diversification is even harder to source than when Lehman collapsed. Market fluctuations are of greater magnitude and greater frequency. The new ‘normal’ is choppy, trend-exhausted markets interspersed with significant reversals.

SEE INVESTMENT MANAGEMENT DIFFERENTLY

Now the good news. Exploiting volatility and dispersion yields new sources of returns and diversification in portfolios with a generally improved risk-return profile over traditional long-only investing.

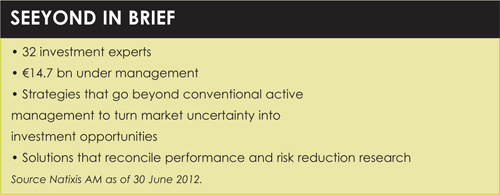

Seeyond, the structured product and volatility management investment division of Natixis Asset Management, has taken risk factors upstream, bringing applied quantitative research and investment management into tight embrace to build resilient portfolios that put risk first. We treat volatility as an equity factor and risk management as integral to portfolio construction.

This means executing ‘alternative’ investment techniques with attention to transparency, liquidity and risk control. It means model-driven investments supported by a large and experienced team, not black-box solutions.

This means executing ‘alternative’ investment techniques with attention to transparency, liquidity and risk control. It means model-driven investments supported by a large and experienced team, not black-box solutions.

It means continual dialogue between investment managers and the quant team that support them. Seeyond’s portfolio managers take a fresh approach to investment, implementing active strategies in which decisions are objectively assessed by models and risk weighted.

Quantitative researchers build proprietary indicators and decision making tools and models. They bring academic research to portfolio management, fostering an environment of creative thinking in which their own (and received) investment thinking is challenged, investment processes are improved and investment strategies are extended.

FOUR KEY CAPABILITIES

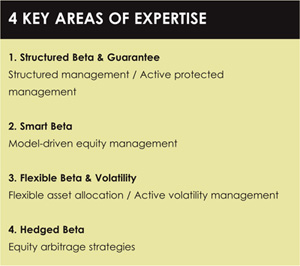

Our first area of expertise is structured beta and guarantee, structured investments that combine some level of capital protection with exposure to a specific performance engine, wrapped in a structure tailored to investors’ needs.

Then comes smart beta. We have seen marked interest in low volatility, an excellent example of how model-driven equity strategies should be exploited.

The portfolio optimisation technique improves the risk/return of an equity portfolio by exploiting the significant longer term outperformance of low-over high-risk stocks. It selects the least volatile equities and those least correlated with each other in unconstrained portfolios focused on reducing absolute rather than relative risk.

The portfolio optimisation technique improves the risk/return of an equity portfolio by exploiting the significant longer term outperformance of low-over high-risk stocks. It selects the least volatile equities and those least correlated with each other in unconstrained portfolios focused on reducing absolute rather than relative risk.

Third comes flexible beta and volatility, multi-asset class absolute return strategies aiming to generate steady risk-adjusted returns within a consistent risk budget, but nonetheless turning volatility and dispersion into performance. For example, we offer an innovative absolute return strategy managed by a recognised team in volatility investing, which provides effective protection against downturns and generates absolute returns during normalised market environments.

Finally, hedged beta is represented by an absolute return event-driven equity arbitrage strategy, which exploits the relative value opportunities provided by corporate events like mergers and acquisitions and operational and/ or financial restructuring. In short, Seeyond offers resilience in the face of a lastingly unstable environment.

Seeyond is the volatility management and structured products investment division of Natixis Asset Management. Natixis Asset Management, limited liability company, share capital €50 434 604.76, RCS Paris no. 329 450 738, regulated by AMF under n° GP 90-009.

©2012 funds europe