CAMRADATA’s Diversified Growth Funds (DGF) investment research report for Q2 2019, which charts the performance of investments and asset managers across the DGF universe, revealed money continues to flow out of this universe.

There is a familiar tenor to 2019’s second-quarter DGF investment review, with weakening economic data, US-China trade tensions, China’s economic slowdown and Brexit-induced uncertainties in Europe all contributing to a cautious risk outlook for global investors.

This has been partially offset by expectations of looser monetary policy during the second half of 2019. This provided a fillip for risk assets during Q2, helping the MSCI World Index to rise 4% in US dollar terms and providing a stimulus for corporate bond and high-yield markets. However, the mid-term outlook is uncertain, with some commentators pointing to yield curve inversion in US government bond markets as a harbinger of darker economic times.

With yields for ten-year US Treasury bonds slipping below the three-month Treasury bill rate during May, this is commonly held to be an indicator that the economy is in ‘late cycle’, a phase of the economic cycle that typically precedes a downturn.

But after an extended period of quantitative easing, we cannot be sure how reliable an indicator of recession this will prove in current monetary conditions.

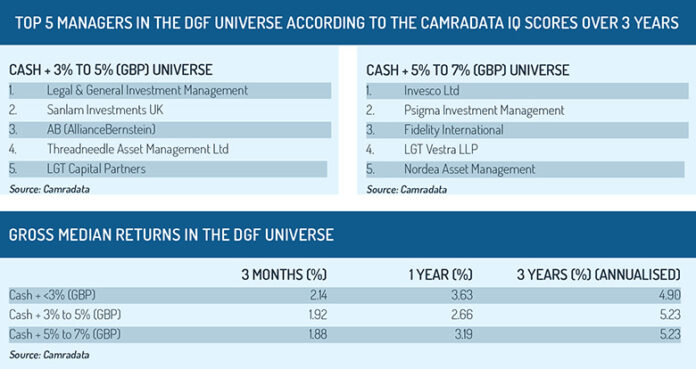

The second quarter of 2019 provided further evidence of performance recovery for products in the DGF universe, with 92% achieving a breakeven or positive return. This was after 98% of products in the universe achived a breakeven or positive return in Q1 2019, representing a healthy bounce back from a tough Q4, when just 2% of vehicles achieved a breakeven or positive return.

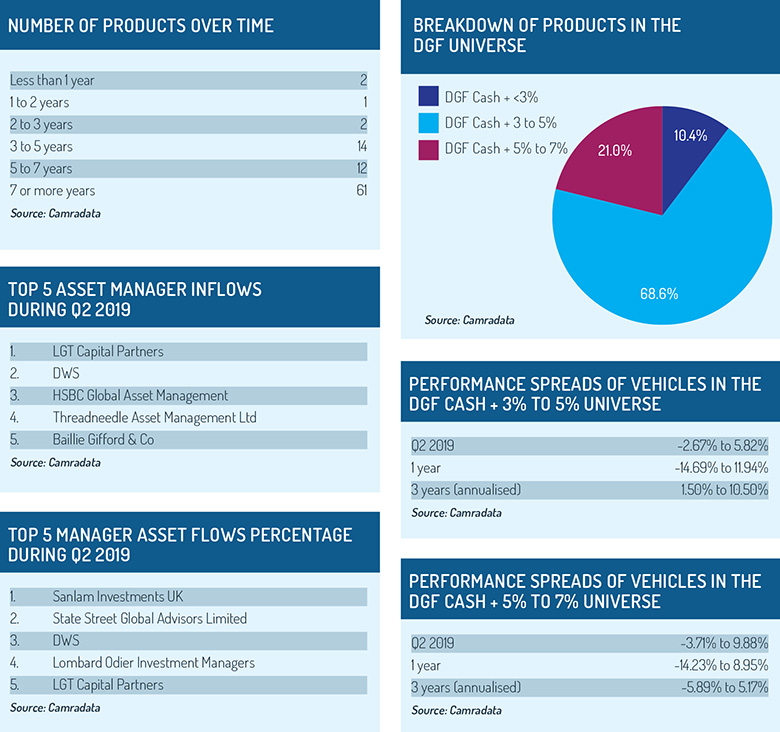

However, investors were again reluctant to commit new money flows to the DGF segment. The sector experienced net outflows of £5.84 billion over the period, the seventh consecutive quarter in which the universe has seen net redemptions.

Against this background of net disinvestment, several asset managers in the CAMRADATA DGF universe did report a successful quarter for asset gathering, with LGT Capital Partners leading the way (+£406 million in net asset inflows).

On an annualised basis, net investor outflows of £20 billion over the year to June 30, 2019 have contributed to a decline in AuM of just under £14 billion across the DGF universe. DGF AuM now sits £23.2 billion below its peak at the end of 2017.

To read more of our DGF investment research report or to carry out manager research across over 250 different asset classes please log in to CAMRADATA Live at www.camradata.com.

©2019 funds europe