The shipping industry has crashed big, with analysts predicting the bottom has yet to be reached. There are certainly bargains to be had, finds Angele Spiteri Paris

Like many other investors, fund managers in the sector are trying to identify the bottom of the market – never has talk of peaks and troughs been so appropriate.

In 2007 the global maritime industry generated a total revenue of $583bn (€412.7bn). The market was still buoyant in May 2008 when fund managers could make over $250,000 a day chartering out ships to exporters.

But valuations have dropped dramatically since September last year in line with the economic slowdown and managers are now on the hunt for bargains.

“‘Capesize’ bulk carriers were trading on a daily basis at less than 2% of what they had been trading in May of 2008,” says Tim Coffin, investment manager at M2M Management. Capesize ships are cargo ships originally too large to transit the Panama Canal and therefore they must round the Cape of Good Hope or Cape Horn to travel between the Atlantic and Pacific oceans.

Coffin continues: “In May 2008 they were trading for over a quarter of million dollars a day. In December they were trading for less than $2,500 a day. The value of the actual ships has crashed as well, since vessel values are linked to the income they are generating.”

The crash in prices is definitely connected to the global recession, but a major cause of the fall is an imbalance between supply and demand.

“When discussing the investment case for shipping you have to understand just how sensitive to supply and demand the shipping market is,” says John Luke, global head of shipping, KPMG.

The $250,000-a-day cost to charter a Capesize ship in the middle of last year may not have been sensible or sustainable, but people were still deciding to invest and ship yards were still taking orders for new ships.

Luke says: “They were not assuming they were going to get $250,000 a day for the rest of the ship’s life, but they were certainly assuming that some demand was there.”

Now, however, due to a lag in building orders, there is potentially a huge wave of oversupply in the shipping market, which could severely lengthen the downside for the sector.

But there are signs of measures to rebalance supply and demand in the sector and to therefore avoid freight markets having to suffer longer than they need to.

In the boom markets old ships kept trading because shipping companies were making enough money to justify higher operating costs but the situation has now changed.

Coffin, of M2M Management, says: “We’re seeing a lot more scrapping now than we were last year. The older portion of the fleet is being scrapped. Also a lot of orders for new ships are being cancelled or delayed.

“So the spike of new building deliveries that we expected in 2009 and 2010 is very rapidly flattening out.”

As a result of these changes in the market, Coffin says the likelihood of prolonged, severely low freight rates is reduced. Rather than looking at a four-year down market cycle, some analysts are cutting the length of the downmarket by up to half, he adds.

As a result of these changes in the market, Coffin says the likelihood of prolonged, severely low freight rates is reduced. Rather than looking at a four-year down market cycle, some analysts are cutting the length of the downmarket by up to half, he adds.

Although the prognosis is therefore not as bad as it could be, several industry observers believe the shipping market has not yet bottomed out.

Pierre Aury, CIO at Clarksons, a shipping fund manager, says: “If you go by historical standards there is the potential for the valuations of ships to probably go down further. Opinion is divided, some people think so, others don’t, so we have to be modest in our approach.”

Aury says that even though the market may drop further, investing in maritime now is still a better opportunity than a year ago. “You can buy a ship at, say, $52m when it was worth $140m a year ago. Although there could be people buying at $50m or less later on, now it still costs practically a $100m less than it did a year before.”

According to Aury, much depends on China.

Sweet and sour

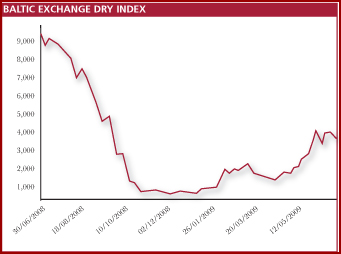

The country has been importing record levels of iron ore in the last few months and this boosted freight rates and vessel valuations. The Baltic Dry Index, which tracks the prices of worldwide dry shipping cargoes like iron ore and wheat, had risen by 244% at the end of May since the beginning of the year.

But this is no reason to think the crash in shipping markets is over. Coffin says: “Our view is that this is not sustainable. Both Chinese steel demand and other forward indicators suggest softening demand for freight capacity towards the end of the year and into 2010 at least. We remain bearish on nearly all sectors.”

Luke, of KPMG says: “The recent fortunes of the dry bulk sector reinforce the link between China’s demand for, and sourcing of, coal and ore. It highlights how vulnerable owners currently are to volatile demand-side forces that are substantially outside of their control.”

Luke says the surge in demand might lead to a delay in the rebalancing of supply and demand factors. “It has always been thus for ship owners, investors, and farmers: make hay while the sun shines,” he says.

So, although the general consensus appears to suggest that shipping markets are not out of the squall yet, volatility has remained intact, meaning returns can still be made through arbitrage.

Volatility

Aury, at Clarksons, says: “The market dropped like a stone, then it bounced back, began falling again and is now back up. This means that the ability for a manager to extract money from the shipping market is completely intact. We’ve still got 100% volatility today as we had a year ago.”

Managers in the sector therefore still have the same potential to make money, in spite of the drop in the market. However, this is only good news to more short-term, speculative investors.

Those who have a longer-term horizon may have to sit tight if they want to find an inroad at the bottom of the market.

©2009 funds europe