We profile some of the most interesting fund launches in recent weeks and examine the performance of a product already on the market.

SHORT DURATION BOND

SHORT DURATION BOND

Morgan Stanley Investment Management (MSIM) has launched a Global Buy & Hold Bond fund, aiming to offer stable income while avoiding volatility.

The portfolio will be globally diversified within government, investment grade and high yield corporate bonds, and emerging market government debt, with an expected maturity of about

four years. The maturity profile means the fund will be open until June 2021. Income will be provided regularly over that time.

The firm’s global fixed income team manages the fund. Co-manager Jim Caron said that in the current low interest rate environment, the search for yield from fixed income products has intensified, with investors seeking alternatives to European government bonds and other kinds of non-diversified fixed income exposure.

The fund is for sale in France, Italy, Spain and the UK.

It is the latest short-duration vehicle to be launched recently, following similar offerings from Aberdeen Asset Management, Axa Investment Management, Pioneer, Standard Life Investments and Royal London Asset Management.

However, it is the first to target a range of risk-rated instruments in a single fund.

ABSOLUTE RETURN

ABSOLUTE RETURN

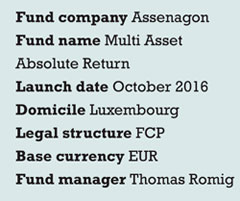

Assenagon has launched a Ucits-compliant Multi Asset Absolute Return fund. It aims to offer daily liquidity and targets an annual return of 3%, with volatility between 2%-5%.

The fund will be managed by a team led by Thomas Romig, head of multi-asset at the firm. He joined Assenagon in March 2015 from Union Investment.

The portfolio will be drawn from an investable universe of 500 strategies, including liquid alternatives, managed futures and multi-strategy.

The fund is open to both institutional and retail investors, although it is perhaps most appropriate for conservative investors, with an investment horizon of at least three years.

“We believe forecasting short-term performance for an absolute return strategy generally makes little sense,” says Romig. “We therefore focus on the medium to long-term potential of an individual absolute return strategy.

“In structuring the portfolio, we focus on diversifying loss scenarios of individual strategies.”

EQUITY INCOME

EQUITY INCOME

Woodford Investment Management has launched an offshore ‘feeder’ version of its highly popular Equity Income fund, allowing investors outside the UK to access the vehicle for the first time. It is available in sterling, euro and dollars, in addition to offering hedged and unhedged share classes.

The fund invests primarily in UK-listed companies and aims to provide investors with a reasonable level of income together with capital growth.

Craig Newman, chief executive at Woodford, said that launching the fund was a “natural” extension to its fund range, and would give wealth managers based in the Channel Islands and the Isle of Man, and clients domiciled outside the UK who supported Woodford in the past, the opportunity to invest in his equity income strategy.

From its launch in June 2014 until October 1 this year, the onshore product has been the top-ranked fund in the UK IA Equity Income sector, returning 29.8% versus with the FTSE All Share Index’s 12.2% over the same period.

MULTI-ASSET INCOME

MULTI-ASSET INCOME

JP Morgan Asset Management (JPMAM) has launched an alternative version of its Global Income fund, designed to reduce volatility.

The fund will offer broad diversification with the flexibility to source income across geographies and asset classes.

It has the same portfolio team as its parent, and targets a yield range of 3%-5% and a volatility range of 3%-7%. The asset split is 30% equities and 70% fixed income holdings.

Massimo Greco, head of European funds at JPMAM, said that with bond yields remaining near record lows as a result of central bank policy, the need for income is stronger than ever among investors, forming a critical component of overall

total returns.

“The fund will have the same flexibility to seek strong risk-adjusted returns across income-generating assets globally as the Global Income fund, but is geared towards investors who have a higher degree of sensitivity towards volatile markets,” he said.

Michael Schoenhaut will be lead portfolio manager, supported by co-portfolio managers Eric Bernbaum and Talib Sheikh. Collectively, they have around 50 years’ industry experience.

The managers are based across New York and London.

ONE YEAR ON

ONE YEAR ON

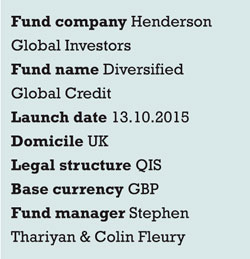

A year ago, Henderson launched a global credit strategy.

The fund aims to provide returns from both income and capital appreciation by exploiting valuation differences in global credit markets.

It invests in a broad range of secured loans, high yield bonds, investment grade bonds, asset backed securities and other fixed income securities, targeting a total return of 3%-5% per annum. It has achieved the top end of this target return parameter since launch, growing 5% over the period ending September 30, 2016.

The firm’s underlying investment strategy group is responsible for the selection and management of securities.

Accommodative central bank policies have produced lower default rates and a strong demand for assets with attractive yields. As a result, both government and corporate bond holdings have contributed positively to the fund’s performance, and sub-investment grade assets (such as secured loans and high-yield bonds) have also been positive performers. However, the fund largely missed out on the rally in US sub-investment grade assets, which started in February 2016.