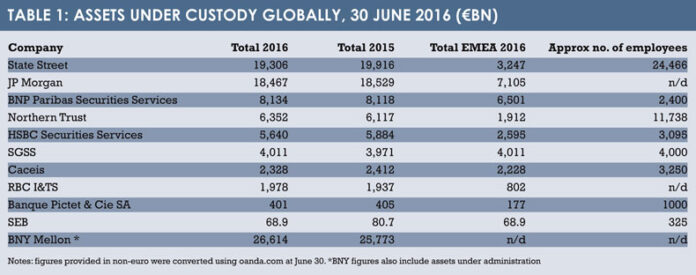

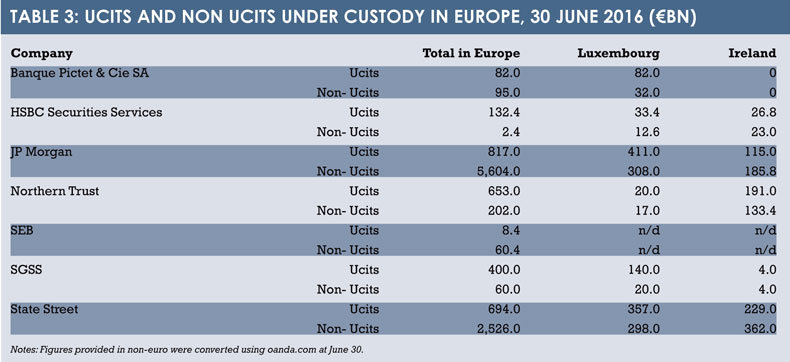

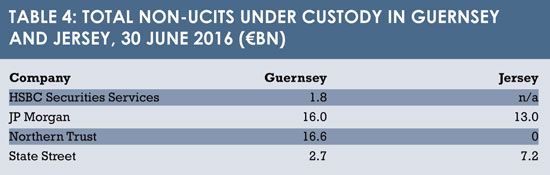

Funds Europe presents a table of rankings for some of the largest custodian banks active in Europe and the world.

There has been little change in the standing of custodians when it comes to assets under custody. JP Morgan has the largest Europe, Middle East and Africa (Emea) figure for assets under custody (AuC) and State Street has the highest number of staff, for example.

Just four of the eleven participating custodians enjoyed any growth in terms of AuC. This should not be surprising given that custodians continue to face cost, operational and regulatory pressures, and perhaps given market effects. Within this environment, some modest loss in AuC is preferable to acquisition by a rival.

Scale and size are again emphasised by the custodians as a key to survival, though smaller players will see service as more important. The global head of business development and client relationships at Pictet, Claude Pech, believes that as long as custodians define their strategy – either as a ‘factory’ approach, or tailor-made – it will be possible to survive. The one unanimous view expressed by custodians is that technology will be the important factor in defining the future of the custody industry.

“The biggest changes to the industry will be driven by financial technology,” says Pierre Cimino, Caceis Bank Luxembourg managing director. Or, as HSBC’s head of custody John Van Verre says, a combination of streamlining and technology investment will “alleviate competitive cost pressures and simplify platform distribution”.

“The biggest changes to the industry will be driven by financial technology,” says Pierre Cimino, Caceis Bank Luxembourg managing director. Or, as HSBC’s head of custody John Van Verre says, a combination of streamlining and technology investment will “alleviate competitive cost pressures and simplify platform distribution”.

Meanwhile, Sébastien Danloy, chief executive of RBC Investor & Treasury Services, says that “continuous transformation in IT will be vital to meeting clients’ evolving needs”. And Jean Devambez – BNP Paribas Securities Services global head of products and solutions, asset and fund services – says that, more than ever, technology and digital solutions focused on data will be critical.

But these broadly positive forecasts come at a time of ongoing uncertainty for the custody industry. Daron Pearce, BNY Mellon’s chief executive officer of asset servicing in Emea, points to Brexit and EU instability, the long-term impact of regulations, as well as the potential impact of fintechs and digital disruption, as challenges.

With the whole of the financial services world currently fascinated by the potential of the distributed ledger (or blockchain) technology, the custody market could be one of the first to see its impact and to see whether the new technology becomes its saviour or its replacement.

As Goran Fors, deputy head of investor services at SEB, says: “The developments with blockchain could really mean a paradigm shift in how we work in the post-trade space. Even if the changes will be more limited, we will definitely see a lot of services and processes being handled by a technology that today we have limited competence of.”

As Goran Fors, deputy head of investor services at SEB, says: “The developments with blockchain could really mean a paradigm shift in how we work in the post-trade space. Even if the changes will be more limited, we will definitely see a lot of services and processes being handled by a technology that today we have limited competence of.”

©2016 funds europe