Deutsche Asset & Wealth Management is combining elements of market capitalisation-weighted bond indices with the latest strategic beta thinking.

Investors tend to think of strategic beta as standing in direct contradiction to market-cap weighted indices. Deutsche

AWM is combining sensible aspects of both worlds, starting with acknowledging that traditional benchmarks in the sovereign bond world do have their strong points.

For a start, they reflect the underlying performance of the securities they hold in a way similar to how equity indices reflect stock returns, and this leads to fewer rebalancings, as the weights of securities vary with their performance.

“This causes considerably lower turnover-related costs than most other approaches”, says Olivier Souliac, director, passive asset management, at Deutsche Asset & Wealth Management (Deutsche AWM).

Deutsche AWM is looking to harness the advantages of traditional sovereign bond benchmarks, while working them into a strategic beta framework to increase the risk-return profile of bond portfolios.

The firm is in the process of launching Deutsche.4C, a strategic beta approach to fixed income rooted in market-cap indices.

Deutsche.4C’s approach to investing in sovereign bonds has a quality assessment at its core, and Deutsche AWM uses this to reconstruct a market-cap index in a way that offers diversification gains while keeping historically similar duration exposure. However, the underlying portfolio of sovereign bonds should remain conservatively invested.

“Market-cap weighted sovereign bond indices are very efficient,” says Souliac. “Country weightings are tilted towards those with higher amounts of bonds outstanding, meaning that being able to buy more bonds when the need arises should generally not be a problem. The indices are liquidity-friendly.”

But the problem with cap-weighted indices being tilted towards countries with higher levels of debt is that portfolios can drift towards holding large amounts of bonds from poorer-quality issuers.

“The drift is the tendency for indices to invest more in countries with larger debt issues compared to the size of their economy,” such as Japan, where debt-to-GDP is more than 240%1. The weight of Japan in such indices is comparable with that of the US, even though Japan has a much smaller economy. “There is a clear overweight of Japan just because it issues more debt,” says Souliac.

“You may think it’s good to invest in countries with more debt if they are rewarding investors with higher yields, but this is not necessarily the case. Japan and France are examples where there is no clear relationship between fundamental quality and yield.”

Getting around the drawback of this natural propensity of market-cap indices to concentrate on countries with more debt issues is where the quality assessment comes into play.

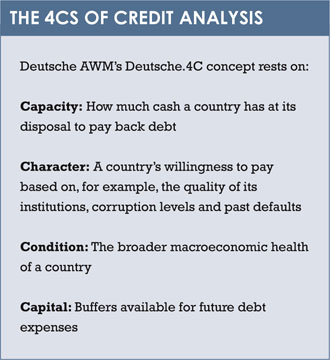

The quality analysis follows the mantra of four ‘Cs’: Capacity, Character, Condition, and Capital.

The ‘Cs’ are used to identify the highest-quality countries. For example, ‘Character’ refers to a country’s willingness to pay its debts and takes account of, among others, any past defaults (see box).

With this done, the next piece of the process is mathematical. The country with the lowest quality assessment is removed, while the highest-weighted country in the reconstructed index is multiplied by two. The weighting of the countries with an average quality score remains roughly the same, but others can see their weightings change between the defined boundaries, depending on where they are on the quality scale.

“It is a rescaling that takes liquidity into account. A country with high quality will remain small in the index if it does not issue a lot of debt and is not, therefore, very liquid. This is the good thing about market-cap indices – they orientate towards liquidity.”

A result of the newly constructed index will normally be a lower yield – this is normal, Souliac says, as higher-quality countries normally pay lower yields.

“The idea, in performance terms, is that by combining the advantages of a market-cap index with the advantages of a quality focus, we are reaching the same level of performance as market-cap benchmarks but with materially reduced risk.”

He further explains that lower yield does not necessarily equate to lower performance. For example, potential losses caused by portfolio switches necessitated by country downgrades can be reduced under the Deutsche.4C approach as this approach will naturally tend to underweight such countries. This can help compensate for the exposure to lower yield in the long term.

He further explains that lower yield does not necessarily equate to lower performance. For example, potential losses caused by portfolio switches necessitated by country downgrades can be reduced under the Deutsche.4C approach as this approach will naturally tend to underweight such countries. This can help compensate for the exposure to lower yield in the long term.

“We do have a lower yield – but this does not mean we have a lower return. If you just focus on yield, like in emerging market bonds, you may be disappointed. For example, five years ago Venezuela was paying 15%, but five years on, the returns have not been five times 15%. There has instead been a 10%loss2 over the same period.

“The yield crystallises better if the focus is on quality.”

Souliac adds: “We are making the case that lower yield doesn’t necessarily mean lower return, and that quality may be your friend. For example, investing in Japan will lock in a lower yield and get you a lower performance because Japan has a poor quality level.

“What we say is, investing in quality can help better crystallise yields in the long run, and therefore reach a very similar performance as the market-cap benchmark while being more conservatively invested.”

Driving the innovation in sovereign bond index investment is the fact that investors no longer consider sovereign bonds of advanced economies as risk-free. The experience of the Eurozone back in 2010-2011 ended that notion. “Sovereign bonds are no longer perceived as being riskless. Instead, people recognise they carry an element of credit risk,” says Souliac.

Last year Deutsche AWM worked on criteria for the quality assessment. Souliac says that different institutions will have differing views about what constitutes quality, but this does not necessarily matter as long as the criteria used are transparent, agnostic and sensible.

“As long as the most fundamentally relevant factors are taken into account, we can expect a reasonable degree of risk reduction to be delivered by quality focused strategies.

But for us, combining this approach with the efficiency of a benchmark index approach is key to delivering a better risk-return profile.”

Summing up the objective of Deutsche.4C, he says: “We are not completely revamping the benchmark. If we did, we would lose out from certain positive aspects of it. We are looking at creating a new benchmark which is focused on quality, obtains a similar performance to market-cap, but has a more conservative risk profile and less correlation with equities. We believe this new tool could serve our clients in achieving a more efficient portfolio allocation.”

Olivier Souliac is director, passive asset management, at Deutsche Asset & Wealth Management

¹Source IMF, end of 2014 estimates as of April 2015

²JP Morgan Chase & Co., Venezuela USD bond maturing 2020, as of 30.4.2015.

© Deutsche Bank AG 2015. Deutsche Asset & Wealth Management is the brand name for the asset and wealth management arm of Deutsche Bank AG.

This article has been prepared solely for information purposes and does not constitute an offer or a recommendation to enter into any transaction. The information was not produced, reviewed or edited by the Research Department. When making an investment decision, you should rely solely on the final documentation relating to the transaction and not the summary contained herein . The strategy mentioned herein may not be appropriate for all investors and before entering into any transaction you should take steps to ensure that you fully understand the transaction and have made an independent assessment of the appropriateness of the transaction in the light of your own objectives and circumstances, including the possible risks and benefits of entering into such transaction. You should also consider seeking advice from your own advisers in making this assessment. If you decide to enter into a transaction with DB, you do so in reliance on your own judgment.

This article has been issued and approved by Deutsche Bank AG London Branch. Deutsche Bank AG is authorised under German Banking Law (competent authority: European Central Bank) and, in the United Kingdom, by the Prudential Regulation Authority. It is subject to supervision by the European Central Bank and by BaFin, Germany’s Federal Financial Supervisory Authority, and is subject to limited regulation in the United Kingdom by the Prudential Regulation Authority and Financial Conduct Authority. Deutsche Bank AG is a joint stock corporation with limited liability incorporated in the Federal Republic of Germany, Local Court of Frankfurt am Main, HRB No. 30 000; Branch Registration in England and Wales BR000005 and Registered Address: Winchester House, 1 Great Winchester Street, London EC2N 2DB. This document is a “non-retail communication” within the meaning of the FCA’s Rules and is directed only at persons satisfying the FCA’s client categorisation criteria for an eligible counterparty or a professional client. This document is not intended for and should not be relied upon by a retail client.

©2015 funds europe