Mexico was largely left out of the de-coupling trend that drove emerging markets in recent years. Now that re-coupling is back in fashion, Nick Fitzpatrick finds this may give lift to Mexican equities.

A heady mix of close ties with the recovering US economy, and industrial reforms designed to increase productivity, means Mexico is rising in the table of investment destinations for international fund managers as they enter 2014.

In a canny move, it seems, President Enrique Pena Nieto has timed his reforms – which cover the labour market, taxes and the energy sector – to coincide with the recovery in the US.

Didier Saint-Georges, a member of the investment committee at Paris-based Carmignac Gestion, writes in a recent report: “Pena Nieto enjoys considerable political capital in Mexico and has grasped the historical opportunity of pegging his reforms to the US energy revival.”

It is close ties with the US economy that underpins the positive view on Mexico that has been held this year by Mike Simpson, investment manager of the Baring Latin America Fund at Baring Asset Management.

Similarly, Mark Burgess, chief investment officer at Threadneedle, says: “Mexico points to a year of solid growth linked to the US economic recovery and the country’s lower manufacturing cost base compared to China.”

RE-COUPLING AND RECOVERING

Maarten-Jan Bakkum, senior emerging market strategist at ING Investment Management, expands on the entwined prospects of the US and its southern neighbor Mexico further. In recent years of the emerging markets boom, he says, the strength of the “de-coupling” argument as emerging markets were developing so quickly meant that investors began to see it as a disadvantage when countries had a close trade relationship with slow-growing North America, Europe, or Japan.

To maximise returns, one strategy of investors was to look for emerging market countries with high exports to other, rapidly growing emerging countries.

Bakkum highlights countries, such as Korea and China, which are benefitting from the rapid growth in the emerging world as they successfully tap markets in South Asia, Africa and in Latin America.

“This concept [de-coupling] worked well for a long time, until the first signs of recovery from the crisis became visible in the US and Europe, and until capital outflow and a reduced demand from China forced a growth slowdown on the emerging world.”

The advantages of busy trade with other emerging countries diminished, he says, as the growth difference between developed and emerging markets decreased. This process began in 2010 and has accelerated

over 2012.

“Now that the best growth dynamics can be seen in the US, Japan and, possibly, Europe, and [now that] the emerging world is gasping for breath after years of excessive credit growth and increased economic imbalances… de-coupling is more of a disadvantage than an advantage at the moment.”

China, by far the most important emerging economy, is only at the beginning of its growth slowdown, says Bakkum, and this will generate strong headwinds for the rest of the emerging world for years to come, affecting commodity-exporting countries in particular.

“Countries such as Brazil, Chile, Peru, Indonesia and the majority of Africa will have trouble maintaining the level of economic growth in the coming years. “At the same time, the countries that the de-coupling largely passed by between 2002 and 2010 will be able to pull themselves up alongside the growth acceleration in the US and the slightly slower recovery in Europe.”

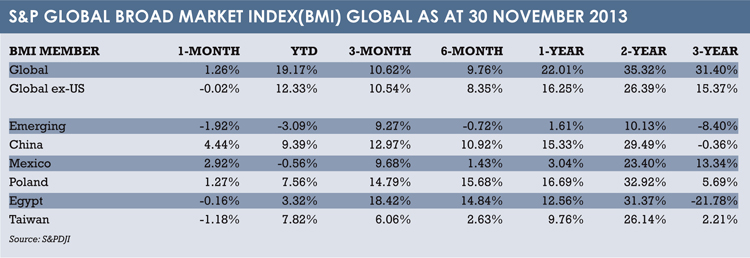

Mexico and Poland are two emerging markets that investors “should keep a close eye on in the near future”, he says.

REFORMS

The reforms, which should benefit Mexico’s economy, have been described as “historical”.

“The Mexican economy’s low productivity – for example, turnover per employee at Pemex is one of the world’s lowest for oil companies – is now the target of a programme of far-reaching reforms tabled by [the president],” says Saint-Georges.

Part of the president’s reforms involve a much anticipated plan for reforming Mexico’s energy sector.

The reform won approval from a majority of Mexican states in December. A declaration from Congress’s permanent committee was due in the following days

The reform won approval from a majority of Mexican states in December. A declaration from Congress’s permanent committee was due in the following days

(as Funds Global – Latin America went to press), with Pena Nieto saying he would enact the reforms immediately.

The proposals contain plans for profit sharing contracts for private sector companies to participate in oil production. The private sector will also be able to obtain licences to build, own and operate refineries, petrochemical complexes, storage sites and distribute oil products.

Will Landers, portfolio manager of the BlackRock Latin American Investment Trust, says: “His proposal, if approved, would bring regulation back to the period before the sector was nationalised in 1938.”

Landers adds that while profit sharing contracts do not go as far as granting full concessions to private operators, depending on how they are legislated, the contracts should provide enough opportunity to attract significant private sector interest. In addition, Pemex will see its corporate governance strengthened in order to better partner with the private sector.

“The electricity sector will also benefit from this proposal, with private companies being allowed to build and commercialise electricity with third parties.”

There are also expectations for fiscal reform, which is needed to offset lower oil revenues to the government in the future.

Landers says: “This proposal is historic, and should have a positive impact on Mexico’s ability to restore growth to its oil production figures, thus having a positive impact on economic activity once implemented.”

The broader reforms should mean job market regulations will be relaxed and it is hoped this will boost non-oil revenues and encourage competition in strategic sectors such as banking and telecoms, as well as energy, says Carmignac’s Saint-Georges.

EQUITIES

Simpson, at Barings, said earlier this year that he is encouraged by the improving political environment in Mexico, where for the first time in more than a decade, the government appears committed to implementing much-needed supply-side reforms around the tax system and energy sector.

“If successful, we believe this will be very positive for economic growth, corporate profitability and, in turn, equity market performance over the coming years.”

Simpson added: “We believe that opening up the energy sector for profit-sharing activities is a major positive and lends further support to the longer-term investment case for Mexico.

“Over time, we expect this to bring global energy players into Mexico and, ultimately, lead to further reform as the technological know-how of foreign companies benefits Pemex and its exploration activities.”

But, he adds: “We are, however, mindful that it remains unclear whether Mexico will allow global energy players to book reserves from profit-sharing activities.

This will likely prove to be a key issue for foreign firms and we continue to monitor the situation closely.”

Recently, Simpson has favoured industrial companies such as Alfa and IEnova, which he thinks will benefit from the recovery trend.

At the company level, Simpson’s fund has significant exposure to beneficiaries of the reforms across the energy, materials and industrials sectors. Holdings include the likes of Alpek, Cemex and Grupo Carso.

After approvals and legislation are in, says, Jan Dehn, head of research at Ashmore, an emerging markets investor, foreign direct investment flows can begin, and a couple of years later material increases in oil and gas production are expected.

“The energy reform is the culmination of an 18-month frenzy of reforms, which is likely to materially raise Mexico’s productivity and trend growth rate.”

©2013 funds global latam