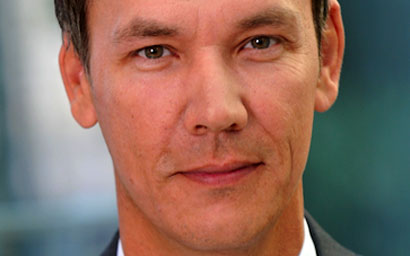

German boutique asset manager DJE Kapital has poached Michael Schütt from French asset manager Carmignac, appointing him to head of distribution.

In his role, Schütt will join the firm’s management board, and will be in charge of the distribution of mutual funds and ‘spezialfonds’ for institutional investors, as well as having a hand in the firm’s marketing and public relations. In total, the firm offers 10 funds, with a focus on European equities (both national and region-wide).

He will report directly to Ulrich Kaffarnik, DJE Kapital’s board member in charge of institutional investors and investment funds, and managing director of DJE’s Luxembourg-based office.

Schütt spent two years at Carmignac as head of Germany and Austria. Previously, he held a number of roles with major financial services firms, including Merrill Lynch, Morgan Stanley, Citigroup Germany, Invesco and BNY Mellon.

DJE Kapital manages assets €10 billion as of June 30 2016. The firm was a founding member of the German Association of Independent Asset Managers.

©2016 funds europe