Spain is very much a fixed income market, but the appetite for risk is rising. Nick Fitzpatrick looks at how domestic and foreign asset managers are positioned at this inflection point.

The total amount of money in Spanish investment funds is nearly back at 2008 levels since Spanish overnight money market rates stopped offering 4% returns with government backing in January this year.

Partly forced to, and partly willing to, Spaniards are targeting more risk as bank interest rates fall and talk of an economic recovery starts to circulate among the population.

Inverco, the Spanish funds trade body, says the increase is down to both portfolio gains and net subscriptions. Assets under management increased at a rate of 25% last year and the number of unit holders rose from 4.48 million to 5.11 million. Last year also saw €33.5 billion of inflows in the first half.

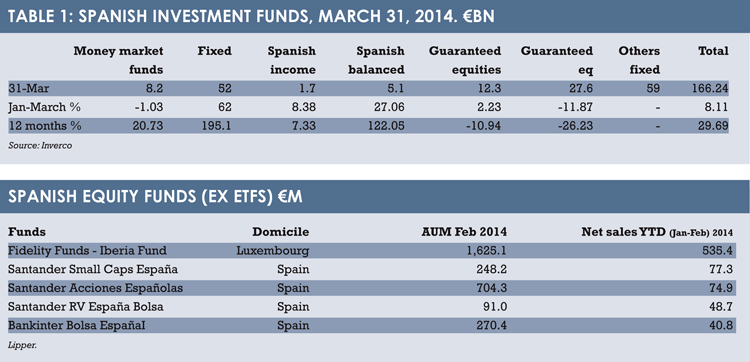

This year, flows into money market funds and guaranteed funds – hallmark products of the conservative investor mindset in Spain – are down (see table 1). Flows to fixed income – an already large segment – and equities are up.

Spanish equity funds have particularly spiked, up 122% over 12 months and 27% since the beginning of the year to €5.1 billion – a tiny number compared to national investments in places like the UK, but notable given the strong fixed income preference in Spain. In total, and including other investment routes, Spanish households own 25% of the stock market, which is capitalised at €462 billion.

Inverco also records increases to balanced funds, and along with AuM in fixed income funds (€51.8 billion), money market funds (€8.1 billion) and various other asset classes, such as guaranteed funds (€39.7 billion), the total assets of Spain’s funds industry at March 31 was €166.2 billion.

Going by the pre-crisis level of assets – €254.3 billion at December 2006 – there could be a further €88 billion in the offing. There is also €1.5 trillion sitting in Spanish deposits from households and institutions, and banks – hugely influential in fund flows – no longer feel compelled to keep households’ cash in savings accounts to fortify their balance sheets.

Spain was one of the hardest-hit countries in the financial crisis and continues to suffer high levels of unemployment – 26% in the first quarter.

Its funds industry was decimated as banks directed flows to bank accounts to prop up their regulatory capital.

Almost serving as a symbol for the troubles that link together its banking industry, funds industry, and its economy in general, was the part sale of Santander Asset Management, the largest domestic fund manager owned by the largest domestic bank and fund distributor, Banco Santander, in 2013. The bank wanted to strengthen its balance sheet, and many of its asset management assets were in troubled Spain.

But the bars in Madrid and Barcelona are said to be getting crowded again as the same optimism that propels investors also energises spenders.

“Capital requirements have been addressed and the interbank market is not so tense, so we have seen investors move from deposits to mutual funds again over the past 12-15 months,” says Juan Aznar Losada, director general of Mutuactivos, the fund management arm of Mutua Madrileña, a Spanish insurance company.

Jaime Perez-Maura, new business and corporate communications director at Allfunds Bank, one of the largest international fund platforms in the world and jointly owned by Banco Santander and Italy’s Intesa-Sanpaolo, says:

“There has been a dependency on capital at the banks, but I think that’s over.” Ongoing recapitalisation means banks are looking to increase profit margins with the sale of higher value products, he says.

Perez-Maura also points out that Spain and Italy have led the international sales of funds in Europe in recent years. “Macro factors do not necessarily determine business opportunity.”

At least one asset manager from outside Spain is noticing: Kames Capital, the UK-based manager owned by Aegon, an insurer based in the Netherlands.

Steve Kenny, the head of sales at Kames, is leading the fund manager’s Spanish push. “There’s a real renaissance in the Spanish market,” he says, adding that it is driven by the improvement in sentiment and the slashing of the overnight money market rates, which have fallen in some cases from 4% to 0.75%.

“The market was ticking up last year, but in Q1 this year the flows were phenomenal.”

But as foreign managers enter Spain, a number of domestic managers are starting, or continuing, to expand beyond it. Some are frustrated at a domestic distribution network they say is stacked against non-bank-owned Spanish managers.

There is also relatively little pension fund and other classic institutional business.

Yet their expansion also reflects the hardship that Spain has endured in recent years, with firms that have come through it now looking to diversify their client base.

ENOUGH QUALITY

Mutuactivos is one of the Spanish fund managers seeking international growth. It is the second largest non-bank affiliated operator in Spain with €3.6 billion, or 2.2%, of the market’s total €166 billion in AuM.

Of its AuM, the parent company accounts for 53%.

“We are migrating part of the portfolio to Luxembourg because we think we have more than enough quality to compete on an international basis,” says Losada.

Another fund manager to look internationally is March Gestión de Fondos, which is part of Grupo Banca March.

March Gestión started to internationalise its business in 2009 and pushes forward its flagship fund, the Torrenova total return fund, which invests in bonds and equities, targets a European CPI plus 2% return, and returned 6.28% last year.

Part of the reason why this boutique asset manager feels confident enough to expand is the financial stability of Banca Macha. It maintained stability during the financial crisis when confidence in European banks, particularly on the Iberian peninsula, was at a historic low.

“Our parent company has been ranked number one by solvency ratio and had core capital close to 30%,” says José Luis Jiménez, chief executive of the fund manager, referring to the 2011 solvency test involving 91 banks by the European Banking Authority.

“Even though we were Spanish, people looked at us differently and that’s a reason we expanded abroad,” adds Jiménez.

But a limited distribution opportunity at home is another reason for some fund managers to go asset raising elsewhere.

Jiménez goes further to say that it is almost impossible to sell financial products in Spain without the banking channel and, although Spain can be considered pretty open to foreign asset managers, it is “really, really tough” for non-bank-owned Spanish firms to get on to a domestic bank platform.

Each of the main bank platforms is run by banks that have financial interests in asset managers and these banks want to protect their asset managers, claims Jiménez, and so it is difficult to capture domestic market share from the likes of Santander Asset Management and BBVA Asset Management, which are owned by Banco Santander and BBVA, respectively. Both are major domestic distributors in retail, private banking and fund-of-fund sectors.

There is a huge concentration of assets among the three largest Spanish asset managers by AuM, which includes La Caixa, another Spanish bank. The restricted open architecture in the domestic market appears to be a widely accepted point.

Ricardo de los Ríos Romero, head of sales at BNP Paribas Investment Partners in Spain, says that outsourcing by a bank to a third-party manager is almost “non-existent” at the retail level, while at the private bank and funds-of-funds level, international managers are dominant.

A spokesman for Santander says the lack of value-added global products by local asset managers is partly to blame. But he adds that the market is changing.

“Up until now, the Spanish asset management industry is highly tied to commercial banking networks. Thus, the distribution of funds has been addressed mainly to retail clients, although the big local banks are multinational groups and have also a strong presence in institutional channels.

“Foreign players have benefited [from the] lack of value-added global products by local asset managers in the past. This is a trend that should moderate notably through the next years, especially when the omnibus accounts start to spread through the industry.”

SPURRING ACTIVITY

Omnibus accounts were recently introduced in Spain and their absence in the past points to another force at work against Spanish funds.

Spain-domiciled funds have always been just too difficult to buy when compared to those domiciled in cross-border centres, such as Luxembourg and Dublin and run mainly by international managers.

This may even partly explain why Fidelity, a US manager, has the largest single Spanish equities fund in the world (based in Luxembourg – see table 2) rather than Santander Asset Management, which comes second, though has more Spanish equity funds and more Spanish assets in aggregate (but domiciled in Spain).

Perez-Maura at Allfunds maintains that the administration involved in buying a fund domiciled in Spain from an intermediary is a burden that makes Spanish funds a less accessible option.

By allowing omnibus accounts, the regulator in Spain – the Comisión Nacional del Mercado de Valores – is making it possible for Spanish funds marketed in Spain and abroad to only have to record the distributor’s name rather than all underlying clients on the shareholder record.

It is one of two important developments that could spur greater activity in the domestic funds industry.

The other is that fund investors can now take advantage of the traspaso rule, meaning they can switch between funds without incurring capital gains tax.

These two changes, coupled with the emerging positive sentiment, are what attract asset managers, particularly for fixed income, where the opportunity in Spain mainly lies.

Kames entered the Spanish market in September 2013 and qualified to become traspable. The fund firm decided to enter the market after colleagues at Aegon Spain reported a large change in sentiment in January and February last year.

“Spain is desperate for income, therefore high yield funds are going down well,” says Kenny. He points out that M&G and Pimco, both known for their fixed income specialisms, sold well in Spain last year. “The best selling funds last year were fixed income, and that suits us.”

He adds: “The Spaniards are very interested in low risk and so absolute return has become popular. We are just getting an absolute return bond fund registered.”

He says Kames is also considering registering its global equity income fund in Spain.

Romero at BNP Paribas Investment Partners says: “Today, the main challenge for Spanish investors is how to deal with fixed income in a rising interest rate environment.” The majority of BNP Paribas’ €2.01 billion assets in Spain are fixed income.

Perez-Maura at Allfunds says people were burnt by the bursting of the internet bubble, which is why there is such an overweight allocation to fixed income and other conservative products. High yields on Spanish treasuries only reinforced this allocation.

Beltran Parages Revertera, head of investor relations and business development at Bestinver Gestion, an asset manager with €9.8 billion of AuM, says that there is now more appreciation of diversification in portfolios, which is causing a growth in multi-asset funds.

“The Spanish investor has gained confidence in Spain and has moved from non-equity into balanced and equity,” he says.

However, he adds that the level of financial knowledge in Spain is low and that it is important to get across to Spaniards that though equities are volatile, they will usually pay in the longer term.

“We have one of the lowest financial knowledge bases in Europe. It’s down to the welfare state, which had been so protective that people have not had to think about their pensions.”

But he adds: “I think it’s changing. The next generation will be more pro-equity.”

©2014 funds europe