Investor interest in European equities has been growing rapidly in recent months. ETFs can be an excellent way to gain cost-effective exposure to the return potential of the European stock markets.

It’s been a very good start to the year for the European economy. Its recovery is strengthening, with employment and consumption figures improving and sentiment at its highest level since 2011. Meanwhile, monetary conditions remain accommodative.

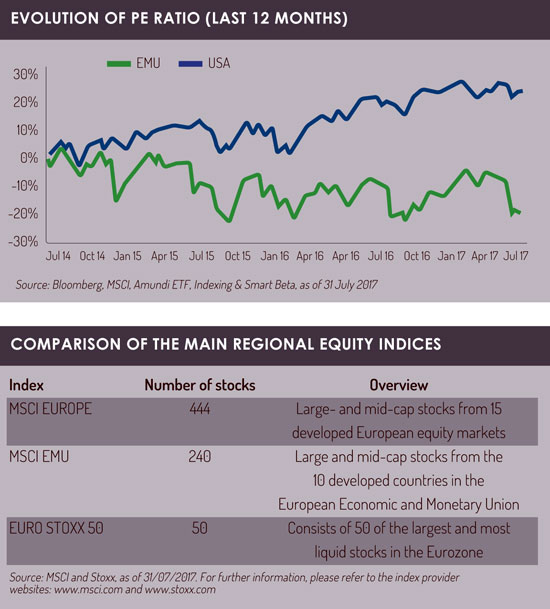

European equity valuations look attractive, especially compared with those of US stocks. While the P/E ratio of the US stock market has risen by 22% over the past three years, that of the MSCI EMU index has fallen by over 20%1. In our view there is a strong chance that this gap could shrink over the coming months due to rising corporate profits, which should lead to a reduction of this differential.

Strong inflows into European equity ETFs

After a mass exodus from European equity ETFs for much of last year, investors’ shift towards the asset class in recent months is an indicator of the general rising demand.

ETFs are an efficient tool with which to capitalise on the return potential currently provided by the European stock markets. Not only are they a low-cost option that can be traded in minutes, the sheer range of ETFs available means there is a huge variety of ways to exploit European equities’ return potential. In short, they enable investors to achieve the allocation that is right for their needs.

Taking broad exposure to the European markets

The most obvious way to gain exposure to European equities is to buy an ETF tracking a major European equity index. This is a straightforward way of gaining exposure to more than 400 stocks from the entire region in one simple, low-cost transaction.

However, there is still lots of choice available to investors when they are buying a broad European equity ETF as there can be considerable differences between the indices that they track. For example, there are ETFs covering the whole of Europe (including the emerging markets to the east of the continent) or just the developed countries of western Europe. Meanwhile, a continental European or eurozone equity ETF may appeal to investors looking to avoid investing in the UK ahead of Brexit.

Exploiting geographical opportunities

Rather than just taking broad exposure to the market, many investors wish to fine-tune their allocation. One way to do so is by adjusting their geographic exposures, which is simple to achieve using ETFs in a building-block approach.

For example, an investor might think that France has particularly high potential after the outcome of the presidential election. If they want to take an overweight position in France they could buy an ETF tracking French equities in addition to their broad European equity ETF.

ETFs also enable investors to exclude a certain country from their investment universe, either because they already have exposure to it as part of their domestic equity allocation or because they believe it has poor return potential.

For example, a Swiss portfolio manager with a significant allocation to Swiss equities looking to take exposure to European equities could do so through an ETF exposed to the MSCI Europe index. But as Switzerland accounts for close to 13% of this index, doing so would add an extra layer of Swiss equity exposure.

An alternative would be to invest in an ETF exposed to a Europe ex-Switzerland index such as the MSCI Europe ex-Switzerland. This would provide the investor with the full benefits of diversification from investing in European equities without increasing their exposure to their domestic equities.

Taking a sector-based approach

Another option for investors is to fine-tune their asset allocation not by breaking it down at the country level, but by taking exposures on a sector basis with the aim of exploiting opportunities presented by the business cycle.

For example, the European economy is currently recovering, and in past recovery phases cyclical sectors such as industrials and consumer discretionary have tended to outperform. At a later stage of the cycle, more defensive sectors have historically tended to do better. There are lots of ETFs available providing discrete exposure to the various sectors within the European equity universe, enabling investors to quickly exploit sector opportunities as they arise.

Smart Beta ETFs

Financial research has shown that asset class returns are in part determined by a number of the risk-return properties or ‘factors’ – such as size, momentum, low volatility, dividend, value or quality – that those assets involve. What’s more, several academic studies have shown that factor-based, or ‘smart beta’, investment approaches have the ability to outperform market-cap indices over the long term. All this has led an increasing number of investors to adopt a factor-based approach to their allocations over recent years.

Single-factor ETFs are an efficient tool with which to capture equity risk premia and there is a wide variety of European equity ETFs tracking factor indices.

For investors who wish to take a more strategic approach to factor investing, there are European equity ETFs providing exposure to multiple factors, all of which have return potential to outperform over the long term. An additional characteristic of such an approach is the extra diversification that multi-factor ETFs provide. Multi-factor ETFs can also produce an asymmetric return profile by reducing their participation in market downturns while maximising their participation in good periods for the markets.

Using ETFs to capitalise on opportunities throughout the European stock markets

ETFs are a popular way of harnessing European equities’ return potential. Thanks to the sheer variety on offer, there is a European equity ETF for everyone: as well as enabling investors to take broad-based exposure to the European market, they make it easy to exploit geographic, sector and factor-based opportunities. This means investors can fine-tune their allocations from whatever angle they think has the highest potential at any given time.

What’s more, these ETFs are available at a very modest cost and can be traded in minutes, enabling investors to easily adjust their exposures if they believe that conditions are changing. This flexibility and cost-effectiveness is making ETFs an increasingly popular choice.

1 – Source: Bloomberg, Amundi ETF, Indexing & Smart Beta, July 2017

For Professional Investors Only. Not to be relied upon by retail investors. This document is not intended for citizens or residents of the United States of America or to any “U.S. Person”, as this term is defined in SEC Regulation S under the U.S. Securities Act of 1933. The “US Person” definition is provided in the legal mentions of our website www.amundi.com.

Promotional and non-contractual information should not be regarded as an investment advice or investment recommendation, a solicitation of an investment an offer or a purchase.

Past performance is not a reliable indicator for future results. Transaction costs and commissions may occur when trading ETFs.

The exactness, exhaustiveness or relevance of the information, the prevision and analysis provided is not guaranteed. It is based on sources considered as reliable and may change without prior notice. It is inevitably partial, provided based on market data stated at a particular moment and is subject to change without prior notice.

Amundi ETF funds are neither sponsored, approved nor sold by the index providers. The index providers do not make any declaration as to the suitability of any investment. A full description of the indices is available from the providers.

Information not to be construed as investment advice or recommendation. Criteria, subscription, conditions and legal documentation available at www.amundi.com. Financial promotion issued in the UK by Amundi Asset Management, with a share capital of EUR 746 262 615 and Registered office at : 90 boulevard Pasteur 75015 Paris France – 437 574 452 RCS Paris – which is authorised by the AMF under number GP04000036 and subject to limited regulation by the Financial Conduct Authority for the conduct of investment business in the UK under number 401883 with registered office at 41 Lothbury, London EC2R 7HF.

©2017 funds europe