Custodians are looking to technology to relieve the market pressures they face, finds Nicholas Pratt. Plus, custody survey results.

For years, there has been talk of shrinkage in the custody market through consolidation. Some of the names of yesteryear were meant to disappear, yet by and large the market has remained stubbornly resilient. The same big names continue to be there, as do specialists in their regional niches.

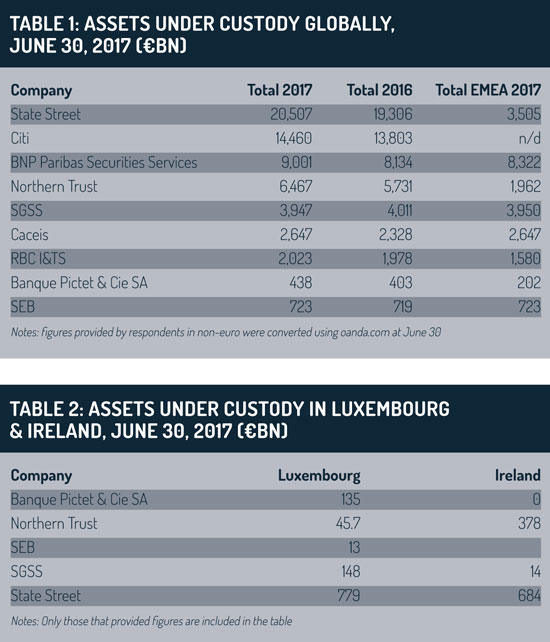

This year’s survey is notable for the conspicuous absence of some of the biggest custodians in the market – BNY Mellon, JP Morgan, HSBC and Deutsche Bank among them. That can’t be helped, but for those custodians that did choose to participate, the figures show that the 12 months to June 30, 2017, were largely positive.

Global assets under custody (AuC) have improved since 2016, albeit modestly, for all but one of the nine custodians (Societe Generale Securities Services).

This is not to diminish any of the challenges that remain for custodians, such as the revised Markets in Financial Instruments Directive, MiFID II. And while custodians have become accustomed to these requirements, it does not mean that meeting these requirements has become any easier or economic.

“The overall aims of investor protection and transparency are commendable, but the volume and pace of regulatory change present unprecedented challenges to asset managers and service providers,” says Sébastien Danloy, chief executive of RBC Investor Services Bank.

“The costs of complying with new regulations may result in the unintended consequence of increased charges to underlying investors.”

Fortunately, there are also a number of market developments likely to relieve some of the pressure on custodians and, by association, their investor clients – namely the normalisation of interest rates and the advance of new technology.

Cash balances

The decade of ever-decreasing interest rates has hit custodians hard, notably the negative revenues as a result of the major currencies that introduced negative credit interest rates.

Under an interest rate normalisation backdrop, we could expect this to be beneficial to custody, due to an increased ability to sustain and support client cash balances. So, although recovering interest rates will ease the balance-sheet burden for custodians, the economic uplift of interest rates is likely to be felt in custodians’ clients’ greater ability to borrow cash and seek out additional alpha.

“Cash on balance sheet has become a real issue for custodians as it costs money and clients are not willing to pay fees for this,” says Claude-Joseph Pech, head of PAS Front Group at Pictet. “In this regard, higher interest rates will be beneficial for custodians.”

Negative interest rates have also had an impact on IT systems in that they have forced custodians to organise invoicing of negative creditor rates on long balances via information systems that were not designed for this, says Etienne Deniau, head of strategic marketing at Societe Generale Securties Services. But just as there is expectancy that central banks will approach interest rate normalisation with caution, there is also a cautious welcome from custody banks to the idea of a rise or at least a normalisation of interest rates.

Negative interest rates have also had an impact on IT systems in that they have forced custodians to organise invoicing of negative creditor rates on long balances via information systems that were not designed for this, says Etienne Deniau, head of strategic marketing at Societe Generale Securties Services. But just as there is expectancy that central banks will approach interest rate normalisation with caution, there is also a cautious welcome from custody banks to the idea of a rise or at least a normalisation of interest rates.

An increase in interest rates will result in a less compressed market, says Clive Bellows, Ireland country head at Northern Trust, which in turn should benefit custodians. But he is also mindful that increases that have happened this year were limited and that rates globally remain near historical lows with no immediate end in sight.

That said, there is anticipation that at the very least, charges will be dropped for deposits and that assets will return to fair costing, says Pervaiz Panjwani, Europe, Middle East and Africa head of custody and fund services at Citi. But the time horizon for this change and the expected spreads are uncertain.

Furthermore, the benefits of a return to fair costing will be “measured by quality of deposit, the balance-sheet need and the client type” says Panjwani. This will lead to “increased sensitivity in balance-sheet management and interest rate return partnerships as well as being central to the bidding process for new and existing transactions”.

Others say that the previous drop in interest rates and its negative impact on custodians’ margins was tempered by an increase in operational efficiency, therefore a normalisation of rates should be able to finance custodians’ continuing digitisation efforts and technology investment.

Digital, data and distributed ledger

The development of digital services is a top priority for custodians and each has its own project. RBC has its ‘advanced client experience’ programme to “align our clients’ requirements with system enhancements to digitise the client experience”, and its enterprise innovation teams to explore so-called disruptive technologies such as blockchain, artificial intelligence, big data and robotics.

Distributed ledger technology (DLT) could provide the solution to specific challenges in the asset servicing industry, says Bruno Campenon, head of financial intermediaries and corporates at BNP Paribas, such as ‘know your customer’ (KYC) reporting, client on-boarding and/or data distribution.

Distributed ledger technology (DLT) could provide the solution to specific challenges in the asset servicing industry, says Bruno Campenon, head of financial intermediaries and corporates at BNP Paribas, such as ‘know your customer’ (KYC) reporting, client on-boarding and/or data distribution.

“This is already happening. Within the workplace, repetitive tasks will become a thing of the past thanks to robotisation and further process automation made possible by artificial intelligence. This will free staff to focus on building solutions and supporting clients,” says Campenon.

Data is another area of interest for custodians and has the potential to develop commercial services.

“Advancements in data technology over the past few years, combined with the unique and truly vast quantities of data held by custodians, means that clients are now looking for further insight from their back-office functions,” says Elizabeth Nolan, co-head of global services at State Street.

“Clients desire more real-time consumable data than ever before,” adds Citi’s Panjwani. “They require customisable reports, with data being presented graphically to enable rapid consumption of information. A comprehensive data strategy is essential to remain relevant in this rapidly evolving environment.”

Northern Trust’s Bellows says: “Asset servicers will need to become data providers and managers – capturing the middle-office investment data to derive business insights and value from this data.”

The importance placed on data by investors, plus regulations like the General Data Protection Regulation, or GDPR, which introduces mandatory notification measures in the event of a data breach, will also make cyber security a key area of focus for custodians and an area of investment.

Cyber security is also an area where there is likely to be more collaboration between custodians and other market participants, says Tomas Engel, head of investor services sales at SEB. He singles out collaboration as the defining feature of the asset servicing industry of the future.

This collaboration will address not just cyber security but also due diligence, such as the initiative by the Association for Financial Markets in Europe (AFME) to create a standard due diligence process, and regulatory collaboration (through the work of the AFME, the European banking Federation and the Association of Global Custodians) to address the EU’s European Post-Trade Forum initiative and any special areas of interest for custodians.

But the partnership principle will be most critical in the delivery of services, be that outsourcing, white-labelling or sub-contracting.

But the partnership principle will be most critical in the delivery of services, be that outsourcing, white-labelling or sub-contracting.

“The successful providers of asset services must understand that they provide a service to the investor, no matter how this investor is branded,” says Engel. “That will happen only in collaboration between the provider and various ‘sub-contractors’ that provide specialised solutions in areas where white-labelling can be possible – such as agency lending, voting and private equity. Only then will a best-of-breed solution be delivered.”

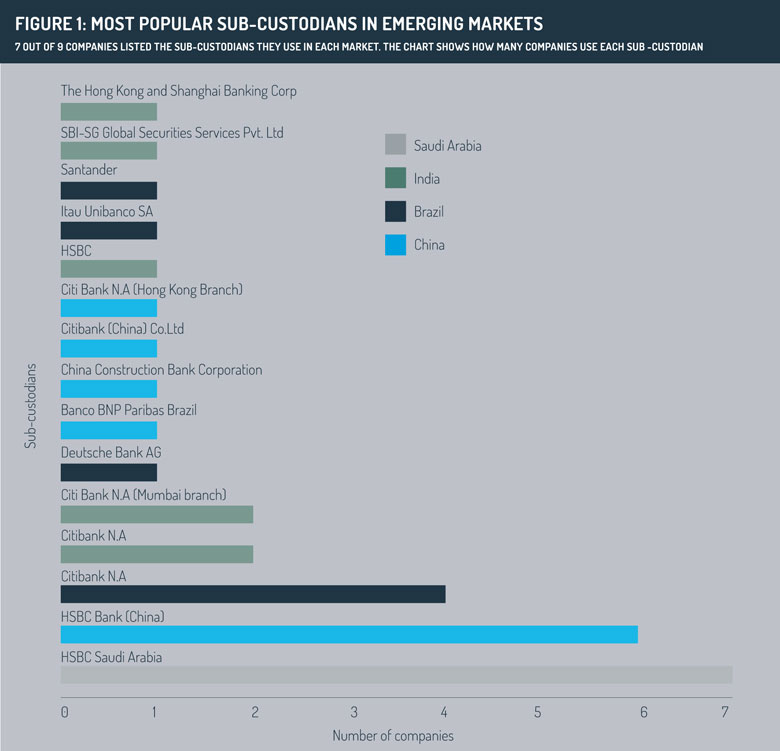

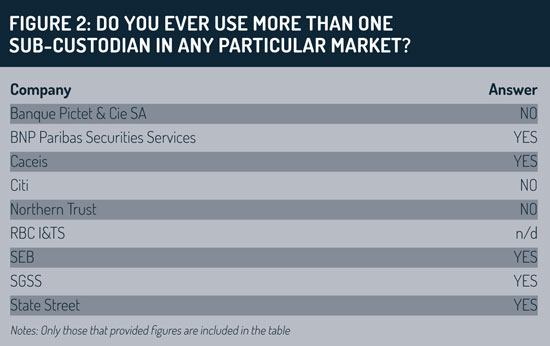

In the spirt of this partnership, sub-custody will become a more important aspect of custodians’ offerings. While a handful of custodians in this survey (State Street, Citi and to a lesser extent, SGSS) are able to provide direct custody services in multiple markets, the majority of custodians are reliant on sub-custodians to provide the global service and scale that will be necessary to survive in the custody market of the present and the future.

However, this is not to say that there is no role in the custody market for specialists. As SGSS’s Deniau says: “There should be a consolidation of global asset servicers that will need to rely on more specialist providers, similar to what has happened to the aeronautics industry.”

And just as the aeronautics industry has become a paragon of technology development and adoption, the Funds Europe survey results suggest that custodians have similar ambitions, covering blockchain, artificial intelligence and robotics.

And while many if not all of the custodians have specialist teams, divisions, departments or innovation labs dedicated to developing practical proof-of-concepts for distributed ledgers, or finding fintech partners to sign up for collaborative projects, the industry is still some way off seeing the everyday use of this technology in a standard service.

Perhaps in 2018, custodians’ efforts to investigate new systems and to court new fintechs will see their technology ambitions finally take off.

©2017 funds europe