Thematic investment might seem like the preserve of active investors because it is based on holding convictions. But Fiona Rintoul asks if these beliefs could be put into indices to gain passive exposure to investment motifs.

How would you go about indexing an investment theme such as “heightened cyclicality and the global reformation of the financial services industry” run by AllianceBernstein? Or even Robeco’s more general “increasing environmental awareness” theme?

Certainly, you could create an exchange-traded fund (ETF) or index fund that has an underlying index of an environmental nature, such as the Osmosis Climate Change Solutions index. But is that really going to capture all the nuances of Robeco’s theme of increasing environmental awareness?

And, indeed, Margot Pagès, head of index funds and ETF development at Theam, part of the BNP Paribas group, concedes that passive themes are usually less precise than active themes. “We concentrate our range on broad themes,” she says.

Theam’s thematic funds include ETFs investing in low carbon, infrastructure, agribusiness and environmental opportunities. The company also offers two ETFs that invest in FTSE Epra indices comprising “property stocks representative of the listed real estate sector in Europe”.

But this raises the question of what a theme actually is.

For Chris Keen, partner at Culross Global Capital Management, a thematic fund of hedge funds manager for whom the concept of passive thematic investment is a mystifying one, themes are simply answers to the question: what is going to happen and how will it be reflected?

“Our view is that that is the right starting point for any investment process,” he says.

By this definition, Theam’s Epra ETFs would not count as thematic funds. Instead, they might simply be described as listed real estate funds.

Commodities by any other name

The concept of thematic investment is actually something of a slippery fish. A recent report on the topic from Cerulli Associates includes “sector specialist funds, such as commodities, and several equity sectors which focus on a particular theme, such as agriculture, biotechnology, consumer goods, renewable energy and climate change” in the mix.

But is it really correct to call a fund that invests in commodities a thematic fund? Is it not a commodities fund by any other name? Investors who invest in such funds may do so because they are aware of certain global economic trends, such as increased demand for commodities from emerging economies, but that does not make the fund itself thematic.

Xiaowei Kang, director of research and design at S&P Indices, agrees that it can sometimes be hard to tell where an asset class stops and a theme begins. Definitions of thematic investment can also be fluid.

One area many investors would not consider thematic now, says Kang, is emerging markets. But the way we look at emerging markets has changed over the years. First we saw them as a block, then we split them into regions, such as the Brics [Brazil, Russia, India, China]. Now we are splitting them into, well, themes, such as the emerging consumer theme in developing markets.

Investors can play this theme passively, for example, by investing in products based on the S&P Global Luxury index. This, says Kang, “contains distributors and providers of luxury goods with exposure to emerging markets”.

On the other hand, this theme has become so recognised now that it is on the radar of every emerging markets fund manager and probably on the radar of most global fund managers. It may, therefore, be well on its way to being “just how things are” rather than one of the world’s “structural shifts that are disruptive in nature”, which is Cerulli Associates’s definition of an investment theme.

It is hard not to suspect the dead hand of the marketing department in all of this. Themes are cool, which can lead to the moniker “thematic” being splashed about more liberally than is perhaps entirely sensible. Overuse of themes can also lead to other problems.

“The self-discipline we need as investors is not to fall in love with the story,” says Mark Tinker, manager of the Axa Framlington Global Opportunities fund, which takes a thematic approach to stock selection. “Take the agricultural story: is anyone making money there?”

This raises another issue when it comes to the passive implementation of themes. “Just because there is money to be made from a theme doesn’t mean that people will make money,” says Tinker.

It’s more effective, he argues, to cherry-pick the winners “unless a theme has a very strong tailwind behind it”.

On the other hand, Kang reminds us that “active management is a very challenging task. It’s hard to add value after charges”.

This brings us back to the age-old active-passive debate that applies across the investment board. When it comes to thematic investment, however, it’s the same, but more so. True thematic investment often takes investors into new and experimental areas – alternative energy, cloud computing, genomic medicine – where, it could be argued, the chances of individual companies getting it wrong and failing are higher.

“I can think of one area where active has more of an edge and that is technology,” says Kang. “You need analysts to interview the companies to identify which ones have the potential to succeed.”

But in some sectors it can work the other way. “If you look at solar energy, it’s hard to tell what individual stocks will do,” says June Aitken, chief executive officer at Osmosis Investment Management, an environmental investment manager. “It’s very volatile and very subject to regulation. An index is trying to capture the theme that somewhere solar will be a provider of clean energy.”

No doubt, equity active will always co-exist with passive, as both Kang and Aitken suggest they should. But what passive can offer in an ever more complex world for investors, suggests Theam’s Pagès, is low-cost and flexible access to themes, along with liquidity.

This kind of easy access is becoming ever more important because thematic investment is on the rise. In its report, Cerulli Associates suggests that European thematic fund assets have grown from €93.7 billion in 2005 to €146.1 billion in May 2011. There is one overarching reason for this: increasing correlation among global markets.

“The main advantage [of passive thematic investment] is that it buys diversification, especially at a time when you can no longer rely on geographic diversification,” says Pagès.

‘Pixie trading dust’

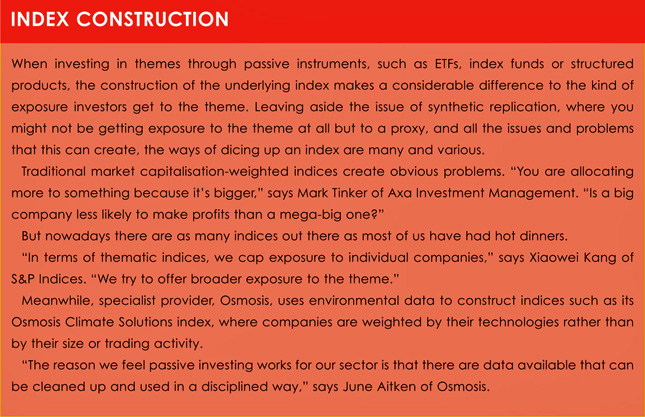

Index construction is becoming ever more sophisticated (see box), but the simplification inherent in indexation always comes at a cost. You miss out on what Keen describes as the “pixie trading dust” some talented managers can sprinkle over portfolios when you go passive.

And you have to be indifferent to income, says Tinker, and aware of the “simplifying assumptions” embedded in the product you are using and the ways in which others will use it.

“The passive vehicle you are using will almost certainly spend most of its time as a trading vehicle,” he says.

Partly as a result of this, “most baskets will move together”.

©2012 funds europe