We asked six investment professionals about the emphasis they are placing on smart beta and active ETFs and how platforms are adopting these products.

Arnaud Llinas (head of ETFs and indexing, Lyxor Asset Management)

Aniket Das (investment strategist, Legal & General Investment Management)

Howie Li (co-head of CANVAS, ETF Securities)

Yazann Romahi (CIO of quantitative beta, JP Morgan Asset Management)

Manuela Sperandeo (iShares head of specialist sales EMEA, BlackRock)

ARNAUD LLINAS LYXOR ASSET MANAGEMENT

Smart beta has to be a major part of successful investment firms’ thinking. The popularity of smart beta among investors cannot be disputed.

More than €2.5bn of new assets have been allocated to such ETFs in the first quarter of this year, and last year equity smart beta assets (€6.8bn) made up nearly 40% of all equity new assets (€17.5bn), showing this is no passing or overhyped fad.

The case for smart beta is made even more compelling when its performance is compared against that of more traditional approaches which have struggled to meet investor objectives.

Our own research shows that minimum variance benchmarks outperformed 89% of active managers in our US, Europe and Japan universes in 2016, further strengthening the case for smart beta in investment portfolios.

Given its performance and popularity, smart beta will play a major role in the future plans of product providers.

Future developments will inevitably be determined by the industry’s largest players. In the European ETF market, for example, the top five largest providers represent nearly 80% of smart beta assets and so are able to exercise significant influence over the future direction of travel.

Lyxor, for example, has two of the top five fastest gathering ETFs this year with its global value and quality income ETFs.

Innovation will also be crucial to success, with providers needing to differentiate themselves within an increasingly crowded space. Lyxor will be launching a number of new ETFs to complete the range of quality income products they offer.

Ultimately, though, we believe strongly that those providers able to offer a broad range of solutions, both ‘plain vanilla’ funds and more specialist, niche strategies, within a ‘one-stop-shop’ framework, are those most likely to be successful as the market continues to expand.

ANIKET DAS, LEGAL & GENERAL INVESTMENT MANAGEMENT

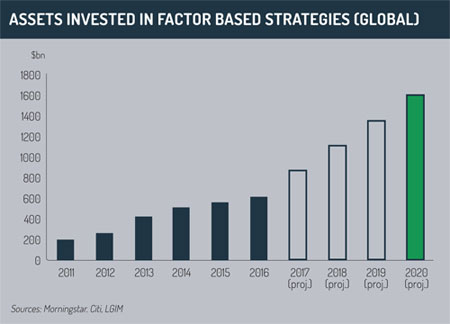

Factor-based investing has seen strong growth since the financial crisis (see graph overleaf) but that has been aided by tailwinds, including investors seeking to reduce costs and governance burden by moving from traditional active managers. Similarly, investors currently invested in market-cap weighted indices (‘traditional passive’) have also been considering factor-based investing as a way of improving outcomes such as increasing returns, reducing risk, improving diversification or generating income. This speaks to the different objectives factor-based investing can help to achieve.

We are experiencing increasing demand for multi-factor indices as clients look to diversify their factor exposures, much as they diversify their asset class exposures. In addition, many clients are increasingly attracted to those propositions which consider diversified stock-weighting schemes, as concentration in market-cap weighted indices is often seen as one of its key weaknesses.

Finally, at the cutting edge, we have had clients invest in multi-factor indices, which incorporate overlays to mitigate the risks presented by climate change.

ESG integration is a fast-growing segment of the index marketplace which we are seeing significant interest in. The growing breadth of product offers investors a very large variety of choices, though it also leads to greater complexity. Due diligence must be performed on factor-based strategies. While they may often carry similar names, not all indices are created equal.

Meanwhile, education and understanding of the strengths and weaknesses of different strategies are crucial if investors are to avoid outcomes that may ultimately disappoint them.

HOWIE LI ETF SECURITIES

The aim of smart beta is usually to improve risk-adjusted returns whilst retaining the lower costs typically associated with passive investment products. Over the next few years, investors will be provided with far greater choice, as asset managers (in both mutual funds and ETFs) seek to bridge the gap between passive and active management to address the need for an optimal blend between added value and lower costs.

However, it’s important to understand how smart beta fits within that context. There has been a great deal of focus on smart beta products, as they’re generally priced less than actively managed investments. Much like an active fund, smart beta products have also been designed to add some sort of value.

There seems little doubt that the active-passive debate will continue for the foreseeable future.

What we’re seeing in the market are lower-cost products for investors which can only be a good thing.

Smart beta gives investors the ability to generate something on top of market cap returns but it requires an understanding of how these tools should be used.

There will always be active managers who can deliver additional returns but investors must do their due diligence and check that the investment process can deliver value to justify the additional fees.

Market-cap investing also has a place if investors simply want market exposure.

Therefore the merits of an active, passive or smart beta strategy within a specific portfolio must be carefully weighted by advisers with clear grounds for choosing one over another.

It is likely that a portfolio will have a blend of each, and each strategy will continue to have a place in an intelligently diversified portfolio that delivers their clients the best value.

YAZANN ROMAHI JP MORGAN ASSET MANAGEMENT

There a number of reasons behind European investors’ steady embrace of passive investment strategies in the last few years, including gaining efficiencies via lower costs market exposures and greater emphasis on transparency.

At JP Morgan Asset Management, we’re bringing to bear our expertise in active investing whilst listening to clients’ growing interest in incorporating passive propositions and adapting accordingly.

This has particularly been the case in the smart beta category, where we can combine active insights in the identification and implementation of factor-based investing and the creation of more optimal indexes, offered in systematic, lower-cost vehicles.

Smart beta investing is fundamentally about trying to redefine the index. It’s about understanding the drawbacks of the market-cap weighted index, such as concentration risk in individual stocks.

Smart beta investing is fundamentally about trying to redefine the index. It’s about understanding the drawbacks of the market-cap weighted index, such as concentration risk in individual stocks.

In the S&P 500, the top 50 stocks account for half of the risk of the index. The top 150 stocks account for three-quarters of the risk of the index. Investors may think they are well diversified, but in fact stock-specific risk is quite concentrated. If we think about the point of having an index, it’s to provide investors with diversified risk and little idiosyncratic exposure. In other words, the ability to capture the market premium without taking big single stock bets. Unfortunately, market cap-weighted benchmarks are limited in their ability to do this. Indeed, at times, market cap-weighted indices can have very concentrated risk, not just in single stocks, but also in single sectors.

Research done as early as the 1950s helped investors understand the notion of risk premia and, by extension, indexation. So while investors have recognised and appreciated the benefits of indexation, such as diversification and transparency, they’ve more recently begun to see the biases inherent in market-cap weighted indexes.

For example, a market-cap weighted index is simply shares outstanding by price and therefore will over-weight overvalued securities and under-weight undervalued securities by definition.

So smart beta is about keeping the best features of indexation but applying what we now know about factor investing to get rules-based market exposure more efficiently.

With smart beta, when we think about redefining the index, we look at it in two dimensions. There’s the risk dimension as well as the return dimension, which involves building in the factor premiums, whether they be value, momentum, size, growth, etc. Interestingly with regards to the growth in smart beta, traditionally investors focused on the risk dimension.

It’s only more recently that much of the talk has shifted to the return dimension with the burgeoning understanding that there are many sources of market return beyond just market growth.

If we take a step back and think about the evolution in our conceptualisation of beta, our understanding has gone from the idea that beta was all about market growth to the ability to build indexes around identifiable factors like small-cap bias or value to achieve a given exposure.

It’s that refinement in the understanding of the sources of market returns that has given rise to much of the smart beta product innovation.

The smart beta industry discussion is today focused on how providers can build efficient indexes whilst at the same time building in all of the desirable factors to drive returns. So having both the risk dimension and the return dimension addressed is an important development. Achieving maximum diversification in the index provides a smoother ride with greater upside capture and better downside protection.

MANUELA SPERANDEO BLACKROCK

Smart beta is a major growth area for the investment industry. Last year was a bumper year for asset gathering, and 165 smart beta exchange-traded products were launched. Assets in smart beta stand at over $363 billion (€323 billion). Investors are using smart beta strategies alongside active and index funds as they seek to improve returns, reduce volatility and increase diversification. We do not believe smart beta is the latest fad. We expect global assets in smart beta strategies to reach $1 trillion by 2020.

Historically, institutional investors and active fund managers have targeted specific factors, but through smart beta strategies, these sources of return are being democratised for all types of investors. For example, favouring stocks with historically lower risk through minimum volatility strategies, and companies that are underpriced relative to fundamentals through value investing.

The future growth of strategies is dependent on a variety of factors. Like standard market cap-weighted ETFs, accessing smart beta strategies is one of the biggest hurdles for retail investors. Not enough platforms have the infrastructure in place so that clients can access ETFs. This lack of choice is prohibiting ETFs, including smart beta funds, from reaching their growth potential. As this is a relatively new area for some, education remains an important component of our work.

Finally, product innovation – particularly in asset classes such as fixed income, where the offering of smart beta ETFs is still very limited – will likely spur further asset growth.

©2017 funds europe