Complexity is one potential difficulty with alternative credit, a newer type of asset class that is more popular in a low-yield environment. Gabriella Kindert of NN Investment Partners discusses how investors can mitigate these risks.

Due to quantitative easing, the prices of publicly traded assets and yields have dropped significantly. As a result, institutional investors are increasing turning to a relatively new but growing sector known as alternative credit.

As with any new sector, it comes with its challenges: assessing the universe of products, their potential risk-adjusted return and the complexity of the underlying assets. Further, every credit product has its degree of downside potential, and the reliability of cash flows change over time.

Are institutional investors ready to handle the challenges associated with alternative credit? Let’s discuss a few of these challenges and suggestions about how to tackle them.

To start with, before investors can assess the potential risk-adjusted returns of an asset, they need to understand its complexity. Many factors contribute to the complex nature of alternative credit products: geography, regulatory framework, political risk and economic considerations.

There is also an overall lack of transparency in private asset classes. It’s hard to obtain independent information to justify return expectations, default and recovery statistics in this sector. Most investment decisions are based on asymmetric information, especially in private asset classes where ratings are not widely available and information is neither broadly accessible nor comparable.

Managers turn to several dimensions in order to add to the return, but these could also lead to increased risks:

- Moving to riskier regions (‘west to east’)

- Moving to more aggressive financing structures (‘lower credit quality’)

- Moving down in the capital structure (‘from more secured to less secured’)

- Including leverage in the investment vehicle (‘add to complexity of the investment structure’)

To mitigate the challenge of information asymmetry and enable comparison of apples to apples, investors need to develop a strong understanding of risk dimensions; create a comparable framework of investment proposals; and ensure there is a strong alignment of interest between investment managers and the investors before pursuing an investment in this sector. Unlike equity products, investors have mostly limited upside potential with alternative credit products, so mitigating the downside potential is crucial.

A whole new world

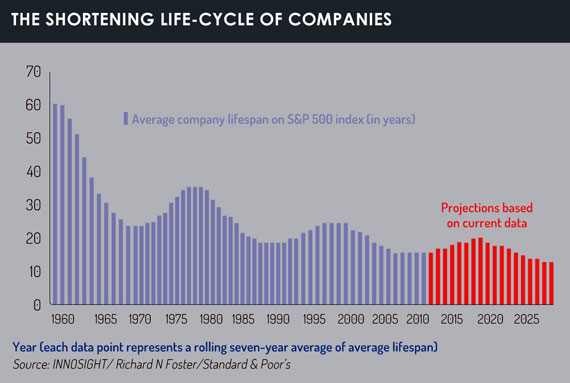

We now live in a world where the reliability of future cash flow projections, models and valuation techniques are less certain than before. Product life-cycles are becoming shorter and a company’s life-cycle might be different than before (see chart). Competition is emerging from unlikely industries and companies. This impacts the stability of a company’s cash flow generation capability, capital expenditure needs and access to liquidity. The cash flow of loans can change over time and are not always reliable. What was ‘long-term’ 50 years is more like ‘medium-term’ today.

To mitigate the risk of product and company obsolescence, investors should consider the following factors.

- First, invest in shorter-term loans, potentially in self-liquidating assets types (financing shorter-term assets, e.g. account receivables).

- Also focus on strong alignment factors and checks and balances; ensure that equity investors and management maintain significant investment interest and ‘skin in the game’.

- At the initial closing of the deal, include clauses dealing with higher uncertainty, such as automatic cure mechanisms in case of credit problems.

- Perform due diligence on management, with special focus of their ability to manage changes and ensure agile approach.

- Also, investors could demand independent industry analysis to mitigate bias received from the company. They may become biased about lending out money without considering, for example, emerging new competitors outside their industry.

- Carefully assess the dynamics of the investor base, assess their financial flexibility and alignment to support the company in vastly changing times (ask if they are they agile or rigid).

- Assess the ability, diversity and depth of experience of the supervisory board, non-executive directors and/or independent advisers to provide guidance and redirect the management on their initial path.

- Last but not least, investors should assess to what extent companies have access to committed liquidity lines. Not everything can be predicted or anticipated in advance or in a crisis; the difference between a good or fatal outcome can be access to liquidity. It is important that investors do a liquidity analysis by taking higher uncertainty factors into account, both in terms of liquidity required (amount) and the available time to obtain it. In the previous cycle, we have seen several perfectly healthy companies defaulting due to a paralysed lender’s group.

Importance of ESG factors

The world 2017 has zero tolerance for reputation and integrity risk. Since alternative credit investments are mostly illiquid with a high buy-and-hold component, this implies the need for careful assessment of the ESG factors and their sustainability in the investment proposition prior to investing.

Here are some ideas on how investors can deal with this arduous task.

Investors can put strong emphasis on ESG analysis of the investment managers, perform or demand independent due diligence upon investing.

Investors can put strong emphasis on ESG analysis of the investment managers, perform or demand independent due diligence upon investing.

Since some industries and regions are more exposed to reputational risk compared to others, mutually agreed upon and accepted guidelines should be part of all investment mandates.

Pay special attention to the ESG sensitivity of equity providers and management of the underlying companies and demand strong independent governance to ensure execution of the agreed ESG guidelines.

Investors could also require frequent monitoring and reporting on ESG development of portfolio companies.

Private asset classes and alternative credit products are very appealing: they provide stable investment return, they increase the diversification of the portfolio and they can be seen as a defensive asset class.

However, due to their illiquid and complex nature, investors should develop the ability to assess the different products, create alignment of interests among stakeholders and put stronger emphasis on the governance framework to ensure that companies have sufficient guidance to navigate a vastly changing financial world.

Gabriella Kindert is head of alternative credit at NN Investment Partners

©2017 funds europe